Clash Of The Titans Propels Gold

When titans clash, reverberations are felt around the world. The US central bank has begun a titanic clash with the US government. Consequently, all markets will be impacted significantly as the battle unfolds.

This short-term chart shows gold beginning a small uptrend, with higher lows and higher highs.

A broadening formation is now in play on this key daily gold chart.

Broadening formations are formed by higher highs and lower lows, and these patterns indicate a loss of control in the market.

I predicted the Fed would hike rates in 2015…and that would be a warning shot to the US government to get its financial house in order, or else more hikes would follow.

I do not believe the Fed’s first rate hike had anything to do with GDP or employment…nor will the rate hikes that follow have any effect. The Fed is enticing banks to move the “QE money ball” out of government bonds and T-Bills, and into the private fractional reserve banking system.

There, it can be loaned out more profitably, which will begin to cause money velocity to rise. For the first time in US history, rate hikes are not being used to cool inflation, but to heat it up. Rate hikes raise the cost of borrowing money for the government and for stock market buyback programs that have created questionable price/earnings ratios in the US stock market.

Gold is trading in a broadening formation because institutional investors are beginning to sense a loss of control, emanating from both government and central banks.

I expect gold will trade essentially sideways until mid-July, which is when it often bottoms anyways. That’s because early preparations for gold-oriented Diwali begin in India, when gold demand begins to surge.

Demand from India was weak in 2013, because of the imposition of a duty and import restrictions, as was the case in 2014 and 2015, because the monsoon season in both years was very dry.

The 2016 monsoon season looks good. It should produce great crops. Consequently, gold demand from millions of farmers may well rise significantly as that happens. India just killed the tax on cash purchases of jewellery. That’s very good news for farmers. They will be holding a lot of cash as their crops are harvested.

Also, if Janet Yellen hikes rates in July, not only will she be hiking just as Indian demand picks up, she will be doing so just as the US stock market enters what I call “crash season”. That’s the August – October time period.

If Janet hikes in September, the damage to the US stock market could be even worse. It’s imperative to note that Goldman Sachs analysts predict she will hike in both September and December. That would put enormous pressure on both the US stock market and US government bonds.

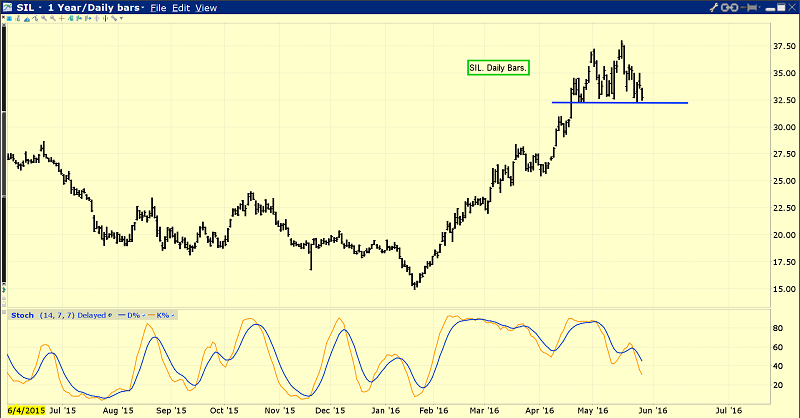

Powerful JP Morgan analysts have forecast gold will surge to $1400 in the second half of 2016. Furthermore, Citi recently voiced a nice price forecast.

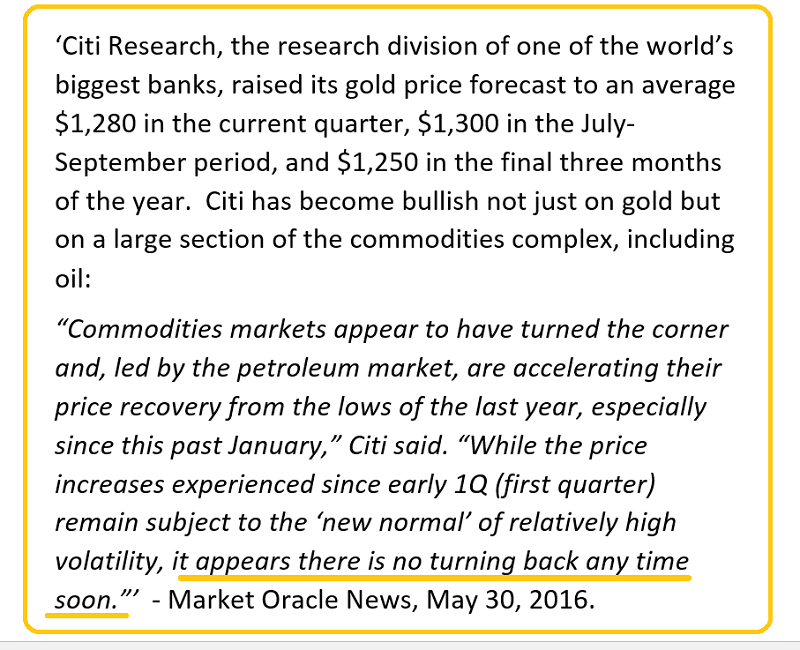

This is the GDX daily chart. I realize that some of the “old guard” of the Western gold community envisioned gold soaring to stratospheric prices as the US government debt crisis deepened.

