Buy Bank, Gold And Silver Stocks

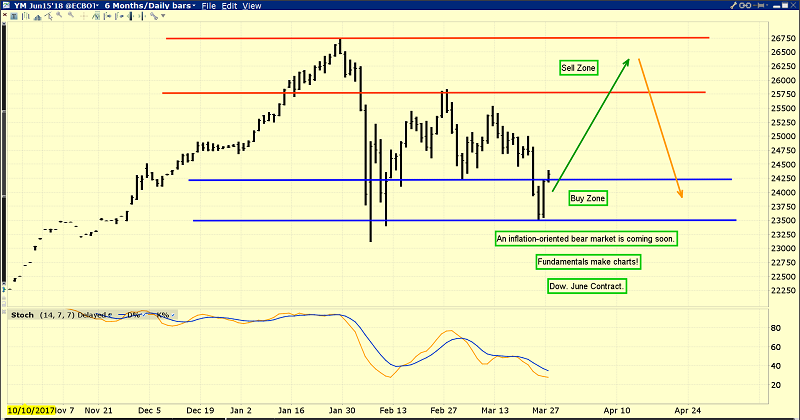

I’ve predicted that in 2018 the US stock market would suffer a series of crashes somewhat akin to the 1987 event, but smaller in size.

this interesting chart of the US stock market. Clearly, these mini-crashes are starting to happen.

Having said that, I haven’t sold any of my US bank stocks and I have no plans to do so.

I’m still “long and strong” with the bank stocks in this environment. Bank profits are soaring because of tax cuts, QT, and rate hikes.

Corporate boards are still using the bulk of the profits for stock buybacks and bonuses for the “fat cats”, while throwing crumbs to the lower-paid workers.

As disgusting as that is, it’s a good environment to own stock market indexes, and a great environment to own bank stocks.

This is the stage of the business cycle where “big growth” transitions to “decent growth with inflation”. Simply put, in this environment bank stocks do well, growth stocks stumble, and gold stocks start to get modest liquidity flows from institutions.

As the cycle moves to “inflation with low growth”, growth stocks crash, bank stocks fade, and gold stocks soar.

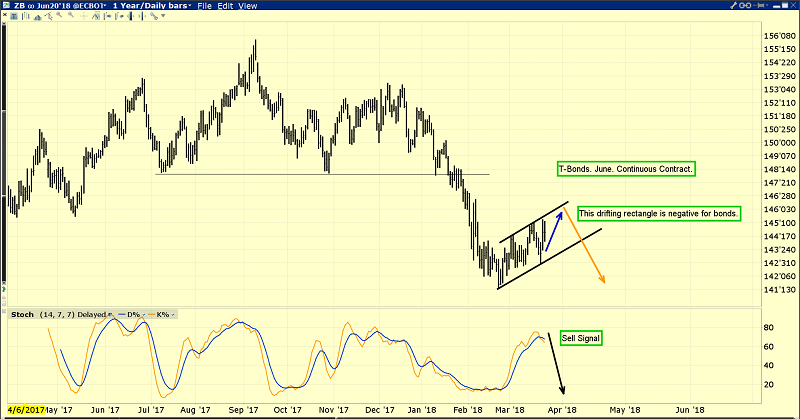

This is the key T-bond chart. US interest rates are rising now and poised to rise relentlessly for the next several years.

There are “institutional thresholds” of importance in major markets. For the US stock market, institutions will generally continue to buy stocks until the ten-year yield reaches the 4%-5% range.

Goldman is predicting four rate hikes this year and I’m predicting a minimum of three. The yield should get close to 4% by the end of this year.

I realise that most gold bugs are “stock market crash enthusiasts”. There’s no question that the US stock market has soared mainly because the “hot air” of QE and low rates has incentivized corporate boards to focus on stock market buybacks rather than worker wages and business expansion.

Having said that, patience is required. Investors need to focus on the slow but steady cyclical transition from growth to inflation as the Fed pushes the enormous QE money ball out of government bonds and into the fractional reserve banking system.

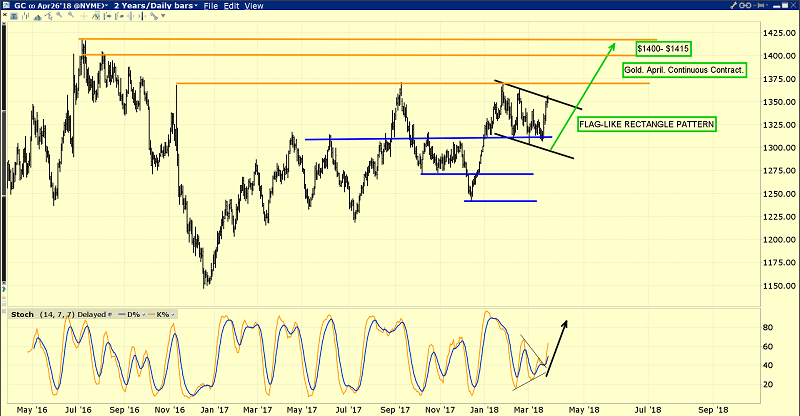

This is the fabulous daily gold chart. The rectangle pattern is flag-like, and suggests gold is coiling to burst above my key $1370 resistance zone.

Short-term traders who took my recommendation to buy the $1310 area should be sellers in this $1340-$1355 area. That’s because there could be quite a bit more coiling action before a true breakout above $1370 occurs. The bottom line is that investors need to be patient and traders need to book profits now!

Looking at the big picture, the inflation trade is clearly becoming more positive for gold every day. The Trump decision to appoint John “The Hawk” Bolton to a key post in his administration makes the geopolitical trade for gold a positive one as well.

