COMEX Gold Trade At Settlement

Back in November, we noticed a surge in COMEX gold "Trade at Settlement" volume. This occurred at a time when total contract open interest and price were also rising, and it all preceded a sharp reversal in price two weeks later. This same scenario may now be playing out in January.

First some background. It was a member at TF Metals Report who first connected these dots last November. We took his ideas and incorporated them into this post, dated November 23:

And if you're unfamiliar with what "Trade at Settlement" is, see this link from the CME and the screenshot below: Trading at Settlement (TAS) for Metals Futures

The working theory in November was that the surge in open interest and TAS volume was likely due to a sudden interest in spread trades. Whether or not these spreads were being placed for legitimate or manipulative purposes is impossible to ascertain. What is possible to discover, however, is the connection between TAS volume and spread volume. How? By a review of the weekly Commitment of Traders reports from the CFTC.

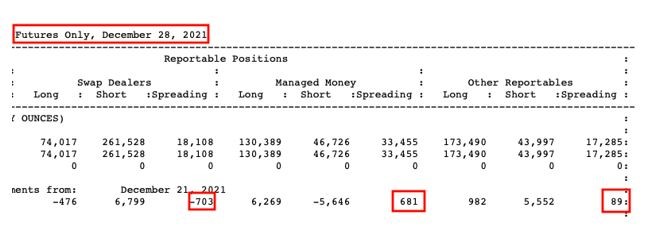

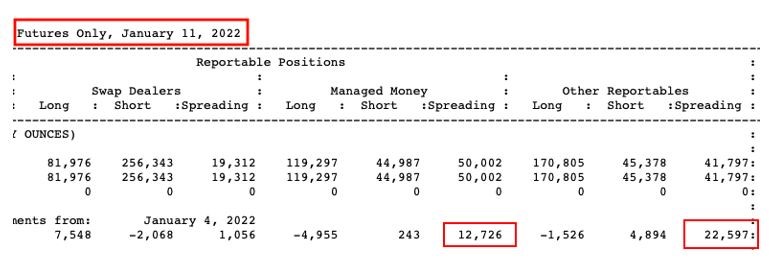

Below is a typical CoT report. This one is from the last week of December when Trade at Settlement (TAS) volume was at its usual daily average of under 3,000 contracts per day. Price rose by $22 during the reporting week, and total contract open interest rose, too, by over 8,000 contracts. As you can see, it was a typical CoT report for a price rally with Swap Dealers moving net short and Managed Money speculators moving net long.

Note, too, the total spread volume that I've highlighted, and while we're at it, we might as well post again the CFTC's definition of these parties. What is a "swap dealer"? What is an "other reportable"? Here's how the CFTC defines them:

So, if you're not considered a part of one of the main three groups, you're simply lumped into Category Four and considered an "other reportable". Do we know who these traders are for certain? No. However, if you study the CoT reports each week as I do, you'll quickly notice that the Other Reportable positions often change in line with the Swap Dealers or Commercials and in the opposite direction of the Managed Money or Speculator category.

Does this mean that these "Other Reportables" are actually Bullion Bank trading accounts that are camouflaged to hide their manipulative intent? Well, I'll let you decide that as you read the paragraphs that follow.

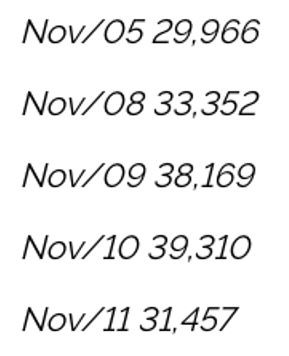

Let's start with that period last November when price rose by $100 in just nine days. Total COMEX gold contract open interest rose by over 100,000 contracts or 10,000,000 digital ounces, and total Trade at Settlement volume exploded by 10X from an average of 3,000 trades per day to over 30,000 per day.

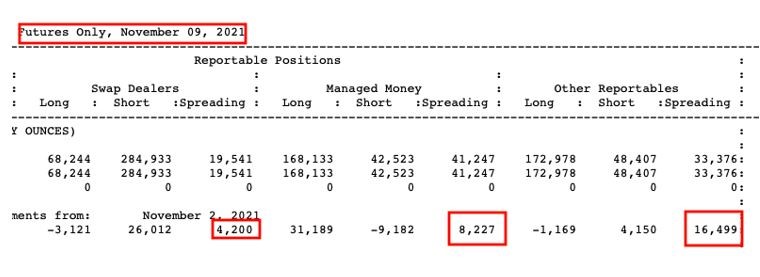

Next, check the CoT reports from that same two-week period. Note the surge in spread volume November 3-9, not only from the Managed Money category but that Other Reportable category, too:

