Critical Week For Gold Looks Like A Bottom

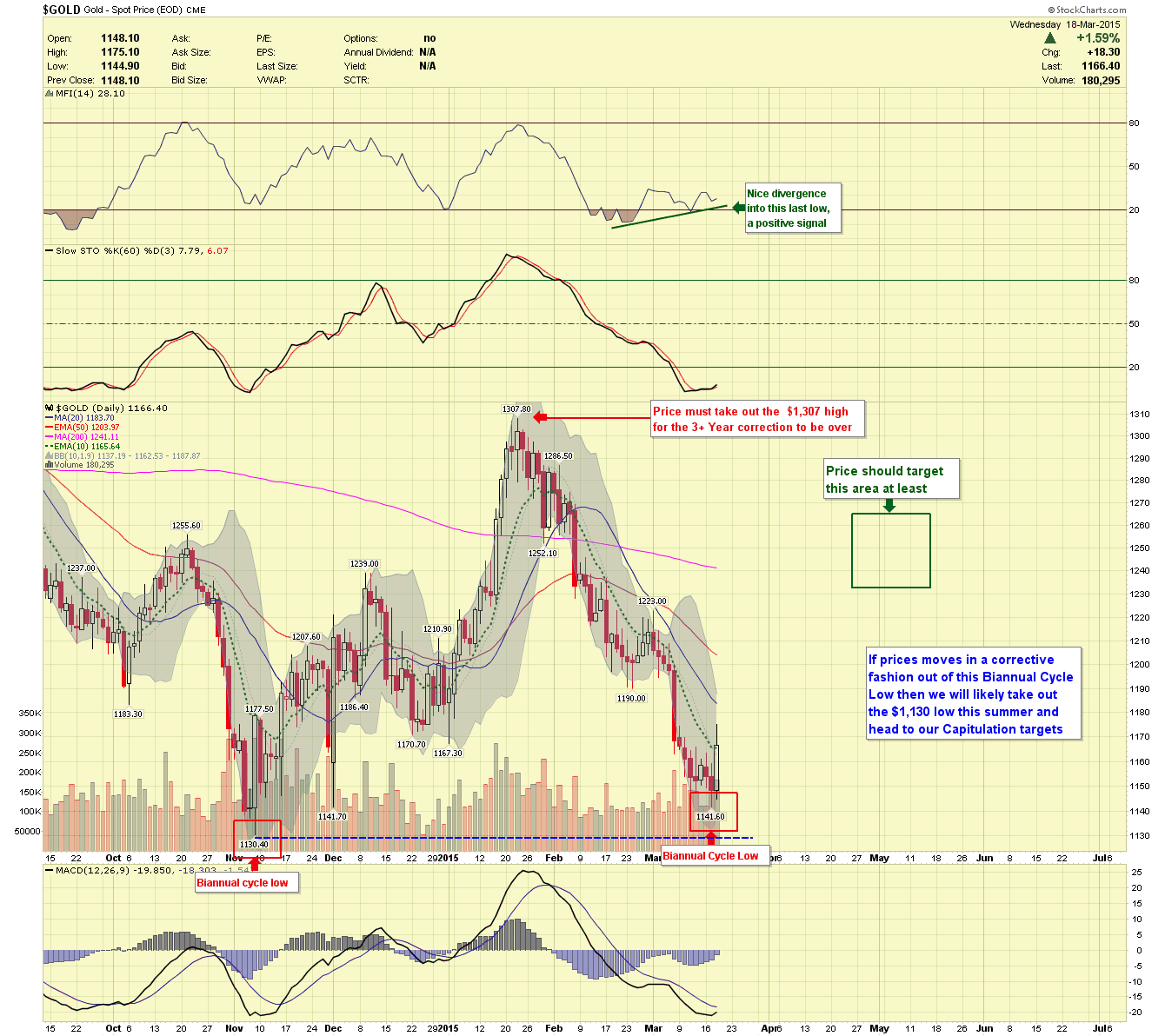

As stated in part 2, either Gold would bottom this week or begin a sharp move lower, both outcomes hinged upon the Fed decision. The statement they released dampened expectations of an interest rate hike coming sooner rather than later, and commodities moved higher. As previously stated we have been looking for the arrival of a Biannual Cycle Low and as the name suggests they occur just twice per year. All of our models are indicating the bottom potentially just arrived.

As stated in part 2, either Gold would bottom this week or begin a sharp move lower, both outcomes hinged upon the Fed decision. The statement they released dampened expectations of an interest rate hike coming sooner rather than later, and commodities moved higher. As previously stated we have been looking for the arrival of a Biannual Cycle Low and as the name suggests they occur just twice per year. All of our models are indicating the bottom potentially just arrived.

Where does that leave us on a larger scale? As long as the price holds above the $1,130 low made in November of 2014 there is a chance the 3+ Year correction is over. If price falls below that low, then the capitulation versions (part 1 of this three-part editorial) will be in play. Gold prices were dangerously close to the $1,130 level and for that reason this week was critical for the Metals prices.

Where do we go from here? The way price moves out of this low will surely help fill in the blanks and the $1,307 high must be taken out to even consider this 3+ Year correction as over. If price behaves in a corrective manner out of this low versus impulsive, then we will likely break the $1,130 low later this year. The Chartseek Example Portfolios began taking their positions and will continue to be nimble as this picture unfolds.

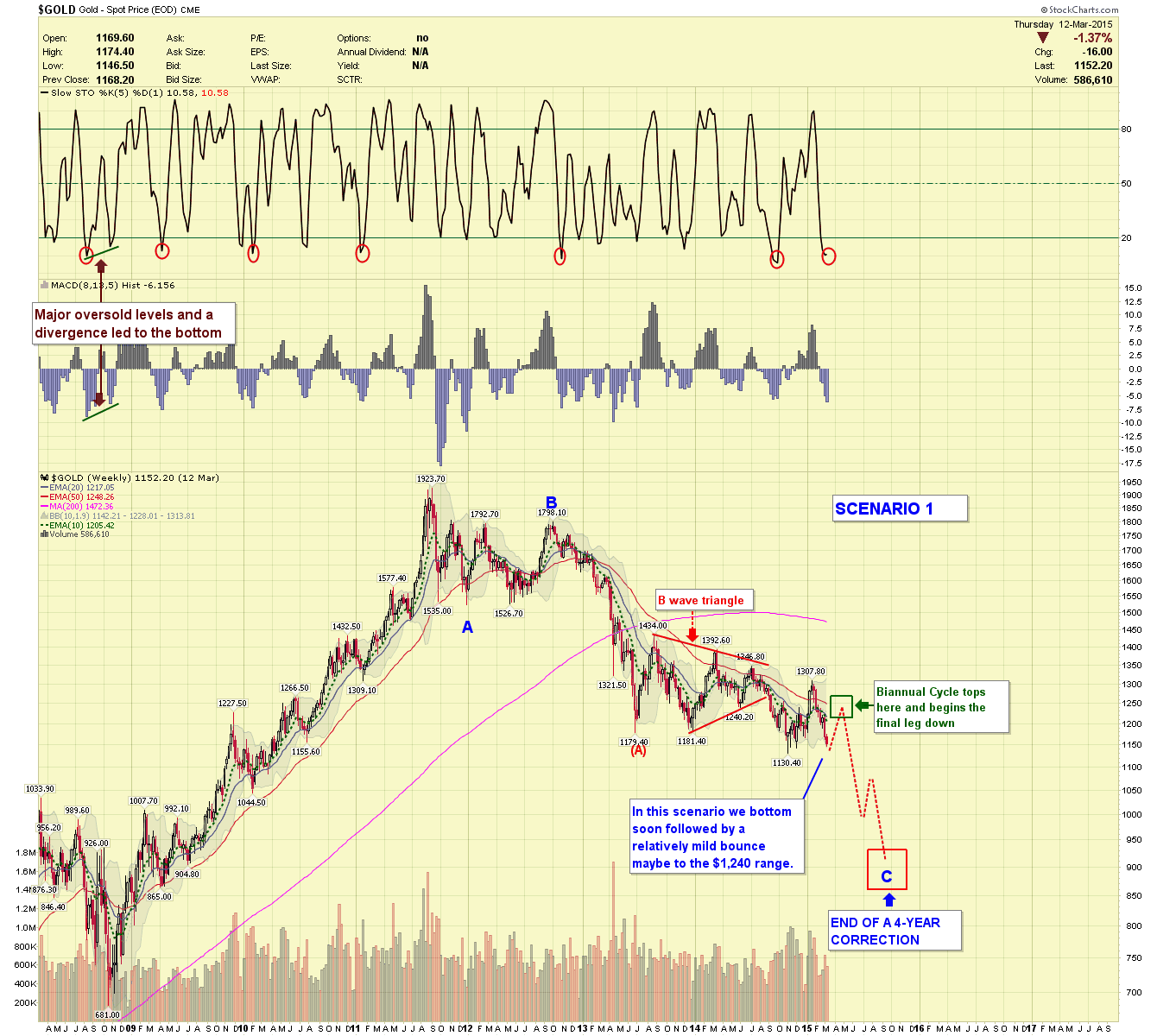

If price is unable to take out the $1,307 high and wanders in a corrective manner, then our Scenario 1 (below) will be brought to the front on the line.

