Debt: Sizzle Versus Steak

I predicted gold would bottom in mid-November and it did.The fabulous daily gold chart.

A lot of amateur gold investors have missed this rally.That’s partly because they thought the “smart money” was shorting a lot of gold on the COMEX.

What they probably overlooked was the possibility that the smart money has been buying the miners and physical metal while shorting “paper gold” on the COMEX.That’s been a magnificent trade and I’m predicting it will become even more profitable in the years ahead!

Some republicans have labelled a US economy growing at sub 2% GDP growth with a 100%+ government debt to GDP ratio as the “mightiest of all time”.

They have also missed the massive rally in the miners, because of a silly focus on partisan politics. The bottom line: They bought the stock market late in the business cycle rather than miners early in the inflation cycle.

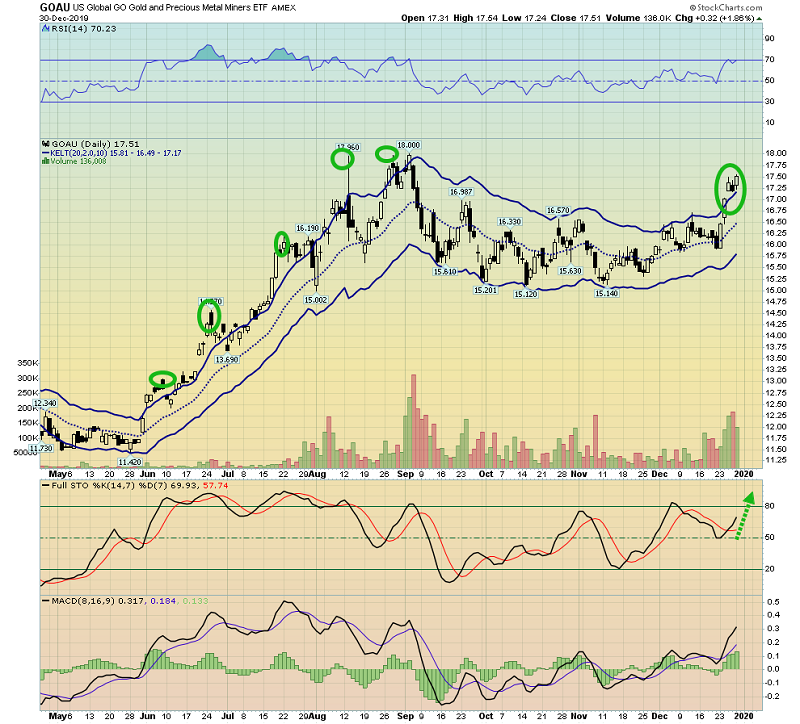

To get richer, gold investors need to change with the times, or get left behind. To keep up with the good times, the awesome GOAU gold stocks ETF chart.

Note the surge above the Keltner supply line.RSI is not overbought, and Stochastics is on a buy signal.That’s bullish action!

Even if there is a light pullback in gold, I expect many miners to keep rallying.

US unemployment is at 50year lows, yet GDP growth can barely hold the 2% marker.The problem of course… is debt.As global debt versus GDP skyrockets, investors need to focus on gold, silver, miners, and countries where debt growth isn’t promoted as “awesome” the way it is in America.

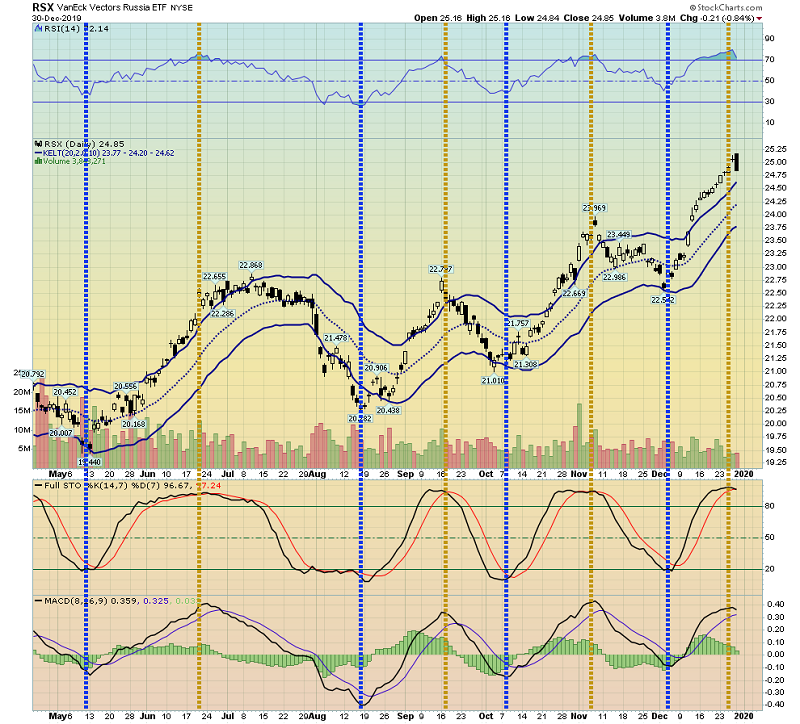

The superb RSX Russian stock market ETF weekly chart.

A pullback is likely, but GDP growth seems set to surge, and so does the stock market. The Russian government’s debt to GDP ratio is only about 30% and personal income tax is a flat 13%.

In contrast, in socialist America, citizens are subject to an obscene progressive income tax system that is really a vile extortion racket.There’s also horrifying capital gains and property tax, and the government wallows with a 100%+ debt to GDP growth ratio.

Incredibly, the massively indebted US government assumes the right to take on even more debt and use it with the power of the dollar… to impose sanctions and regime change on a myriad of nations around the world. Economic growth gets smashed during these macabre attempts to “save the people”.

To Trump’s credit, he’s reduced the military side of regime change, but not sanctions.US government meddling in the nations of the world continues. It will be ended by debt implosion, as it was in Rome.

This RSX daily chart is awesome.Note the synergy between price, RSI, Stochastics, and MACD. If US sanctions were lifted, Russian GDP growth would skyrocket and the RSX would stage a “moonshot”.

The US government claims it needs more QE and even lower interest rates to “compete”, but rates are about 6% in Russia, 5% in India, 4% in China, and only about 2% in America.

America needs to compete, but to compete with the nations of what I call the “gold bull era”, US rates need to rise, and QE needs to be dismantled.

The reserve currency of the dollar has allowed the US government to operate a crazed regime change “mandate” without collapsing internally, but now most nations are racing to embrace de-dollarization.

That is making US government debt a much greater danger than it was in the past, and it’s making gold stocks the ultimate asset class for the foreseeable future.

The T-bond chart.

Bonds can rally as a safe-haven when debt is not a major issue.When it is an issue, gold rallies while bonds languish.As the debt problem intensifies, bonds swoon, the dollar essentially incinerates, and gold skyrockets.

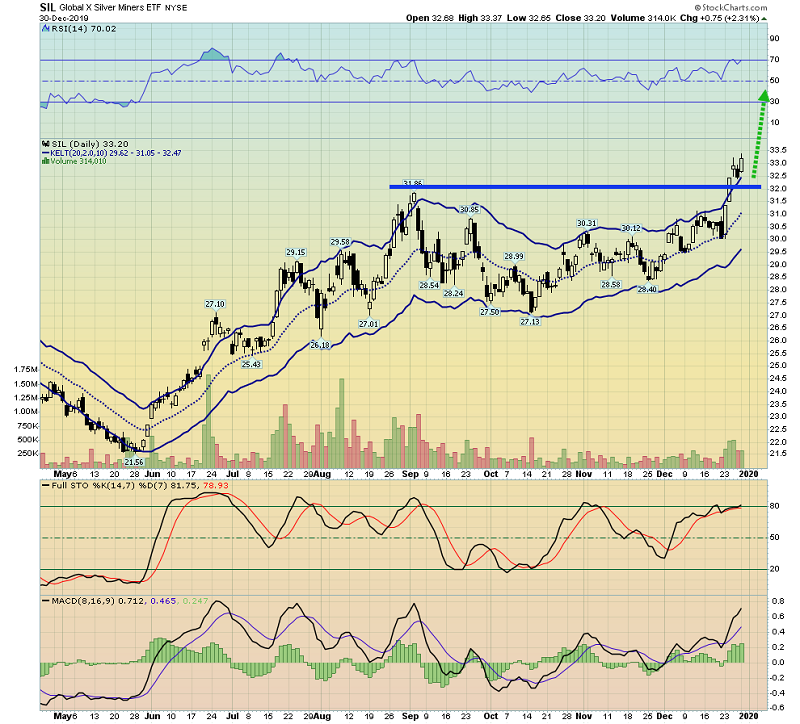

The “pennant of champions” silver chart.As wages, tariffs, and debt all work synergistically to produce serious inflation, silver becomes a “must own” asset, and silver miners gain institutional interest.

The SIL silver stocks ETF chart.SIL has blasted to a fresh high, and the miners tend to lead bullion.

Silver miners are outperforming gold miners, and gold is outperforming T-bonds.These are the hallmarks of debt becoming a major problem in America.When it comes to addressing the debt problem, the US government is sizzle, and gold and silver are the steak!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Golden Pitbulls” report. I highlight a mix of twelve hot junior and senior minors that can keep blasting higher even if there’s a pullback in the price of bullion! I include solid tactics for each stock.

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

Email:

Rate Sheet (us funds):

Lifetime: $999

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: