Derivatives & The Fed's Floating Bankruptcy Clause

What is a derivative? A financial instrument whose value is derived from an underlying asset. For example, the US paper dollar is a derivative. Its value was once derived from the gold, or silver (then lawful money) held at the US Treasury and/or gold and silver coins the US government had minted and placed in circulation. Decades ago, one could take a paper dollar to any bank and demand a coin of precious metal in exchange. The US paper dollar's value is now derived from the full faith and credit of the United States government, meaning that our current dollar it is unbacked by anything of value. Futures contracts and financial options are derivatives too, whose valuations are derived from current expectations of future valuations of commodities, agriculture production, stock indexes or sovereign debt.

Derivatives come in two flavors; those traded on regulated exchanges, and those which are not. Agricultural contracts are traded on exchanges regulated by the Commodities and Futures Trading Commission (CFTC). For instance, the CFTC insures that each contract of corn traded in Chicago is identical to all other contracts, each containing 5000 bushels of clean corn that contains only so much moisture and no mold. This makes exchange-traded derivatives very liquid (easy to sell) as buyers know exactly what they're buying.

But most of the world's derivatives contracts are not traded on a "regulated" exchange, but at the OTC derivatives market, which is a private market managed by the big-international banks. An OTC derivative contract is not standardized, but unique and complicated, which makes them illiquid; hard to sell as potential buyers don't know exactly what's lurking inside them. I doubt these OTC derivatives trade much at all; corporations buy them, and then they're stuck with them by design. Warren Buffett discovered this reality when Berkshire purchased General Re Insurance in 1998. It took years to close out General Re's OTC derivatives positions, at a much greater cost than Buffett (no slouch in understanding financial instruments), was expecting. Four years after General Re, we can still hear a tone of bitterness in Mr. Buffett's 2002 letter to his shareholders.

"The derivatives genie is now well out of the bottle, and these instruments will almost certainly multiply in variety and number until some event makes their toxicity clear....[They] are financial weapons of mass destruction, carrying dangers that, while now latent, are potentially lethal." …. Calling derivatives garbage is an insult to garbage." -Warren Buffett, 2002 letter to shareholders

In the 1990s, it wasn't just General Re that dallied in OTC derivatives; Proctor and Gamble in 1994 lost (what wasthen considered) big money using interest rate swaps. The bankruptcy of Orange County California and the Long Term Capital Management fiasco were also derivative disasters, at a time when the OTC derivative market was much smaller than it is today. Ten years ago, the OTC derivative market became huge as it began to be used to "hedge default risks" for the US sub-prime mortgage bubble that led to the credit crisis of 2008-09. In fact, it was only because of the false assurances from the OTC derivative market hedges that fiduciaries of over a trillion dollars of other people's money bought US mortgages in the first place.

These unregulated derivatives were at the heart of both the mortgage bubble, and the credit crisis that followed. For a few additional basis points in yield above US Treasury debt (from debt that ultimately proved to be junk grade), global money managers foolishly believed their "investment bankers" that the enormous "risk" of purchasing sub-prime mortgages during an inflating real estate bubble could be "hedged" with credit default swaps (CDS). Unfortunately for us all, the counterparties in these CDS (Wall Street Banks) neglected to hold any reserves should the US mortgage bubble begin to deflate. Wall Street understood that Washington would never send the US Justice Department to New York, with instructions to prosecute the banking system's elite for committing a trillion dollar fraud. Wall Street knew it would be the exact opposite; that they could depend on the US Congress and President to stick it to the tax payer whenever the banking system had a moment of need.

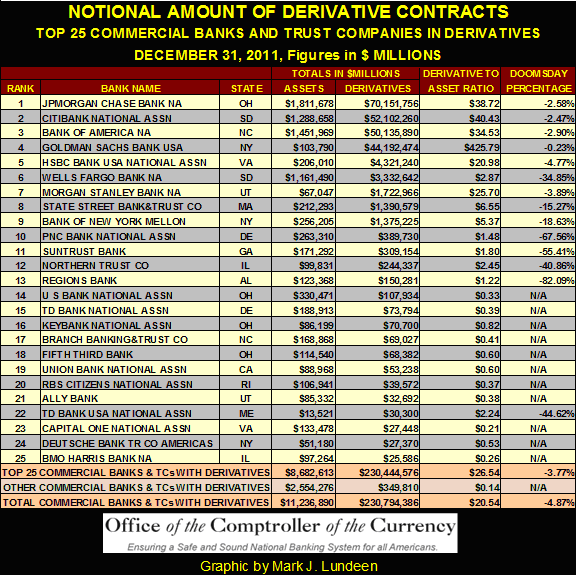

Just in case you were wondering what the US banking system's exact derivatives position is today, (and you should), below is a table from the Office of the Comptroller of the Currency (OCC) listing the top twenty five US commercial banks' total derivatives exposure, sorted from largest to smallest. The OCC data only includes the assets and derivative positions of the twenty five largest US banks. However, I took the initiative of adding two additional columns in the table to calculate the Derivatives to Asset Ratio (DAR) and my own invention; the Doomsday Percentage (DP), or the percentage decline for a banks' net portfolio in the OTC derivative market that would drive a particular bank into bankruptcy; the larger the DP, the safer the individual bank's derivatives portfolio.

This table examines only those banks' derivatives positions and assets. How large a loss any particular bank could take in the derivatives market, and still honor their obligations to their depositors is unknown.

JP Morgan (#1) takes top honors with $70.15 trillion dollars of notional value exposure in derivatives, but Citibank and Bank of America (#2&3) aren't far behind. Of interest is the leverage these banks have exposed themselves (and their depositors' money) to the OTC derivatives markets, as noted in my DAR column. JP Morgan is now in the news for losing a few billion dollars on a "hedge." The question in Congress, and the financial media, is whether this "hedge" was legitimate or just a speculative play by Morgan. What's wrong with our lawmakers and media "experts?" How can any bank who has leveraged its assets (bank capital and deposits) by over 30:1 be said to be hedging anything?

Goldman Sachs (#4) is a rude surprise. This bank was classified as an "investment bank" before the Credit Crisis of 2008-09; as such, it was outside the protection of the FDIC system. But their Washington political connections were so solid that Congress allowed them to change their legal status to that of a "bank holding company" so they could have a seat on the US government gravy-train instead of letting this pirate bank walk-the-plank.

Goldman's "corporate culture" is still one of pillage and scorch earth; for every $1 of assets held in this "venerable financial institution", it carries $425 of potential liabilities. This is ten times the leverage carried by the top three in the above list.

Maybe this extreme level of leverage exists because Goldman's classification as a commercial bank is fraudulent, as they don't take deposits from individuals or small businesses. So Goldman's assets may contain only their bank capital (the bank's own money). JP Morgan's own derivative to asset ratio (DAR) might be quite similar to Goldman's if it didn't include the funds deposited by the public as assets, but these are suppositions on my part. Anyway, Goldman is pregnant with counter-party risk. Its derivative's book looks like it's been gestating for a long time and could break water any day now.

Leverage does make a difference, as we can see in the table's "Doomsday Percentage" column, which like the D/A Ratio column is derived by the author from information published by the OCC. The WP is simply the inverse of the DAR expressed as a percentage, or 1 divided by the DAR. My wipeout percentage is a theoretical percentage move, based on the D/A Ratio that gives the threshold percentage in market volatility that could totally wipe out a bank's assets. Goldman's WP is an astonishing 0.23%! Why is this allowed by the banking systems regulators?

Let's look at JP Morgan, who seems to have their fingers in every significant market in the world. Every trading day some markets go up while other markets go down. But should JP Morgan's derivative book see a net decline of only 2.58%, their "fortress like balance sheet" (as described by CNBC) might now belong to Morgan's derivatives counter-parties. Could just a 2.58% move really do this? That is what the math says, so I suspect these big banks frequently become technically bankrupt, but are never forced into bankruptcy proceedings.