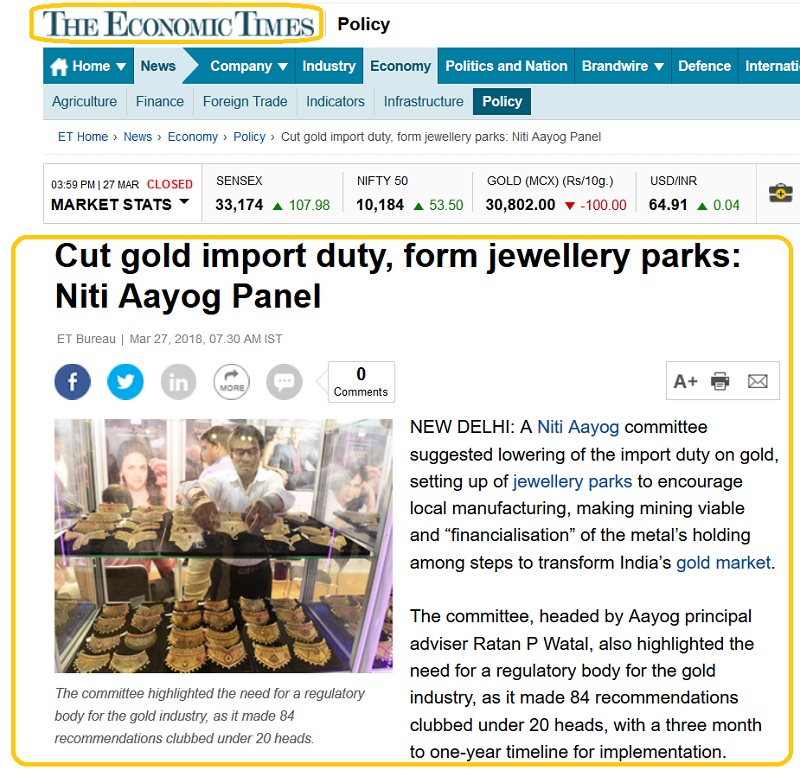

What about the love trade? The 2019 Indian elections are approaching and the Modi government is likely to win again.

Modi is backed with “monster money” and to ensure he wins again he’s launching a huge farm income program called MSP. This program is inflationary because it boosts crop prices. That alone is positive for the global price of gold.

The MSP program also is poised to create a massive boost in farmer income, and rural Indians always use extra income to buy more gold. This MSP policy launch is happening at the same time as the influential Niti Aayog panel pushes the Modi government to implement a massive gold-positive policy agenda.

I’ve been adamant that 2018 would see the absolute end of gold-negative policy from the Modi government, and the launch of positive policy. That’s clearly in play, and it’s going to exponentially accelerate relentlessly.

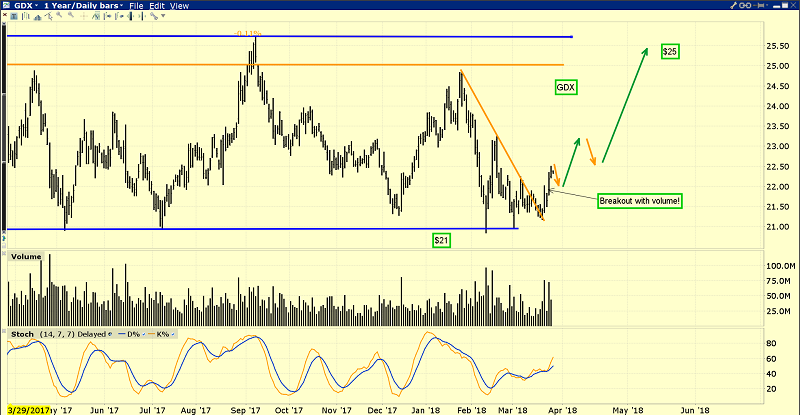

This is the GDX chart. The technical action is superb, and investors should now be buyers of their favourite GDX and GDXJ component stocks on all two and three-day pullbacks.

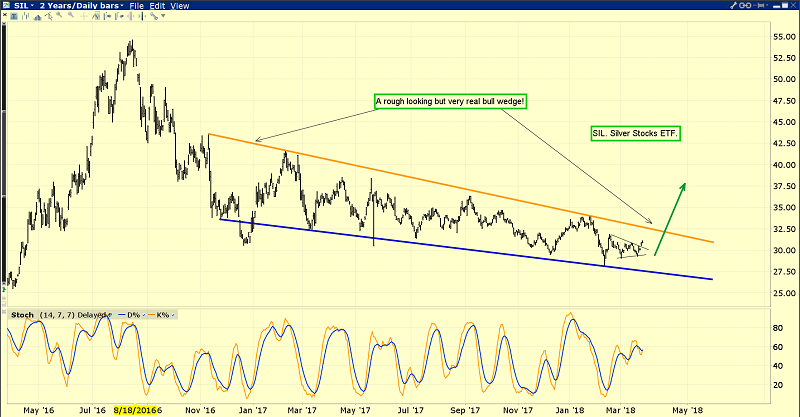

With food inflation set to surge in India and general wage and price inflation on the move in America, it’s time for investors to take a more serious interest in silver stocks. The big upside action won’t start until there’s a volume-based breakout from the bull wedge pattern on this silver stocks ETF chart.

Call option buyers should wait for that breakout before buying, but all silver stock enthusiasts should be buyers of key SIL component stocks right now. Use two and three-day pull backs to take buy-side action, in preparation for the imminent upside rocket ride!

*********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Gold Stocks In The Bank!” report. I highlight four community bank stocks set to soar, and four junior gold stocks trading under $3 a share that are poised to stage potential 100% gains by year-end!

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

https://www.gracelandupdates.com

Email:

Rate Sheet (us funds):

Lifetime: $999

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: