Current Signals & Positions

After a week of heavy selling, many public readers have asked if this is now a good buying opportunity. There will be opportunities this week for short term scalpers, as the metals are deeply oversold and should see a relief bounce. But for position traders, our current signals suggest being in cash or short are the only viable positions.

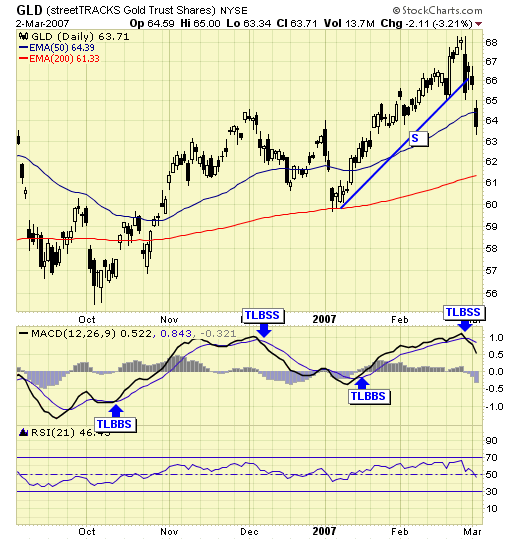

GLD - sell signal on 2/27 ended the buy signal of January.

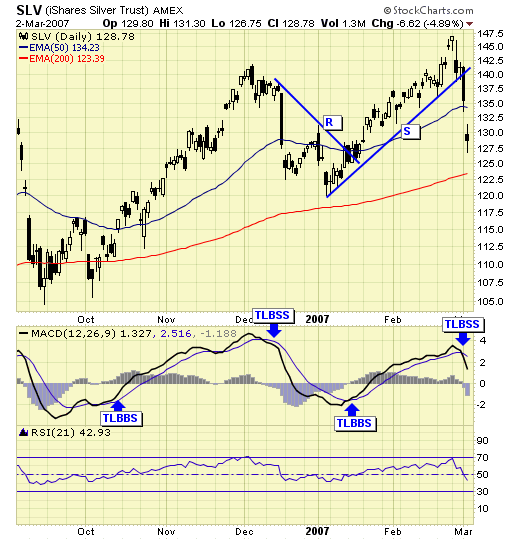

SLV - also on a sell signal ending the buy signal of January.

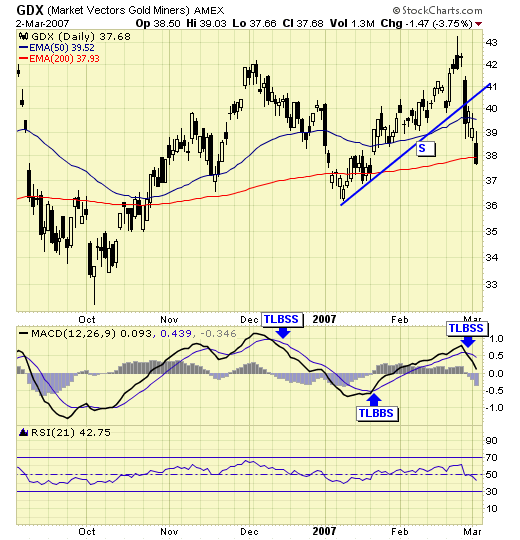

GDX - sell signal on 2/28 ended the buy signal of January.

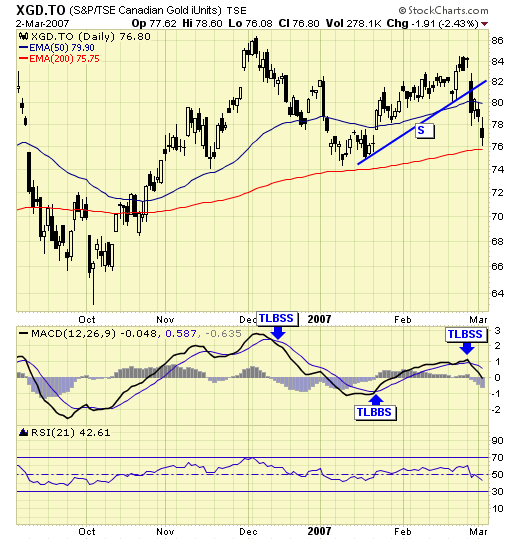

XGD.TO - Cdn traders also had a sell signal on 2/27 ending the buy signal of January.

Summary

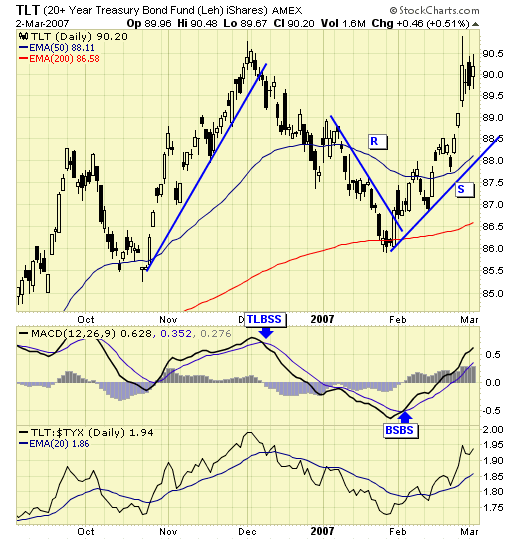

The gold sector is on a sell signal and traders should be in cash or short. For our subscribers, we moved into 50% bonds and 50% cash during the week of 2/04 and have been there since.

********

Disclaimer: Words of caution: public readers of my commentaries should exercise their own judgment as to whether to buy or sell anything. Never trade based on other people's analysis. Knowing which way to place our bets is only half of the formula to success. Wishing you peace and profits......................................