Does Gold Love Symmetry?

The Fed turns neither hawkish nor dovish. It turns symmetric! What does it mean for the gold market?

Fed Pauses In May

In line with expectations, after an upward move in March to a range of 1.5-1.75 percent, the U.S. central bank unanimously left the federal funds rate unchanged at its recent meeting in May:

In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 1-1/2 to 1-3/4 percent. The stance of monetary policy remains accommodative, thereby supporting strong labor market conditions and a sustained return to 2 percent inflation.

Why did the FOMC not raise interest rates? First, there was no press conference scheduled, so chances for a rate hike were small. Second, the Fed completely removed the following sentence from its statement: “The economic outlook has strengthened in recent months”, presumably noting some slowdown in economic activity.

But (Inflation) Signs Are Everywhere

As market participants did not expect a hike, the attention focused on the signals the Fed sent. Investors are trying to guess whether the Fed will hike three or four times this year. Let’s analyze the changes in the recent statement.

On the hawkish side, the Fed acknowledged that inflation has recently risen close to the central bank’s goal of two percent (and that it will run close to that level):

On a 12-month basis, both overall inflation and inflation for items other than food and energy have moved close to 2 percent.

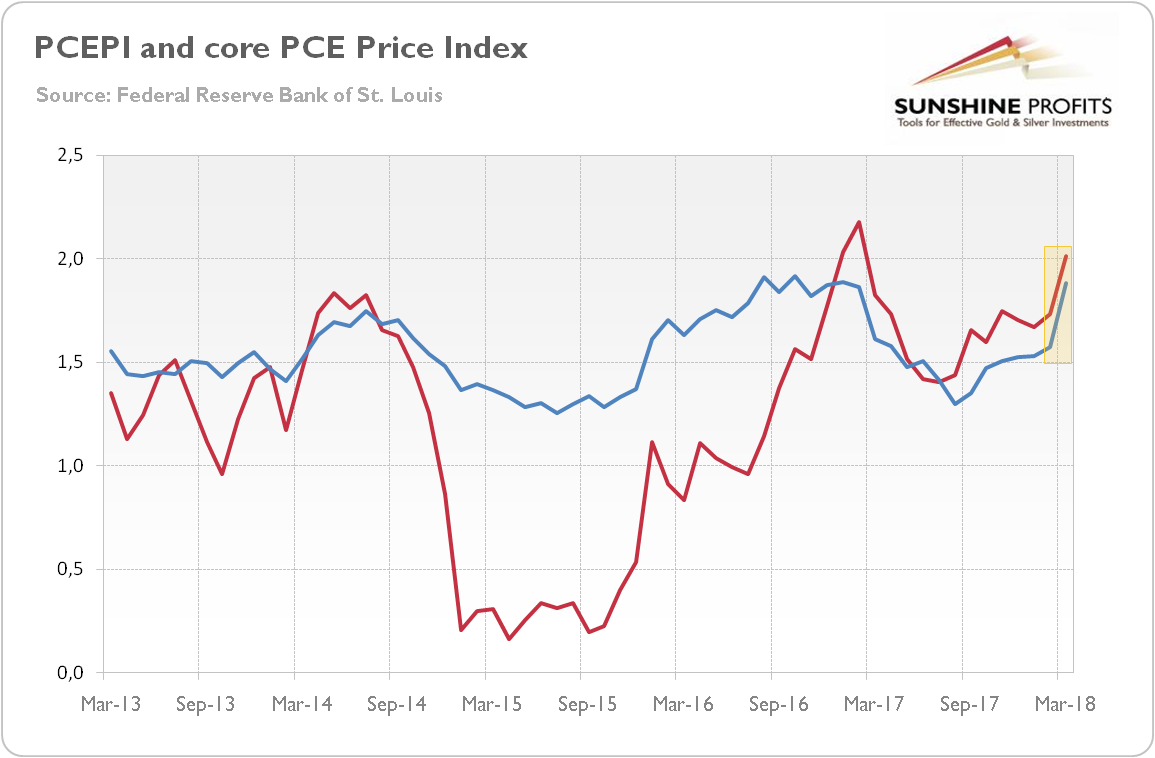

This is an important change compared with the previous statement, when the Fed wrote that both overall and core inflation “continued to run below 2 percent.” The adjustment came after the publication of data showing that the PCE Price Index hit the FOMC target in March (the core index was close behind, rising to 1.9 percent), as one can see in the chart below.

Chart 1: Personal Consumption Expenditures Price Index (red line) and the core Personal Consumption Expenditures Price Index (blue line) as monthly rates from March 2013 to March 2018.

Moreover, the U.S. central bank changed the language about the risk balance. In March, we read: “Near-term risks to the economic outlook appear roughly balanced, but the Committee is monitoring inflation developments closely.” But that sentence was replaced by a much shorter comment: “Risks to the economic outlook appear roughly balanced.” It means that the Fed is more certain about the medium-term outlook (it dropped the “near-term”). In particular, the U.S. central bank is more convinced that inflation will stay at its target, as it removed the words about monitoring inflation developments closely.

Symmetry Is Beautiful. And Hawkish

However, probably the most important change in the recent statement was the addition of the word “symmetric” to the description of the inflation goal. In March, the FOMC wrote: “Inflation on a 12-month basis is expected to move up in coming months and to stabilize around the Committee's 2 percent objective over the medium term”, while in May it changed its language:

Inflation on a 12-month basis is expected to run near the Committee's symmetric 2 percent objective over the medium term.

Why is it so important? Well, such a change has traditionally indicated that the U.S. central bank will be as aggressive in fighting too high inflation as in fighting too low inflation. The 2 percent is a target, not a ceiling. The implications are clear: brace yourself for more hikes, as the Fed is not willing to keep inflation out of control.

Implications For Gold

The recent Fed’s monetary policy statement did not bring good news for the gold market. The FOMC added “symmetric” in the description of its inflation goal, signaling its willingness to curb inflation if it overshoots (which is not expected in the near future). A U.S. central bank more concerned about inflation above the target is negative for the yellow metal, which usually shines during periods of high and accelerating inflation. Gold loves an asymmetric Fed, which cares more about the unemployment than about inflation. But now it seems that the U.S. central bank drops somewhat its dovish bias. Higher real interest rates will also increase the opportunity costs of holding bullion. The recent strong employment report and the rebounding greenback don’t support gold in the short run. Stay tuned!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

********