Chinese Gold Demand And The World Gold Council’s Estimates

There is considerable disagreement about Chinese gold demand, with delivery figures on the Shanghai Gold Exchange and import/export figures for Hong Kong suggesting the real totals are far higher than those published by the World Gold Council and Thompson-Reuters GFMS.

Recently Eric Sprott of Sprott Global Resource Investments Limited tackled this issue and wrote an open letter to the WGC pointing out that import/export figures show far higher levels of gold demand than the WGC's estimates for Asia, particularly China, Hong Kong, Thailand, India and Turkey. The response is not on the WGC website, though it appears to be partially quoted elsewhere.

It seems that Sprott and the WGC are trying to do two different things. Sprott is interested in how much gold is actually taken into a country net of exports, irrespective of its use category, taking the view that there can be no more accurate estimate of overall gold demand, irrespective of how it is used. The WGC is trying to identify how much gold is used for specific purposes, which given the opaqueness of the market means they will never track all of it down. Crudely put it is top-down versus bottom-up.

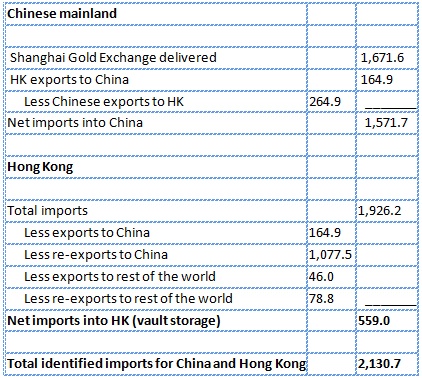

To see how different the results can be let's look at the solid figures for China and Hong Kong for the first nine months of 2013 which are set out in the table below, before comparing the result with that of the WGC.

All these are published figures which we can assume to be accurate. Mainland China does not release import/export statistics for gold but we know what has been physically delivered through the Shanghai Gold Exchange, the monopoly physical market, and we know what Hong Kong imports exports and re-exports. We can also be reasonably certain that these figures exclude off-market government transactions, such as direct purchases from the mines of all China's gold production, given that Chinese-refined bars are never seen in circulation. Exports from Hong Kong refer to gold processed into a materially different form from that imported, typically jewellery; so exported to the Mainland they are additional to SGE deliveries. Re-exports refers to imports re-exported with no material processing, and therefore can be assumed to be bullion trans-shipped and destined for the SGE, ignoring for simplicity's sake that some may have bypassed the SGE and been sent directly to private buyers. Exports and re-exports to the rest of the world obviously must be deducted.

The conclusion is that between them gold absorbed by private sector purchases in Hong Kong and China amount to at least 2,130.7 tonnes in the first nine months of this year, or 2,841 tonnes annualised. This compares with the WGC's estimates from their quarterly Gold Demand Trends of only 818.6 tonnes for the same period, or 1,091.5 annualised. Given the hard evidence of Hong Kong and SGE statistics it appears that the WGC's figures substantially understate the true position. Furthermore, any analysis of gold demand will fail to account for the increase in gold ownership not constrained by national boundaries.

Estimates of China's demand also exclude government purchases of gold in foreign markets, and gold that may have been acquired and imported by wealthy Chinese from foreign locations without going through Hong Kong or the SGE. So without taking into account these extra factors China and Hong Kong's combined imports from the rest of the world exceeds all other mine supply by at least 580 tonnes on an annualised basis.

It now becomes clear that without significant leasing by Western central banks total Asian demand could not be satisfied at current prices, because there is no evidence of material selling by existing holders of above-ground stocks, with the exception of ETF liquidation which is minor compared with the amounts involved.

Alasdair Macleod | Head of Research

Net Transactions Limited

1st Floor | 32 Commercial Street | St. Helier

Jersey | JE2 3RU | British Channel Islands