Black Gold, Low-Cost Oil Opportunity

Capitalizing in the oil sector when the price of crude oil is low is a very challenging endeavor. The recent drop in crude oil from $108 per barrel down to nearly $42pb has pulled the share price of most oil related companies sharply lower, thus providing exceptional investment value in some cases.

Capitalizing in the oil sector when the price of crude oil is low is a very challenging endeavor. The recent drop in crude oil from $108 per barrel down to nearly $42pb has pulled the share price of most oil related companies sharply lower, thus providing exceptional investment value in some cases.

While the price of crude oil has recovered nearly 50% from March 2015 low with a current oil price around $60pb, crude oil continues to be well below the $95 per barrel 3-year average.

Junior oil shares have seen a wave of panic selling that has many junior shares trading at bargain prices. While this may sound great for long-term investors, selecting the correct companies is no easy task. Let me explain:

When it comes to trading or investing in junior shares, the keys to seeing share price rise is through strong management who understand the industry, have solid connections in the field, and have a proven track record. The bottom line is the right people, and their network tend to make or break a company as long as the company has access to a commodity.

Another key is for the company to have an advantage over their competitors. In the oil and gas sector that means easily accessible and low-cost crude oil and natural gas extraction.

While the keys to success make logical sense, it is extremely difficult to find all these keys in junior companies.

Let me share my analysis of crude oil and oil stocks sector as a whole -- and provide you with a company in which I own shares -- and feel will prove to do well going forward.

CRUDE OIL PRICE & ANALYSIS

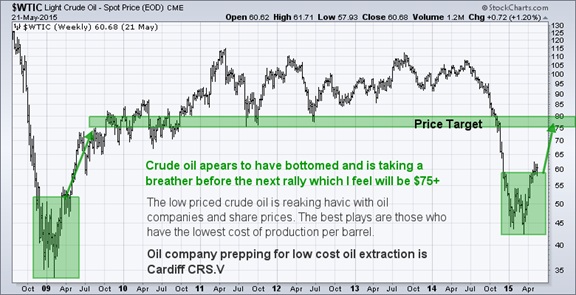

While some experts are still bearish on oil, my analysis is pointing to $75-80 per barrel.

My specialty is on technical analysis. I follow price, volume traded and the momentum behind a stock’s price movement. With that said I do look at fundamentals. And if the fundamentals support my analysis, I become more certain about an opportunity for long-term gains.

FUNDAMENTAL ANALYSIS

On the technical analysis chart of crude oil posted above, the price target of $75 per barrel looms. Now if we look at the fundamental analysis, the $75 price target will look more likely to occur, let me explain:

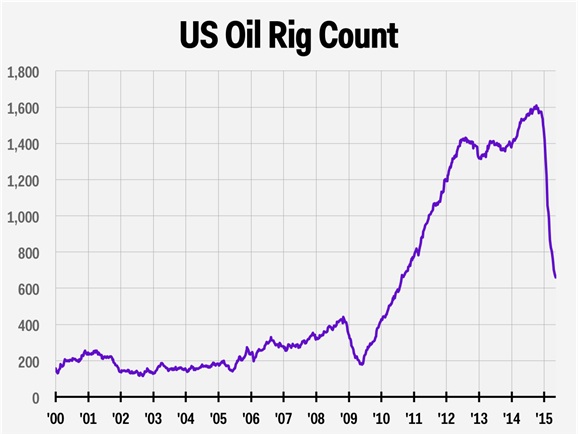

The global marginal cost to produce a barrel of oil is $75. In consequence to oil trading below the cost of production, about 60% of US oil rigs have already stopped producing.

In fact when oil price crashed in 2008/2009, the number of US rigs dropped roughly 60% also.

What does all this mean? It means the crude oil supply is declining…and eventually demand will outpace current production…thus sending the price of oil higher.

Take a look at the recent US oil rig count. Compare 2008/2009 drop with the current drop in rigs…both are nearly 60%.

OIL STOCKS INDEX

We can track the oil-stock sector with the XOI oil index. As you can see on the chart below, the oil-stocks index has fallen 30% in value from the all-time high in 2014 to the low just a few months ago.