Gold forecasts of $1400 from banks like JP Morgan may not sound very exciting to investors who envisioned gold at much higher prices by now. However, it’s important to understand that it only takes a modest amount of upside action in the price of bullion to create dramatic movement in the price of gold stocks.

Gold bullion rose about 25% from the December lows to the May highs, while GDX surged about 100% in the same timeframe! Many individual gold and silver stocks staged “five bagger” and “ten bagger” performances.

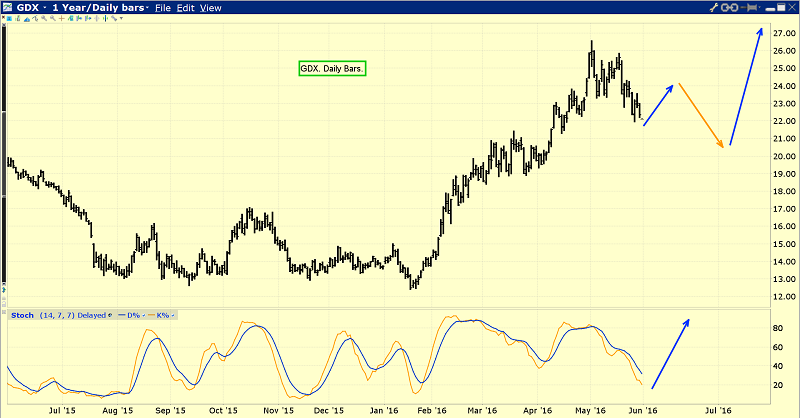

This is the daily silver chart.

Silver bullion rallied about 30% from the $14 area lows to about $18.

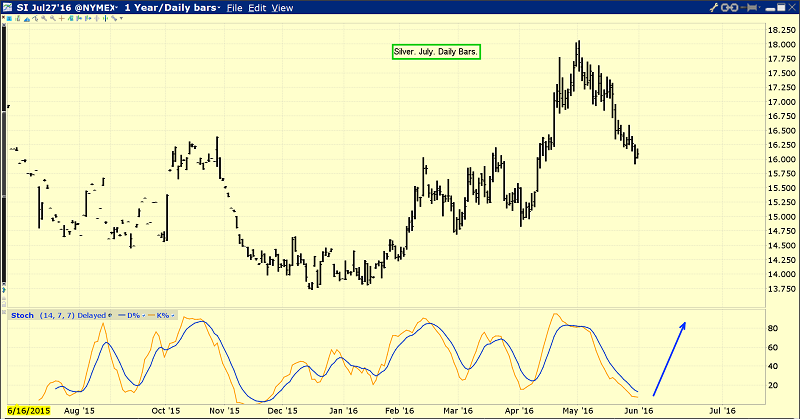

In the same time frame, the SIL silver stocks ETF surged well over 100% higher. What is even more important is that while silver bullion has now fallen about 25% from the $18 area high, the SIL silver stocks ETF is only down about 15%!

This begs the question: How is it possible for gold stocks and silver stocks to pullback so slightly, after such a huge rally, even while bullion has a material pullback?

It’s possible because so many powerful value-oriented institutional investors are showing great concern about coming inflation, loss of control in government and central banking, and overvaluation of the US stock market. They are buyers of gold stocks and silver stocks on price corrections, price rallies, and when they trade sideways!

A real correction is coming to the gold market, but I don’t believe it will happen until well into the 2017 calendar year. A lot of US economic reports will be released this week, including the jobs report on Friday morning. Gold has a strong tendency to rally following the release of that report.

Investors who may have recently become somewhat obsessed with calling a gold price correction may want to consider throwing a bit of caution to the wind. This is a time for investors to position themselves for the next wave higher. And for gold stocks, that wave may just begin on Friday morning!

********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Senior Gold Stocks Rock!” report. I highlight seven senior gold producer stocks that are poised to outperform the GDX fund in the second half of 2016, with precise buy and sell points for each of them!

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Email: [email protected]

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to: Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: