Central Bank Overreach Benefits Gold

Strengths

- The best performing precious metal for the week was palladium, up 5.99 percent. Although gold consolidated this week, platinum group metals (PGMs) continued to climb.

- Gold advanced early in the week as turmoil across oil markets increased demand for a safe haven, reports Bloomberg. “The market these days seems to follow oil, with gold trading the opposite way,” explains ABN Amro analyst Georgette Boele. On a similar note, a silent gold rush has emerged among world oil producers, writes Bloomberg. The demand may continue through central bank purchases, increased consumer appetite, and mining supply.

- Swiss gold exports rose to 117.9 metric tons in March, reports Bloomberg, up from 93.1 metric tons in February. Other positive news for the precious metal shows that gold traders and analysts are bullish for the first time in three weeks as prices reach their highest in a month. Bloomberg News reports that silver imports by China climbed in March, up 13.7 percent year-over-year to 251.2 metric tons.

Weaknesses

- The worst performing precious metal for the week was gold, down -0.13 percent. UBS and Macquarie believe the yellow metal has peaked. Macquarie is tipping gold to edge down slightly this year to $1,199, reports the Sydney Morning Herald, and downgraded a range of Australian gold miners.

- HSBC and four other banks accused of fixing gold prices for 10 years could face “substantial damages” should the case have staying power, reports Bloomberg. Trillions of dollars’ worth of gold and gold-based derivatives and securities are alleged to have been affected by the gold fix, the article continues. Interestingly enough, now China has stepped forward to fill the void, announcing on Tuesday the start of its twice-daily price fixing in a move to be the new price setter versus London or New York.

- Detour Gold provided an update this week related to the investigation of an employee’s death at Detour Lake Mine. The company was charged on Thursday with “criminal negligence,” according to Bloomberg, causing death under the Criminal Code of Canada. Certain individuals may also face charges in the investigation.

Opportunities

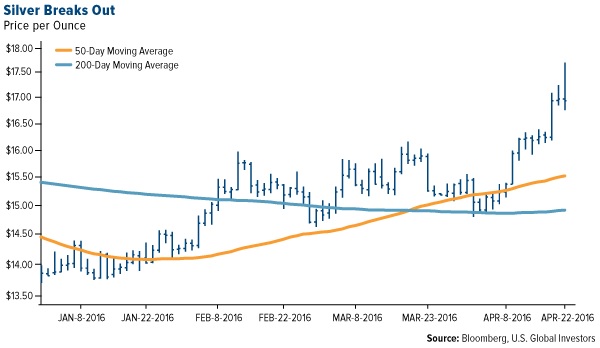

- Bank of America thinks the breakout we are witnessing in silver is for real, stating in a technical report this week that the precious metal could begin a bull move higher. Deutsche Bank agrees and believes silver could rise to $20 in near-term momentum. Silver has outperformed gold in nine of the last 10 sessions, reports Bloomberg, with the gold/silver ratio falling to the lowest since October. In a related article from ZeroHedge, the group writes that while Comex silver inventories have been declining from a peak in July 2015 to today, silver stocks at the Shanghai Futures Exchange have been doing the exact opposite. Silver inventories at the SHFE began to pick up in 2016, surging to 802 metric tons in January from 596 metric tons in December.

- Gold could reach $1,400 an ounce over the next 12 months, says BNP Paribas SA, citing central bank overreach. “There has clearly been an uptick in general investor concern about the eroding effectiveness and potential overreach of global central bank policies,” explains BNP’s wealth-management arm in a briefing on Thursday. Both Capital Economics and Cantor Fitzgerald are bullish on the gold price as well, as real interest rates will probably stay low even if the Fed raises borrowing costs in response to higher inflation, reports Bloomberg.

- China wants greater clout in the global bullion industry, reports Bloomberg. The nation’s gold miners plan to extend the biggest buying spree in four years, with some of China’s top producers saying they want to build on last year’s spree (when the nation spent the most on overseas gold assets since 2011). Japan’s Sumitoma Metal Mining was also cited by Bloomberg, expressing its interest in acquiring overseas gold mining assets.

Threats

- HSBC sees potential roadblocks for gold to move higher, according to an article on Scrap Register. “The gold rally is most under threat from the resurgence in investor risk appetite,” HSBC analysts stated. “The move in stocks to fresh 2016 highs, if the run continues, may rob gold of some of the oxygen it needs to continue to rally.” Goldman agrees that gold could slump this year, citing its forecast for the Federal Reserve to hike interest rates three times.

- Gold could be put on pause in the near-term, according to RBC Capital Markets. In a research report this week, the group highlights the extreme long positioning and the waning momentum in global gold ETF holdings.

According to Mineral Resources Minister Mosebenzi Zwane, South Africa’s government will meet next week with mining companies to resolve a dispute over black ownership laws. Sibanye Gold, South Africa’s biggest gold miner, has criticized the country’s planned Mining Charter, reports Bloomberg, saying some aspects of the legislation are “not acceptable” in its current form. The Democratic Republic of the Congo is dealing with similar issues. The government suspended the payment of value-added tax reimbursements to all companies until further notice, reports Bloomberg, in an attempt to shore up finances as the deficit balloons.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of