Central Bank Gold Buying Soars To Near A 50-Year High

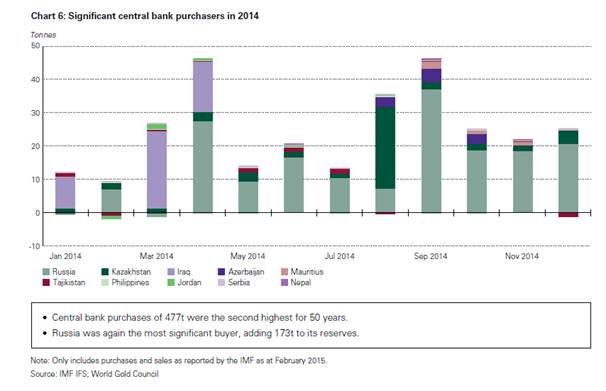

During 2014 country Central Banks bought 477 tonnes…close to a 50-year high…and that’s equivalent enough to buy 75 Boeing Dreamliners planes. This is at once astounding as well as revealing vis-à-vis a slowly dropping gold price since late 2011.

During 2014 country Central Banks bought 477 tonnes…close to a 50-year high…and that’s equivalent enough to buy 75 Boeing Dreamliners planes. This is at once astounding as well as revealing vis-à-vis a slowly dropping gold price since late 2011.

Russia was by far the largest buyer. Its purchases made up a staggering 36% of total Central Bank buying. In total, Central Banks bought 477 tonnes of the precious metal last year of which 173 tonnes flowed into Russia, according to a report from the World Gold Council.

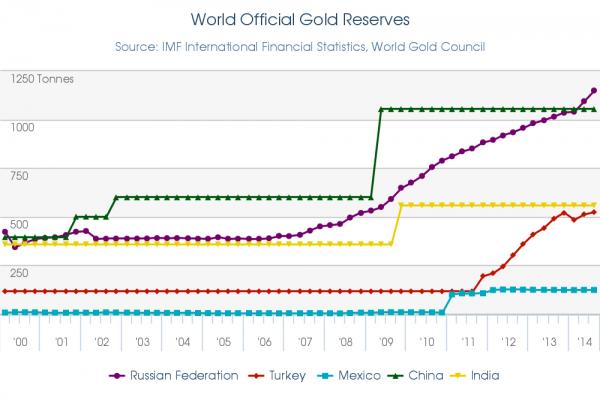

Emerging market Central Banks in general have also had a strong appetite for gold in recent years. "They don't have the legacy of the gold standard, so they are looking to add to their gold reserves," explained World Gold Council's Bhatia. "Big buyers over the last decade? China has added, India, Thailand, Mexico, Kazakhstan," he said.

Looking ahead what can we expect to see from Central Banks in terms of gold purchases? Most likely more of the same. "We expect Central Banks to be consistent buyers of gold. We are looking at steady as she goes. We expect Russia to continue to buy gold -- and we don't expect major sales from anyone," concluded CPM Group's Christian. (Source: KitcoNews)

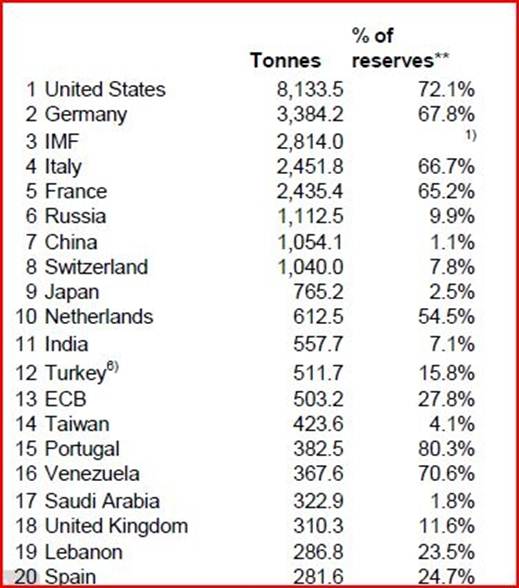

World Official Gold Holdings

International Financial Statistics, October 2014

Source: World Gold Council, IMF data

World Gold Council View

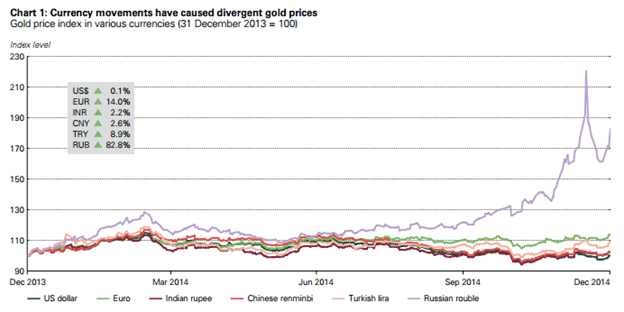

“We have previously highlighted the stability of the gold price throughout 2014. Volatility was relatively low and the price closed the year little changed from its opening level. At least, this is the story when considering gold in US dollars. For consumers outside of the US, the picture was a little different as currency fluctuations took local gold prices on a different path.