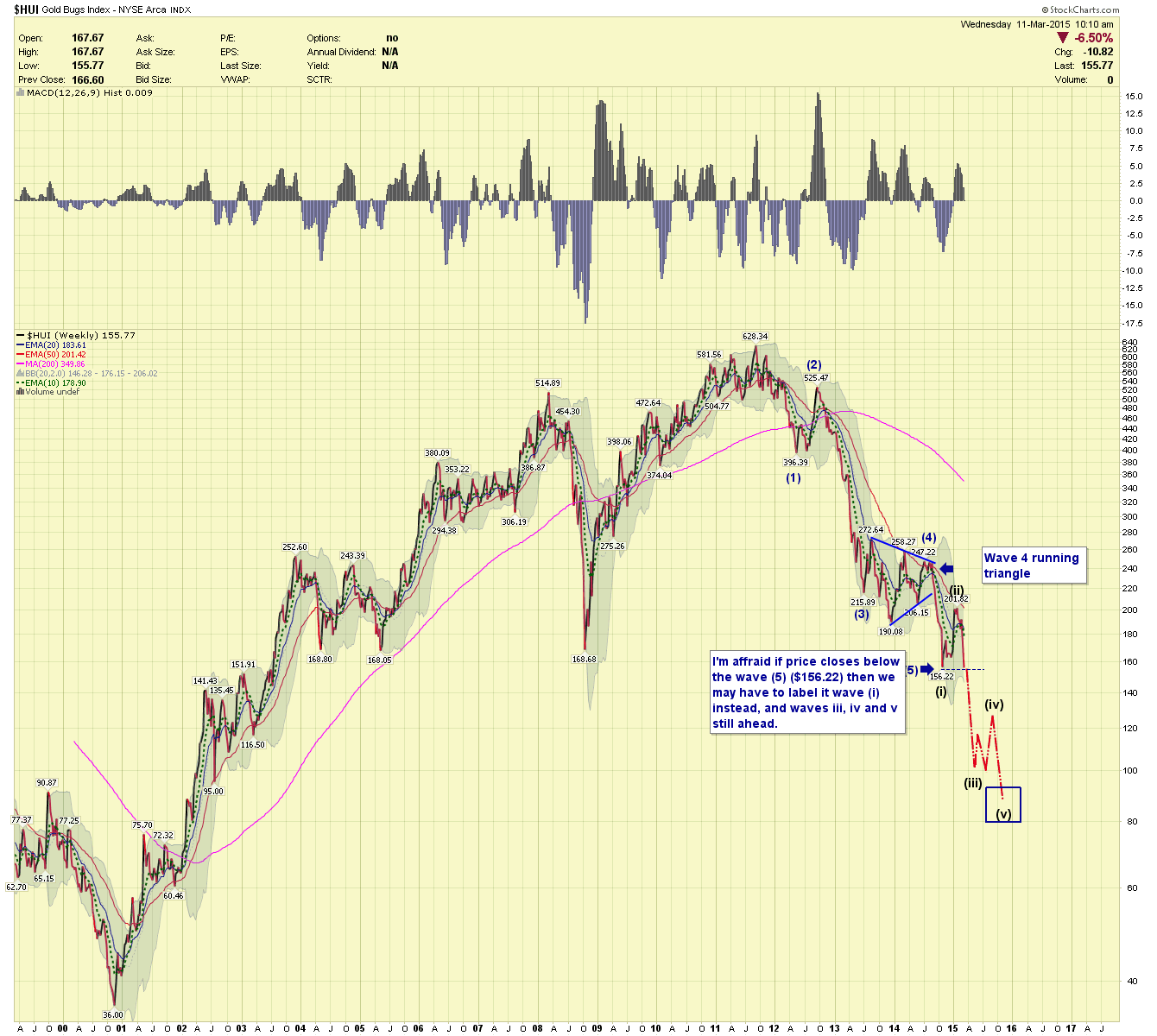

When we look at the HUI (below), I see a complete five wave structure in Elliot Wave terms. The move out of the wave (5) does not appear impulsive, and price should not have retraced as far as it has. If the $156.22 level is broken, then much lower prices may be seen.

