Best Month For Gold Price In 2 Years

Strengths

- The best performing metal this week was silver, up 5.15 percent, finally getting some respect as it approaches its 200-day moving average. Hitting six-month highs this week, money managers are the most bullish they’ve been on gold in months. Gold has been a beneficiary of the volatility experienced in global equities this week. Bloomberg reports that gold priced in the British pound has jumped back above 1,000 pounds an ounce and is trading at its highest level since September 2017. The move in gold could be further supported by international markets, which have seen the greenback fall to nearly a five-year low of just 61.9 percent of allocated reserves, reports Bloomberg.

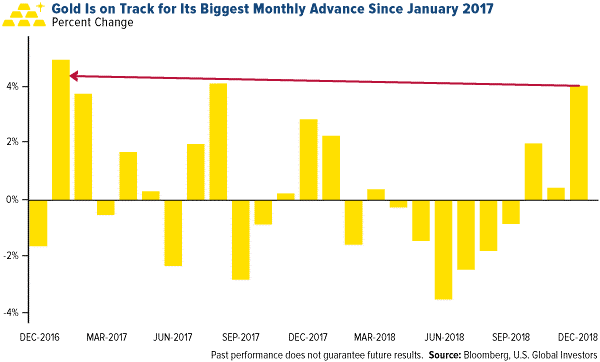

- Gold bulls added substantial positions to ETFs backed by bullion as the yellow metal is heading for its best month in two years on the heels of the partial U.S. government shutdown and shaky equities. Gold-backed ETF holdings have surged by more than 100 tons since October and the rapid inflow has helped to boost prices, reports Bloomberg. On Thursday’s trading session, ETFs bought 662,080 troy ounces of gold, which is the biggest one-day increase in at least 12 months. Also on Thursday, the SPDR Gold Shares fund saw inflows of more than $643 million, the most since July 2016.

- Turkey continues to add to its gold reserves. Holdings rose $191 million from the previous week. The country spent most of 2018 selling off about 15 percent of its bullion in an effort to prop up the local currency, but its reversal to add to reserves is a positive trend. According to official figures from the central bank in Ankara, Turkey’s reserves are worth $19.8 billion as of the end of last week.

Weaknesses

· The worst performing metal this week was platinum, up just 0.23 percent. The Federal Reserve of Richmond said on Wednesday that its measure of factory activity across the eastern U.S. fell unexpectedly to minus 8, while economists were predicting an increase to 15. In another unexpected drop that could demonstrate weakness in the economy, the contract signings to purchasing previously owned U.S. homes fell for a second month in November, reports Bloomberg.

· U.S. leveraged loan funds have been seeing big outflows since November. In the week ended December 26, investors pulled out $3.5 billion for a third straight week of record setting withdrawals, according to Lipper data. It was also the sixth consecutive week of outflows of more than $1 billion. Bloomberg’s Lisa Lee writes that swooning prices are scaring other institutional investors away from the market.

· This December has been particularly volatile for the U.S. stock market and traders and investors have agreed that these are not usual times. Stephen Innes, head of trading for Asia Pacific at Oanda Corp., said that this month is “completely bizarre” and that “it’s incredible just how harmful markets veer when sentiment slides.” First Majestic Silver, a Canadian gold mining company, is set to offer $50 million in shares via BMO Capital Markets through “at-the-market distributions,” reports Bloomberg. Shares have climbed 27 percent in the past money and the proceeds of the sale will be used for developing existing mines and adding to working capital.

Opportunities

· Morgan Stanley strategists wrote in a note this week that 2018 has been a historically bad year, with the top five worst asset classes all being equity-related. Analysts write that such down performance across the board for the year has not occurred in recent history. Morgan Stanley does, however, remain bullish on gold, as forecasts for a weak U.S. dollar and lower yields could push the metal higher in 2019.

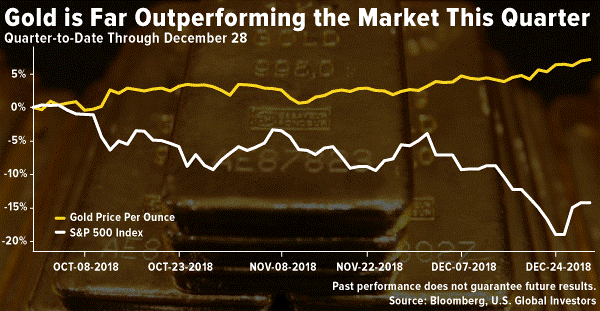

· Global chaos has made gold a holiday winner on safe-haven demand. Quincy Krosby, chief market strategy at Prudential Financial, said that “the market is questioning whether the Fed is making a policy mistake, and that could not only lead to slower growth, but perhaps to a recession.” She continued to say that when you see this heavy selling in equities, “it’s indicative of fear, and gold becomes a safe-haven allocation.” Gold has actually crushed the S&P 500 so far this quarter, returning close to 5 percent while the stock market is down close to 15 percent.

· Another precious metal having a great run is silver, which rose to its highest since August and is approaching its 200-day moving average. On Wednesday, silver futures were nearing their highest in more than four months. Tai Wong at BMO Capital Markets says that silver, although down 12 percent for the year, is rallying now on the back of bullishness in gold as a safe-haven asset.

Threats

· This week the People’s Bank of China emphasized that its monetary policy would remain prudent, pushing back against interpretations of its recent moves as signaling looser policy, reports Bloomberg News. Sun Guofeng, director of the monetary policy department, told reports that “the stance on prudent monetary policy hasn’t changed” and that policymakers won’t “flood” the economy with excessive liquidity. China continues to face challenges of slow investment, weak consumption and the effects of the trade war with the U.S.

· Russia and Turkey have been maneuvering to position themselves for a new order in Syria after President Donald Trump announced the withdrawal of American troops in the region, reports Bloomberg. It is likely not a coincidence that Turkey has turned down the media heat on the Saudi state murder of Jamal Khashoggi with President Trump trading off our Kurdish allies to President Erdogan. This could result in further geopolitical instability.

· Russia is considering constitution changes that might allow President Vladimir Putin to remain in power beyond the end of his current term in 2024, in which the current law would require him to step down, according to comments from the speaker of Russia’s parliament. On Wednesday President Putin said he witnessed a final test of a hypersonic glide vehicle, which is one of a series of new weapons that would be able to overcome existing defenses, reports Bloomberg.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of