China Comes Alive And Junior Miners Surge

Ancient Rome had the denarius, which was diluted into hyperinflationary oblivion. America has the dollar, which is on track to suffer an equally disgusting fate.

Silver bullion investors prospered during the denarius dilution that was orchestrated by the Roman “Creep State”.Today’s silver bugs will prosper from US Creep State dilution of the dollar.

Silver is pushing against a key trendline of supply, and that trendline is also the neckline of a loose inverse H&S bull continuation pattern.The target zone of the pattern is about $30.

Goldman Sachs has estimated that gold would be $150/ounce higher than it is right now (roughly at all-time highs) if the love trade in China and India hadn’t been temporarily derailed by the Corona virus.

I have some spectacular news in that regard.The FXI, aka the “Chinese Dow”, is soaring after the Chinese government issued a call for the nation’s citizens to invest in the stock market.

The Chinese stock market is one of my larger holdings and of course I recommend it for long-term investors.From the Corona crisis lows in March, the FXI has already outperformed both the US Dow and the Nasdaq.It now may be set to leave the debt-oriented markets of the West in the dust.

If this performance of the Chinese stock market continues, love trade demand for gold will rise significantly, while the “Mad Max” nation of America descends deeper into the current state of debt worship, chaos, and pestilence horror.Sadly, the debt-obsessed US government blames everyone but themselves for the crisis.

Please click here now. Clearly, the fear trade for gold in America is firing on all cylinders, and now the love trade in China is leaping to life.

This Ukraine action sums up empire transition reality. The gold bull era that is China-oriented is unstoppable, and the more aggressively that the US government acts to slow China down…

The more gold will be bought by nervous US money managers (and citizens) to hedge the fast-growing risks of war and inflation.

Money manager Pete Boockvar astutely called the US market low on March 26.He now says the Fed should be embarrassed by its orchestration of a soaring stock market…which it engineered against the background of a decimated economy.

I’ve referred to the US stock market as the US government’s “poster boy”.I own it with some size from the March lows, but I feel guilty about why I own it.

That’s because mangled US working class citizens get crumbs from the Fed’s printed money programs, while the government, banks, and ultra-rich stock market investors get the lion’s share of the free photocopied money.That will change and create what I call MSI… Main Street Inflation.If I’m wrong and there is no change, then a transition from riots to civil war becomes likely.

Gold is in a spectacular position here, both fundamentally and technically, but ecstatic gold bugs still need to exercise patience.

Why patience is required?What I refer to as the most spectacular chart in the world.

I’m projecting that a modest rise in inflation becomes more concerning by the Spring of 2021.Gold should continue to rally until then, but from there, the Fed is likely to pause its aggressive money printing and low interest rate policy.

2021 should be a soft year for gold, and 2022 could be the most spectacular year in gold market history, with a surge above $2000 and a mighty run into my $3000 target area.

The short-term gold chart.Tuesdays are often disappointing for gold investors, and today’s early morning price dip puts a right shoulder of a small H&S top into play.

Short-term traders can go to the sidelines until gold rises above the $1800 right shoulder high on this August futures chart but…

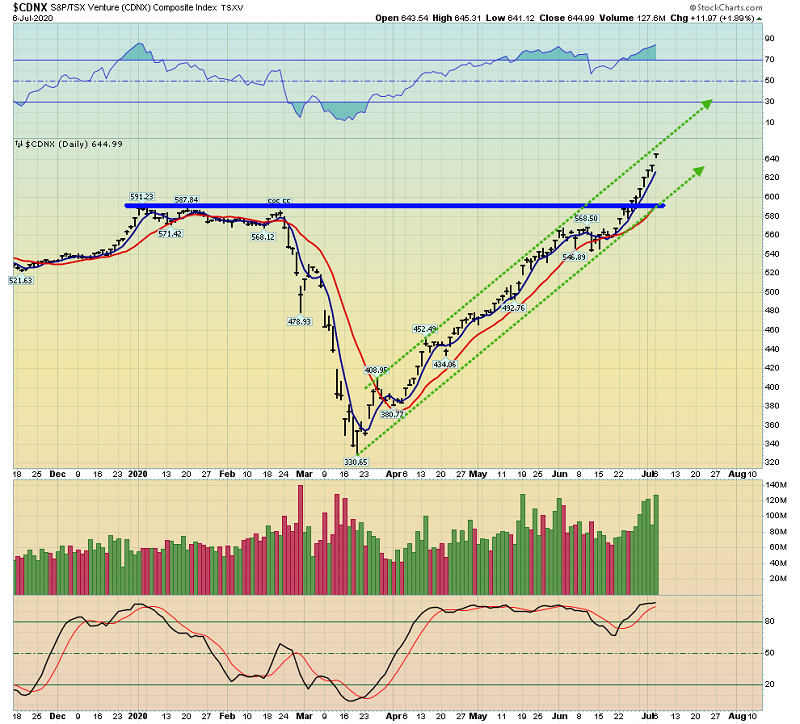

The CDNX index chart of champions!Even if gold slips back to $1700 or so, I expect a boatload of CDNX-listed junior miners to keep screaming higher.

Junior mine enthusiasts may want to check out the ongoing action at my https://gracelandjuniors.com newsletter and use the buy signals to get richer as some of the incredible price action becomes parabolic.

The GDX chart is bullish, but the $38 area corresponds with $1800 gold and that’s significant resistance.

Stoploss enthusiasts can use the $35 price zone as a marker to lock in profits and make sure they don’t slip away.If GDX can push above $38 as gold moves over $1800, an enormous rally in most gold stocks should take place.

Call options could be bought by aggressive gamblers if that breakout occurs, and the potential is real for all investors to make enormous profits, as my next GDX price targets above $38 are $46, $50, and $52!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Amp My Golden Champs” report. I highlight six new junior miners that I’m adding to my Graceland Junior Champs Portfolio this week, with price entry and profit booking points for each stock!

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily

Email:

Rate Sheet (us funds):

Lifetime: $999

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: