Crashing U.S. Dollar…and the future price of gold (Part 1)

For Part 2, please see: https://www.gold-eagle.com/article/crashing-us-dollar-vs-gold-part-2

For Part 3, please see: https://www.gold-eagle.com/article/crashing-us-dollar-vs-gold-silver-prices-part-3

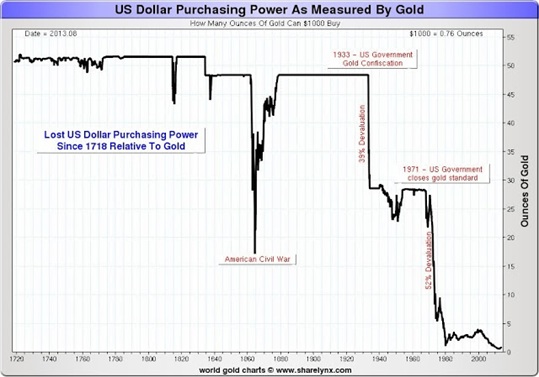

Since the 1930s Great Depression the U.S. Dollar’s value has been in a Kamikaze-like Dive.

Another way of describing the disastrous history of the greenback is to simply say:

Measured against gold, the US Dollar purchasing power has dropped by 99.9% during its lifetime

(1720-2013).

Historical U.S. Debt Defaults

Most Americans believe that the US has never defaulted on the National Debt. Not True! Indeed dire circumstances in our history have forced our government several times to default the National Debt. Here are the most notable historical occasions of US debt default.

- The Continental Currency Default of 1779 – The US was at war for its Independence from Great Britain. Consequently, the Philadelphia Congress or the original 13 states issued bills of credit in the amount of 2 million Spanish milled dollars. US money at that time was called “Continentals.” In November of 1779, Congress announced a devaluation of 38.5 to 1 on the Continentals, which amounted to an admission of default. From this was born the expression: “Not worth a Continental,” meaning WORTHLESS.

- Lincoln in Civil War defaulted on U.S. bonds in 1862 – To preserve the Union President Abraham Lincoln had to finance the raising of the Union army in order to defeat the Confederate Army of the south, who wanted to secede from the United States. Consequently, the US Congress created a new currency called the “greenback,” which was redeemable in gold. Less than five months later, in January of 1862, the US Treasury defaulted on these notes by failing to redeem them on demand.

- Roosevelt allowed U.S. bonds to default during the 1930s Great Depression - To finance the horrific bellicose activities of World War I (known historically as the Great War), Congress issued a series of debentures known as "Liberty Bonds" starting in 1917. The preliminary series were convertible into issues of later series at progressively more favorable terms until the debt was rolled into the fourth Liberty Bond, dated October 24, 1918, which was a $7 billion dollar, 20-year, 4.25 percent issue, payable in gold at a rate of $20.67 per troy ounce. By the time President Franklin D. Roosevelt entered office in 1933, the interest payments alone were draining the treasury of gold; and because the treasury had only $4.2 billion in gold it was obvious there would be no way to pay the principal when it became due in 1938. With the country’s back against the wall due to the 1930s Great Depression, Roosevelt decided to default on the whole of the domestically-held debt by refusing to redeem in gold to Americans and devaluing the dollar by 40 percent against foreign exchange. By taking these steps the Treasury was able to make a partial payment and maintain foreign exchange with the critical trade partners of the United States. Effectively, the value of gold leaped over-night from $20.67 to $35.00 per ounce in early 1934.

( Source: http://mises.org/daily/5463/ )

Fast-Forward to 2013

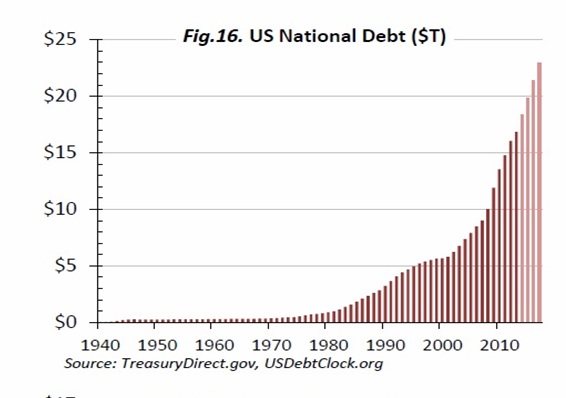

And today with the floundering Obamacare fiasco, exacerbated by the National Debt soaring over $17 TRILLION and targeting $25 TRILLION in the next few years, AGAIN U.S. T-Bonds are of questionable value in the minds of prudent investors. The following chart clearly demonstrates the U.S. National debt is totally out of control and rising “like a bat outta hell…” pardon the vernacular.

Noteworthy articles about our festering US Default threats:

http://rt.com/op-edge/us-debt-gold-price-threats-481/

http://www.therealnewsmatters.com/2013/10/12-very-ominous-warnings-about-what-u.html

The Ominous National Debt Clock Is Ticking:

U.S. National Debt Clock Real-Time: http://www.usdebtclock.org

The most important question for all investors today is: How much must the greenback be devalued (again) in order to finance the soaring National Debt and incalculable future Obamacare costs in order to avert a looming U.S. DEBT DEFAULT?!