Our financial system's currently accepted "good-business practices" no longer requires significant financial institutions to "mark-to-market" their profits and losses at the end of the day, so no one can really say what shape these huge banks find themselves in at the end of every trading day. The multi-trillion dollar OTC derivative market is Wall Street's private market, a market where prices are a closely kept secret. So if the major banks in the United States were insolvent and bankrupted after a day's trading, who would know it? In the old days, a financial institution that couldn't make good its obligations after a day's trading was prevented from trading the next day, but that was long ago. Retail speculators in the commodity markets still find themselves playing by the old rules. Should their capital account at the end of the day find itself in negative territory, their trading account is closed-for-business, and remains so until they make good their debts in the market. If they can't pay, the exchange will take legal action to recoup the money owed to them.

But today, the Federal Reserve is always ready to supply as many dollars as requested, via overnight repos, to any of its favored banks that had a bad day. Supplying "liquidity" when and where it's needed is what the Federal Reserve does to maintain "stability" in the markets. By itself, these overnight repos aren't a nefarious after hour's activity. Many billions of dollars flow into, and out of the global payment system (banks) daily. Having access to 24 hour loans from the Federal Reserve, based on the bank's collateral, is justified when one bank is waiting for payment from another that will come the following day.

However, banks walk a thin-red-line between solvency and bankruptcy when they have leveraged their assets to the extent that a 2% or 3% net loss on their derivatives position will consume 100% of their assets. How could a few of these banks not be wiped out after a volatile day or week, and be called to the carpet and publically declared bankrupt should 100%, or more of their capital belong to the counterparties of these derivatives?

Looking at the bottom few lines of the chart above, we see that a 3.77% loss in net derivatives position would totally wipe out the derivatives book of the 25 largest US banks, and any further loss would have to be paid from other sources. Similarly, a 4.87% loss in net derivatives position could wipe out the entire US banking system.

We should keep in mind the context of our current era, the credit crisis era where major banks in America and Europe have fouled their nests with OTC derivatives. I clearly remember during the live televised coverage of Congressional hearings during the October 2008 credit crisis; "market stability" (not fraud) was * THE * major theme repeated over and over again at the proceedings. Congress granted the Federal Reserve unstated "new tool's" to achieve "stability" in financial markets, and I think I've revealed one of these "new tools" in the possible expansion of the overnight repo market.

When a "favored-financial institution" (a term coined in the 2008 credit crisis) finds itself bankrupted at the end of a bad day in the markets, does the Federal Reserve make its overnight repo system available to a busted bank to enable it to honor its commitments to its counter-parties in the OTC derivative market? For such a bank, whatcollateral could they post for the overnight repo? After a total wipeout in the markets, wouldn't their assets legally belong to someone else?

If so, this "new tool" would amount to providing a * FLOATING BANKRUPTCY PROVISION *, to any big bank that became insolvent. That, by itself, will not solve the problem for more than very short period of time. But should the Plunge Protection Team on the following day manage to wrench the offending market back into "policy" compliance, thus restoring solvency to a bank, and "stability" to the American market place, who would notice?