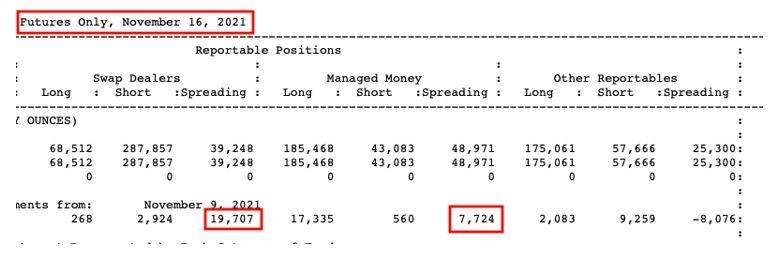

The TAS and spread volume continued into the next CoT week, too. Check this report for the week November 10-16. Notice it was Managed Money and Swap Dealers who continued to add the spreads:

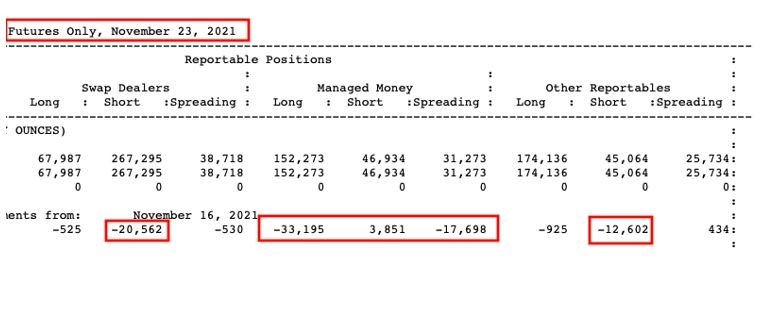

Then, as price fell dramatically on November 22 and 23, the next CoT report revealed a Managed Money dumpfest as this category shed long positions and spreads. The Swap Dealers and Other Reportables used this Speculator selling to cover short positions, and total contract open interest collapsed by nearly 60,000 contracts.

So now look. Maybe all that contract dumping was legitimate? Maybe it was all simply related to a shift in positioning as the Dec21 contract moved off the board and the trading action shifted to Feb22 and beyond? And maybe all of those spreads placed through TAS as volume surged 10X was just a two-week trade placed as price rallied?

Or maybe something else was taking place.

Maybe those spreads were placed ahead of a strategy to unwind them for profit at a later date? An entity, classified as either "Managed Money" or "Other Reportable", might have sought to manipulate price through the "legging out" of those spreads. Individual traders on margin leg out option trades all the time. Traders with infinitely deep pockets and who are deemed "too big to fail" while avoiding all regulatory scrutiny have the ability to "leg out" futures market spreads, too.

So, were some of those spreads placed in early November "legged out" two weeks later? Did a party dump 10,000 longs, watch price get slammed, and then wait for follow-on selling to smash price further before acting to cover the 10,000 contract short side of the spread?

If that seems far-fetched, then perhaps you haven't monitored the gold space and the manipulative bullion banks for as long as I have. But, whatever. Let's now bring this up to present day.

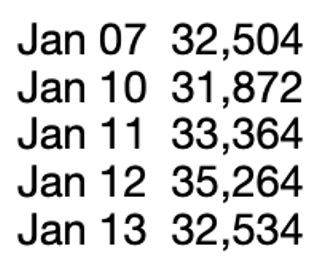

And what do we have as the new year begins? Another 10X surge in TAS volume. This surge began on Friday, January 7 and ran for five trading days through Thursday, January 13. You might first notice that this is relatively the same period of the month—and ahead of a delivery month expiration—as we saw the TAS surge back in November. The published TAS volume numbers are about the same, too.

Total COMEX gold open interest also rose during this period from 517,853 contracts on January 6 to 547,111 contracts on January 12, and price rose, too, climbing from $1785 to $1830.

And now check the most recent CoT report. This data is for the reporting week of January 5-11 and was released last Friday. What do we see? Just like the week of November 3-9, we have another massive surge in spread trades from both the Managed Money and Other Reportable categories.

So, in the end, what do we have here? I'll give you three choices:

- This is nothing. The COMEX is a free and fair market where participants place trades and hedges consistent with their investment objectives.

- This is nothing. What you've seen outlined above is just the simple trading activity of institutions that are placing and unwinding spread trades ahead of front month contract expiration.

- This is something. Bullion Bank and/or hedge fund traders are seeking to influence price and profit by placing spread trades. They conceal the size of their positions intraday and intramonth by using spreads and placing these trades through the TAS system. These spreads are then removed at a later date for maximum price impact and profit.

Frankly, it's too early to conclude whether or not we have discovered a new price manipulation technique. Let's watch closely the rest of this month as the Feb22 contract goes off and the action shifts to the Apr22. Will price collapse again as it did in November? If it does, will we see another mass exodus out of spread volume and Large Spec long positioning?

*********