Central Banks Buy More Gold In 2018 Than Any Year Since 1967

– Central banks buy gold in largest buying spree in a half century

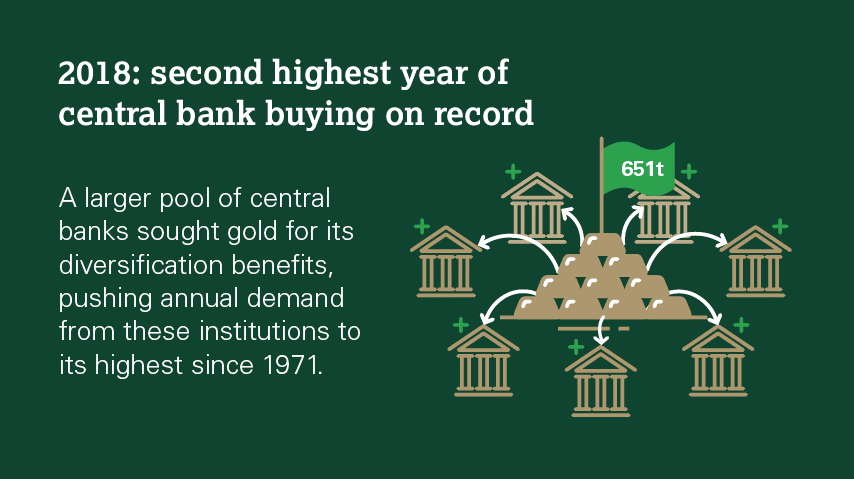

– 2nd largest year of gold purchases by banks on record – WGC

– Central banks bought more gold bullion last year than anytime since 1967, prior to the U.S. ending the gold standard in 1971

– Governments added 651.5 tonnes (metric) of gold to their foreign exchange reserves in 2018, a 74 percent increase from the previous year

– Surge in gold purchases by central banks and strong demand for gold coins and bars in Europe and Iran helped push global demand for gold up 4 percent last year

Source: World Gold Council

The Queen inspects a gold vault at the Bank of England

Source: World Gold Council

Central Banks Are on the Biggest Gold-Buying Spree in a Half Century (Bloomberg)

Central Banks Bought More Gold in 2018 Than Any Year Since 1967: WGC (Reuters)

Gold Demand Trends Full year and Q4 2018 (Full Report from World Gold Council here)

*********

Mark O'Byrne is executive and research director of

Mark O'Byrne is executive and research director of