Keep in mind this index tracks only the large oil companies that are widely held among investors. The smaller companies like juniors have fallen much harder down 60%, 70% and even 80%.

The good news is that the oil sector looks poised to rally. From a technical standpoint, the trend is now up and pointing to higher prices for shares. The companies that will do best in the near-term will be the ones that have little to no debt, proven management and have a lower than average cost of production.

LOW-COST JUNIOR OIL OPPORTUNITY

The big question is which companies will go out of business because of low oil prices, and which ones will prosper for the next major oil and commodity rally that I believe is just on the horizon?

I am proud to be working with Kal Kotecha and the Junior Gold Report to bring you exciting and undervalued investing plays in the junior resource markets. Our focus is on oil, silver and gold stocks. We believe commodities will be starting a new bull market soon. See oil price and gold price.

Through our research of looking for junior oil and gas companies to invest in, we discovered Cardiff Energy Corp.

Cardiff is an emerging junior oil and gas company engaging in the acquisition, exploration, development, and production of oil and gas properties.

They are currently focusing on its multi-zone oil and gas project in Runnels County Texas. Cardiff has partnered with Martin Energies; an experienced operator with an extensive track record of operating successful oil and gas projects in Runnels County since the early 1980’s.

Over the past month, I have spoken with the president and chief financial officer of Cardiff Energy to learn about their management team, financials, and current properties.

POINTS OF INTEREST

The first well drilled in the Runnels County property through the Gardiner lime stone was the Bearcat #4. The Bearcat #4 was completed in November 2014. It had an initial production rate of 180 Barrels of Oil per day and 250,000 Cubic Feet of Gas.

Cardiff has a 60% interest in the Bearcat #4 well, which had stronger gas production than expected.

The Clayton #1H project will target the Gardiner Lime stone also. The Gardiner Lime is a fractured limestone approximately 15 feet thick and comparable geologically to another major oil field in Texas called the Austin Chalk. The Austin Chalk has had successful horizontal wells with some having initial production of 1500 barrels of oil per day.

This well will be approximately 4100 feet in depth with a horizontal leg of up to 3500 feet. Frac is not required as the oil will flow through the limestone fractures allowing Cardiff to avoid the expensive frac process to release oil from the ground. So Cardiff could produce oil at a lower cost than the average producers.

Cardiff’s properties have several successful oil wells surrounding them which tells me they are in an oil and gas rich zone.

The Clayton #1H horizontal well will be drilled on June 15th, 2015. The cost of horizontal drilling has gone down drastically in the past six months. I heard this well could produce profits even if oil was trading at $25 per barrel and sold at WTI pricing with no discount.

Cardiff will tie in both the Bearcat #4 well and Clayton #1H well for natural gas production and there is a gathering station for this nearby to make it a low-cost natural gas extraction process.

Cardiff is debt free, but they plan to raise between $800K to $1m in the next 30 days as they prepare for the June 15th horizontal well operation.

OIL OPPORTUNITY – CRS.V

Below is a chart of Cardiff Energy Corp. (CRS.V). Overlaid is my chart analysis that shows the majority of investors own shares between 5 and 8 cents according to the volume by price indicator. This chart also shows my price targets of 18, 25, and 51 cents.

One of the most bullish points on this chart is the “On Balance Volume”. In short, this shows us that shareholders are holding onto their shares tightly and not selling. I believe this is because they see the same opportunity for growth that I have explained in this report.

View Live Update Chart Analysis for CRS.V – Click Here

IN CONCLUSION

Junior oil stocks trading at multiyear lows….and a weak US dollar forecast would help lift the price of crude oil. Moreover, commodities have been in a 4-year bear market and look ready to bottom. Consequently, I believe the horizon is looking very bullish for the price of crude oil, natural gas and commodities in general.

The best time to get positioned in a stock like Cardiff is when the underlying commodities for a specific company are bottoming, which, in this case are crude oil and natural gas.

Here is my next play - a gold exploration that is about to start production - CLICK HERE

********

Get More FREE Trade Ideas at www.GoldAndOilGuy.com

Disclaimer:

Disclosure of Interest and Advisory Cautions: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.