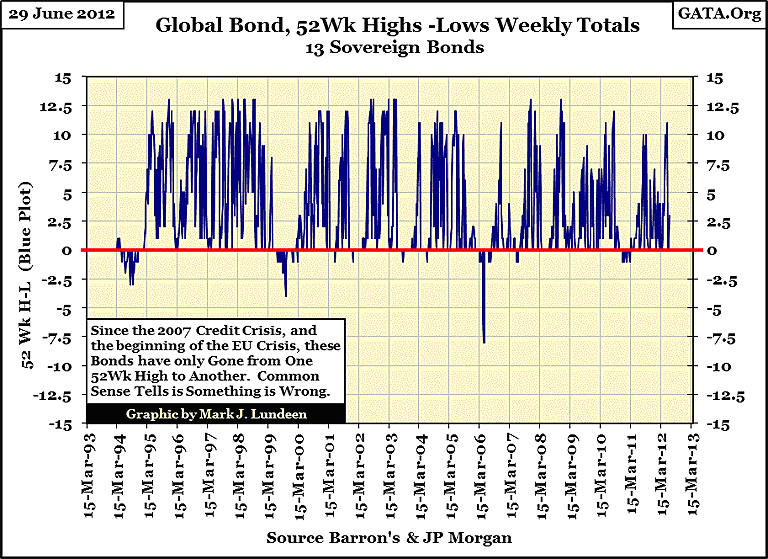

Look at the sovereign bond issues' 52Wk Highs and Lows in the chart below. These thirteen sovereign bonds are a major market in the world of OTC derivatives.

Daily, the financial news is full of stories of nations who have spent more borrowed money than they could everpossibly repay, with their central banks holding these bad bonds for their reserves. This is a problem so large that it risks breaking up the European Union, possibly rendering the euro worthless. One would expect to see these bond issues under pressure, and to some extent they are. But where are all the new 52Wk lows? Sure, not all these bonds are from European Union issuers but:

- Belgium

- France

- Germany

- Italy

- Spain

- Netherlands

are in the list. Then consider that even for nations with good financials, like Germany, these bonds are issued ineuros, a currency that may not even exist in a year or two. So, who is buying these bonds, at these prices, and why?

I admit that the idea of manipulating the entire global financial market place for the benefit of a constant income stream for the elite of the world's banking system sounds like a crazy idea, but go back to the table above and look at these banks' Doomsday Percentages. What trader doesn't see a net-down day in their positions of a few percentage points now and then? Everyone does! But when leverage exceeds 35:1, a net-down day of a few percentage points means ruin and bankruptcy; but apparently not for the above "favored financial institutions." How do they accomplish what no one else can, and do so year after year? They must be cheating, with the full knowledge, and support of the US government and the European Union's "authorities" who are willing to move heaven and earth to maintain the all-important "market stability."

It's obvious, that the OTC derivative market is a continuing fraud on all market participants not connected to the Federal Reserve System and ECB. These banks can maintain this high gearing because they understand that all significant markets' trading ranges are managed. Wall Street, and other large global banks, have created the OTC derivatives market to create a source of income from the derivatives they peddle to their clients who are seeking hedges from market risks. By manipulating market valuations, these banks have been able to ensure that they seldom have to make good on these hedges, as these hedges sold to their counterparties never come into the money. So to the criminal minds that rule our "free markets", there is no reason for Wall Street to maintain reserves, as theirclients' fees and commissions always end up on their bottom line by design.

With Wall Street's total derivatives book of $231 trillion dollars, (as per the OCC), this criminal conspiracy must be a real milk cow for the big banks with large DARs listed in the table above. I have no knowledge of their derivative's fee structure, but with fees and commissions of a mere 0.1% of the cost of the "financial products" (these banks sell to the cream of the world's corporations), they could collect an annual income of $231 billion dollars from their OTC derivative operations, but only as long as "market stability" is maintained.

"Market stability"; our banking system's thin red line between keeping it all for themselves, or having to go back to a complicit Congress for another US taxpayer bailout. Is this the world we live in? It seems so to me! But with Europe's banking system teetering on the edge, and the real possibility of Europe's sovereign debt markets melting down, maintaining "market stability" will one day become impossible.

I think I'll leave the last word on the subject to George Stephanopoulos, currently employed by ABC News:

"Well, what I just want to talk about for a few minutes is the various efforts that are going on in public and behind the scenes by the Fed and other government officials to guard against a free-fall in the markets...perhaps most important, there's been--the Fed in 1989 created what is called a * PLUNGE PROTECTION TEAM * [that is what George was told by his sources], which is the Federal Reserve, big major banks, representatives of the New York Stock Exchange and the other exchanges, and there--they have been meeting informally so far, and they have kind of an informal agreement among major banks to come in and start to buy stock if there appears to be a problem. They have, in the past, acted more formally"

- George Stephanopoulos, former Clinton adviser September 17, 2001 on ABC Good Morning America

[email protected]