Do The Consumer Reports Drive The Gold Price?

GDP, employment and inflation are a Holy Trinity of economic indicators. However, reports on consumer activity are also extremely important for the financial markets. It is not surprising: consumers are the ultimate rulers of the economy and their actions affect GDP, corporate profits and stock prices, labor market, inflation, the housing market and so on. There are several ways of measuring consumer activity, but it is the Personal Income and Outlays report that is the most widely watched data on consumer spending. The report includes data both on personal income and personal consumption expenditures (PCE). The latter primarily measures consumer spending on goods and services in the U.S. economy. It indicates the economic growth, since it is released monthly (while GDP is published quarterly) and it accounts for about two-thirds of the final domestic spending. Therefore, it should move very closely together with the GDP. Does it really do so? Let’s look at the chart below.

GDP, employment and inflation are a Holy Trinity of economic indicators. However, reports on consumer activity are also extremely important for the financial markets. It is not surprising: consumers are the ultimate rulers of the economy and their actions affect GDP, corporate profits and stock prices, labor market, inflation, the housing market and so on. There are several ways of measuring consumer activity, but it is the Personal Income and Outlays report that is the most widely watched data on consumer spending. The report includes data both on personal income and personal consumption expenditures (PCE). The latter primarily measures consumer spending on goods and services in the U.S. economy. It indicates the economic growth, since it is released monthly (while GDP is published quarterly) and it accounts for about two-thirds of the final domestic spending. Therefore, it should move very closely together with the GDP. Does it really do so? Let’s look at the chart below.

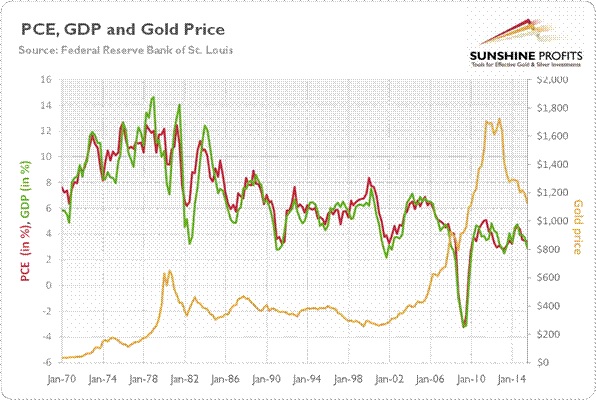

Chart 1: Personal Consumption Expenditures (red line, left scale, annual percent change), GDP (green line, left scale, annual percent change) and the price of gold (yellow line, right scale, London P.M. fixing) from 1971 to 2015

Indeed, as one can see, there is a very strong correlation between PCE and GDP growth. Not surprisingly, given that the former indicator is actually used to calculate the latter. Therefore, PCE exerts impact on gold through changes in the expectations of economic growth and, thus, Fed’s policy. However, since the Personal Income and Outlays report comes out later than other indicators, such as the retail sales, it attracts less interest. This is also probably why Rohan Christie David et al. in the paper “Do Macroeconomic News Releases Affect Gold and Silver Prices” found that the announcements of this report have no detectable effects on gold futures.

Let’s move therefore to the analysis of relationship between retail sales and gold. This indicator measures the sales of retail goods, but does not include money spent on services (except for food services). Hence it represents less than half of total consumption within a month. Nevertheless, the Fed watches it very closely. Retail sales provide relatively new data that are released about two or three weeks earlier than the personal consumption expenditures. This is why the data on retail sales is used to forecast consumer expenditures and GDP. Let’s analyze the chart below, which presents the relationship between retails sales, personal consumption expenditures and gold prices since 1993 (the current series on retail sales started in 1992).

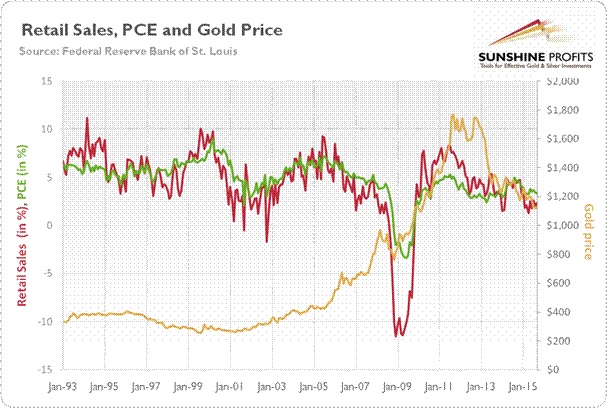

Chart 2: Retail sales (red line, left scale, annual percent change), personal consumption expenditures (green line, left scale) and the price of gold (yellow line, right scale, London P.M. fixing) from 1993 and 2015

As one can see, there is a strong correlation between percent changes in retail sales and personal consumption expenditures, and thus also with GDP. The retail sales are visibly more volatile, due to the impact of the volatility of motor vehicle sales. Similarly to PCE, the retail sales affect gold through changes in expectations of economic growth (GDP) and, thus, Fed’s policy. According to the IMF Working Paper “The Effects of Economic News on Commodity Prices: Is Gold Just Another Commodity”, retail sales are one of the most influential indicators for the gold market.

The bottom line is that reports on consumer activity, such as Personal Consumer Expenditures and Retail Sales, are widely analyzed by the financial market. Gold investors also should be aware of them as they provide insight into trends in economic growth and future GDP. However, because data on PCE is released much later than retail sales, the latter indicator is seen as much more important for the gold market.

********

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor