Commodities and the Next Major Macro Phase

As the macro backdrop evolves, our investment orientation will include more commodity-related investments and speculations

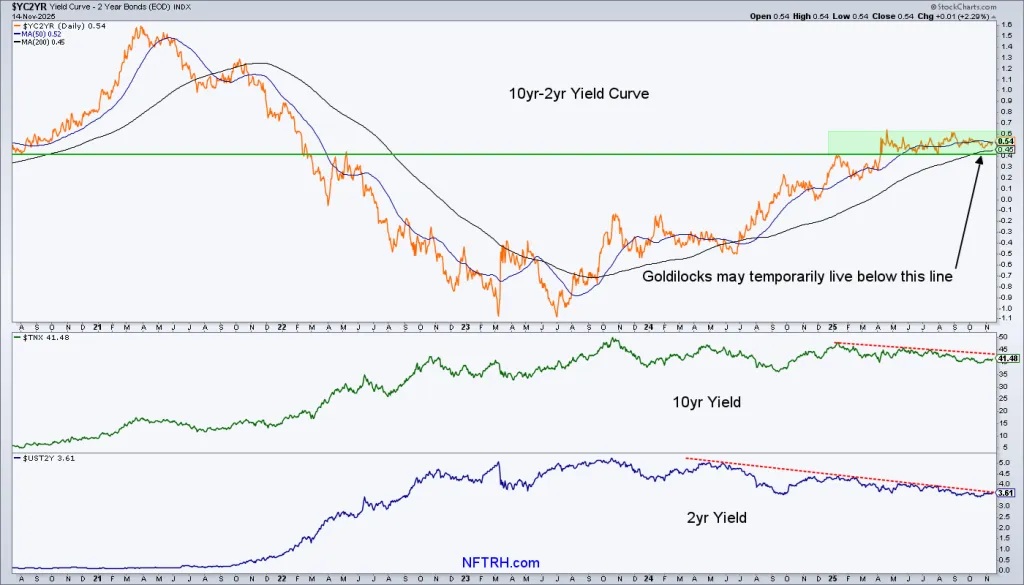

It comes down to a question of when (not if, in my opinion) the broad markets will swing toward a coming inflation trade in a wider segment of the commodity world. Currently, per the work done in this week’s edition of Notes From the Rabbit Hole, NFTRH 889, and many reports that preceded it, we are in an interim disinflationary phase. This has been indicated by yield curves, among other measures we use.

The 10yr-2yr yield curve had steepened with a mildly disinflationary underpinning, as evidenced by the downtrends in its nominal 10 and 2 year yield components. Currently, as the curve travels sideways, neither steepening nor flattening, the question is whether Goldilocks may get an interim bid to end the year.

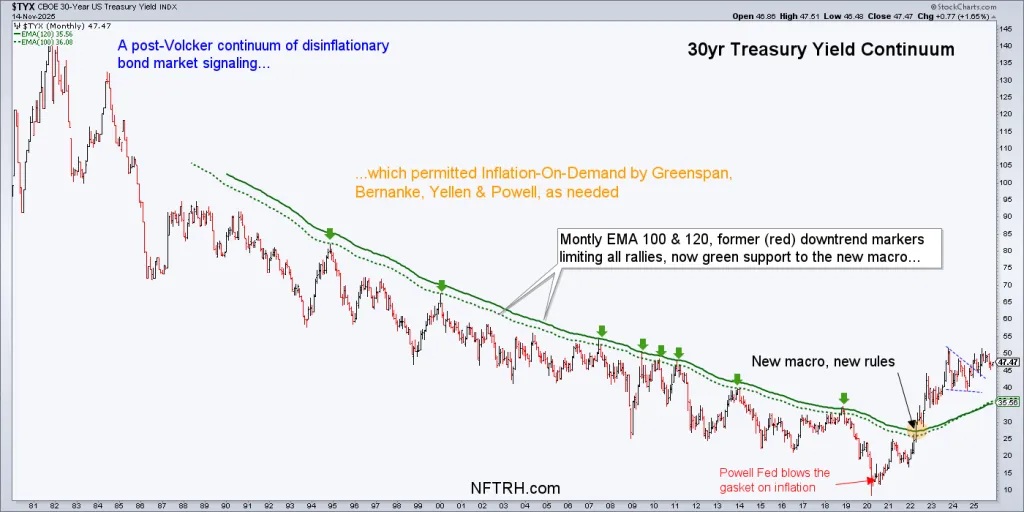

But the bigger picture in Treasury bonds is inflationary, as I have harped upon repeatedly since the 30yr Treasury Yield “Continuum” broke trend in 2022. The current easing in a relatively pleasant disinflationary interim is just that, “interim” to the next inflationary phase as nominal yields pull back within the new major uptrend in bond yields. After this phase completes, we should see renewed upside in interest rates on Uncle Sam’s long-term debt.

The interim will be guided by indications like the Silver/Gold ratio (SGR), among others. NFTRH 889 took an extensive look at the SGR, the caution point it currently resides at (an extreme within an intact downtrend), but also the future it portends.

For years it was like shooting fish in a barrel projecting eventual failure in the Silver/Gold ratio, and by extension, commodities, pre-2022. But the macro changed, and the change is profound in many ways beyond my Continuum chart above and its inflationary message.

The world is ever more divided and a global commodity/resource grab is likely in its early stages. We saw a vertical explosion in the critical minerals areas (especially Rare Earths, which NFTRH anticipated long before, with ongoing analysis of the strategic case for MP Materials), that is now being corrected. While the ensuing speculative momentum took things too far (as MOMO will), it was for the right reasons. An ever more contentious world is at economic war over the raw materials of modern society.

But this was not a bubble in the critical minerals space. It was the first impulse of what is to come, in my opinion. We can add the producers and explorers of Copper, Nickel, Uranium, Platinum and Palladium, among others, to the list of go-to commodities in the near future. Oh and didn’t silver just get added to the list of critical minerals?

As for gold and gold stocks, we were right on the correct (disinflationary) fundamental reasons for being bullish before the recent bull cycle began. When the correction clears, I expect gold and silver stocks to participate. But I also expect our investment theses and profit opportunities to expand well beyond gold stocks. I am a gold bug, sure. But where the miners are concerned, they will likely participate, but not be nearly as unique as they were in the recently completed upward impulse.

Meanwhile, this big picture chart of the CRB index appears to be biding its time. Again, we had much more detail in NFTRH 889, but this picture has a lot to say in its own right. Hint: while the current cycle has similarities to the cycle that ended rudely in 2008’s deflationary crash, there is reason to believe that will not be the case any time soon on this cycle.

Bottom Line

The anticipated disinflationary phase is and has been in play in 2025. When it ends, either with a Goldilocks whimper or a liquidity crisis of some kind, the next inflationary macro phase should fan out to include more commodity and resources areas. Gold and eventually silver stocks were the stars of 2025. However, in 2026 I expect the profit opportunities to broaden.

We had our indicators for caution (like the extreme upside within an intact downtrend in the Silver/Gold ratio), and we have our indicators on watch for future buying opportunities.

For “best of breed” top-down macro analysis and market strategy covering Precious Metals, Commodities, Stocks and much more, subscribe to NFTRH Premium, which includes a comprehensive weekly market report, detailed NFTRH+ updates and chart/trade setup ideas, and Daily Market Notes. Receive actionable (free) public content at NFTRH.com and subscribe to our free Substack. Follow via X @NFTRHgt and BlueSky @nftrh.bsky.social, and subscribe to our YouTube Channel. Finally, watch for ANS coming soon and check out Hammer’s trade (long and/or short) setups.

*******