In Europe, the euro gold price rose by 14% over the course of the year as the single currency weakened versus the dollar. The robust price likely helped to sustain demand for bars and coins across the region. The most notable currency-related impact on local gold prices was in Russia. Sagging oil revenues and western-imposed sanctions led to the sharp depreciation of the ruble in the final few months of the year, prompting a sharp rise in the local gold price. The impact on gold jewelry demand was immediate. Modest increases in the local gold prices in both India and China conceal some considerable fluctuations throughout the year, although nothing on the scale of the moves seen in 2013.

The striking West to East shift in gold demand of the past two years is now being reflected in a similar period of change in global gold market infrastructure. Innovators in Turkey, India, China and South East Asia are developing gold products, services and platforms across the entire supply chain to boost market development. Consumer choice is expanding and the supply chain is becoming more efficient and more transparent.”

Countries have bought 1,964 tonnes of gold over the past five years, equal to more than seven months of global mine output, as they sought an alternative to fiat paper currencies, according to the World Gold Council report.

Currency Movements Have Caused Divergent Gold Prices

Gold price index in various currencies (31 December 2013 = 100)

Reasons For Central Bank Gold Buying

Why do Central Banks purchase gold for official reserves? There are three primary reasons:

- Diversity to reduce FOREX risk

- Lack of credit risk (as it is not an obligation)

- Liquidity is almost immediate and into almost any other currency

"Emerging markets have very strong, healthy foreign currency reserves —$200-$300 billion. They are turning to gold as a way to reduce burgeoning dollar reserves. It is great to have an asset that can be relied upon if there is another financial crisis. It is a way to reduce credit risk to the U.S., Euro area and Japan," experts opine.

Total foreign reserves held by Central Banks has surged sharply over the last 14 years. "In 2000, there was two trillion in foreign reserves, now there is 13 trillion in foreign reserves. There is desire for diversification away from the US dollar and the euro. Emerging market Central Banks have heretofore such strong allocations to the US dollar and euro, that they have recently been looking at other assets for diversification…including the Chinese renminbi, Australian dollar, Canadian dollar and GOLD,”

Russia had by far the greatest appetite amongst those who raised gold reserves. The country accumulated an additional 177 tonnes (36% of total Central Bank demand in 2014) over a turbulent 12 months. 2014 was bookended by tension and uncertainty for the country: geopolitical antagonism with the Ukraine, and the resulting international sanctions at the beginning of the year was followed by severe economic distress towards the end.

Kazakhstan (48tonnes), Iraq (48tonnes) and Azerbaijan (10tonnes) were also notable for the size of purchases made. Fortification and diversification of reserves, namely away from the US dollar, continues to be the driving force behind this activity.

If that was all there was, Russia could actually be thankful to Ukraine for essentially transferring over its gold from Kiev to Moscow. But there is much more here than meets the eye, and the biggest wildcard remains as usual China. Because after its gold-buying splurge, Russia currently has - according to official data - more gold, 1,208 tonnes in its (and certainly not the NY Fed's vault) than China. The problem, is that China's gold holdings were last updated officially in early 2009. It is really anyone’s guess how much gold China has today.

Official Gold Reserves Accumulation Of Emerging Countries Since 2000

And as everyone following China’s physical gold space knows, there are really just two outstanding key, questions:

- What is the updated total inventory of Chinese gold holdings (estimated to be somewhere between 3,000 and 6,000 tonnes or more), and

- Just what is the PBOC waiting for and when will it reveal this number

Source: ZeroHedge)

As Central Banks of most emerging countries have been hell bent for leather accumulating gold hand over fist during the past five years, one has to wonder if Currency Devaluation Contagion looms on the horizon…WORLDWIDE! Add to this China’s covert monetary objective to eventually back its Renminbi with gold, it is reasonable to expect that the gold price will inevitably soar to new all-time highs in the not too distant future.

CENTRAL BANK GOLD BUYING WILL NOT ABATE…IN FACT IT WILL ACCELERATE

Central Banks also will help boost demand for bullion as they expand reserves.

Based upon the above, the logical forecast is that gold will never reach a PEAK PRICE. Nonetheless, there will be brief periods of correction when the price of gold rises too far too fast (i.e. 2011-2014). However, these will be godsend opportunities to accumulate gold on the cheap. Obviously, TODAY IS ONE OF THE TIMES.

A parting seminal thought to ponder:

Recently Russia became the world’s largest producer of Crude Oil and Natural Gas. And no matter how strange it may seem, right now Russian President Putin is selling his country’s oil and gas only for physical gold.

Recently Russia became the world’s largest producer of Crude Oil and Natural Gas. And no matter how strange it may seem, right now Russian President Putin is selling his country’s oil and gas only for physical gold.

Related Articles:

Gold Price History In 16 Major World Currencies During The Past 10 Years

Gold Price Forecast Of Plausible $12,000 By Year 2020

Grandmaster Putin's Golden Trap

Russia is Selling Oil and Gas in Exchange for Physical Gold

Grandmaster Putin’s Gold Trap: Russia Is Selling Oil And Gas In Exchange For Physical Gold

********