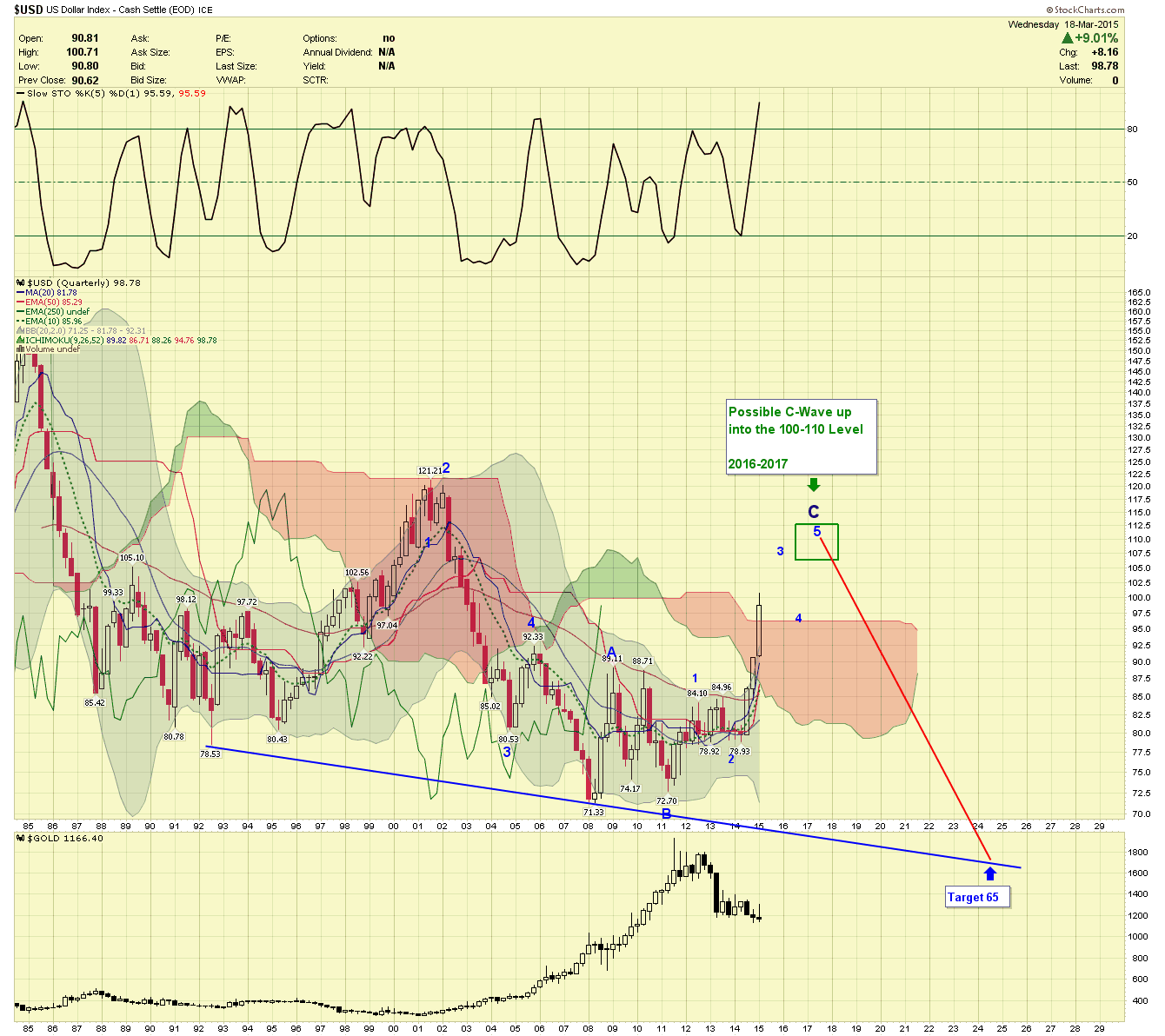

To conclude this three part series I wanted to pull up a chart of the US Dollar (Quarterly Chart). It has had a meteoric rise over the last three-quarters. History suggests this move may continue into the year 2017 but due to the price increase we’ve already seen the top may come sooner than that. The point I wanted to illustrate is the $65.00 target we have. This target has a timing model of approximately 2022 to 2024 which coincidently lines up with our overall Gold Bull Market timing and objectives.

The next two months should be very telling. Our Newsletters will keep subscribers up to date, and the Example Portfolios will continue to take advantage of the Cycles and Momentum.

********

We are offering a 14 Day Free Trial to our Basic Plus Newsletter, released every Sunday, Tuesday and Thursday.