Does Gold Need A Fiat Mask?

For a lot of people in the United States, being forced to wear a mask is abhorrent. They view it as heavy-handed government action… a theft of their freedom.

Their frustration is understandable, but is the Corona mask the one that matters most?

For some insight into the matter, the weekly gold versus US fiat chart. I’ve highlighted the most outstanding buy and sell zones for investors.

Sadly, it appears that the fiat dollar is America’s most popular mask. Instead of calmly measuring the net liquidation value of their stock market holdings in real money ounces and grams, US citizens race to measure it in fiat, often numerous times a day, in what is really an incredibly macabre, “ode to government”.

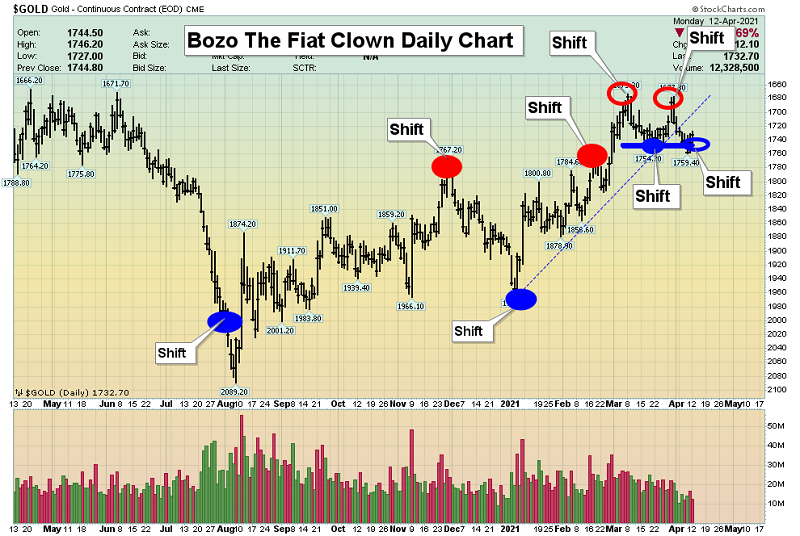

The dollar versus gold chart, aka my “Bozo The Fiat Clown” chart. I highlight fiat price points to shift from gold to fiat, and vice-versa.

The bottom line is that using fiat as a base currency has merit, but gold has more. That’s because over time fiat just oozes lower and lower against gold.

Throughout history, dozens of empires have tried to replace gold with their government money schemes.

The empires are gone, and gold is still here!

When there’s moderate Main Street inflation (like now or in the 1970s), fiat money is practical for buying, selling, and getting paid.

When inflation gets out of control and becomes hyperinflation, the fiat prices of goods become meaningless, and businesses and workers want to be paid with gold, silver, land, food, and other hard assets.

Today’s technology means that an electronic gold or silver currency is easy to create, but until inflation becomes a significant problem, it’s unlikely to happen.

For myself, I like to have a lot of fiat birds in my hand, and in the bank. That reduces my urge to get carried away with the fiat net liquidation value of my assets, and I can focus on putting my booked profits into more real money gold, silver, platinum, and even some palladium.

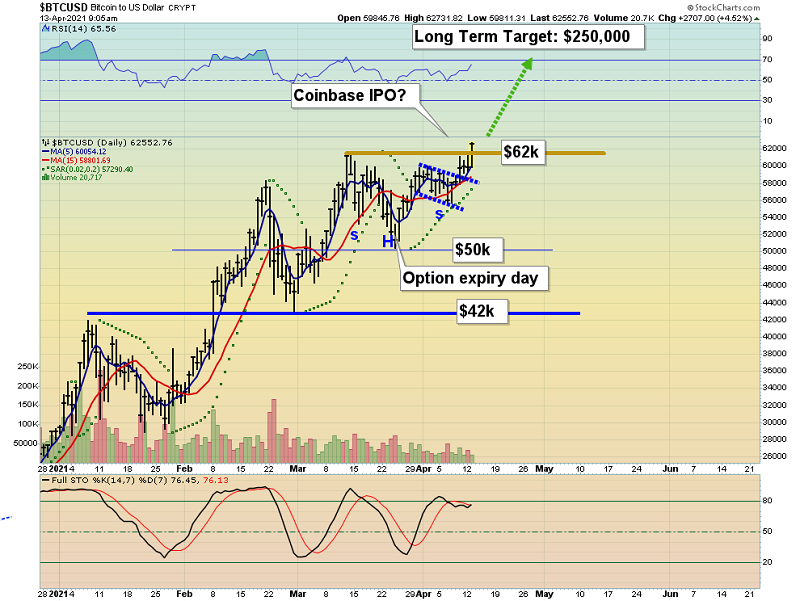

The bitcoin chart. There’s a nice upside breakout ahead of a major crypto exchange IPO. Also, note the positive action of the Parabolic SAR indicator (the green dots on the chart).

My current focus at my GU blockchain newsletter is crypto coins that are tokenized businesses in the gambling, green energy, and business invoicing sectors.

I like funnelling fiat profits from crypto into real money gold, silver, and platinum… and doing it regularly. The bottom line is this: Paper profits never last. Hard money does.

The daily chart for gold versus the dollar.

The $1760 resistance zone is in play, and gold is often soft on Tuesdays. I’ve suggested that gold has a 60% chance of rallying towards $1820-$1850 (a zone to shift some gold into fiat), and a 40% chance of easing to $1566 (a zone to shift some fiat into gold).

It’s important for investors to focus on preparing themselves to act at the major buy and sell zones for any asset class, rather than trying to predict which price likely comes next.

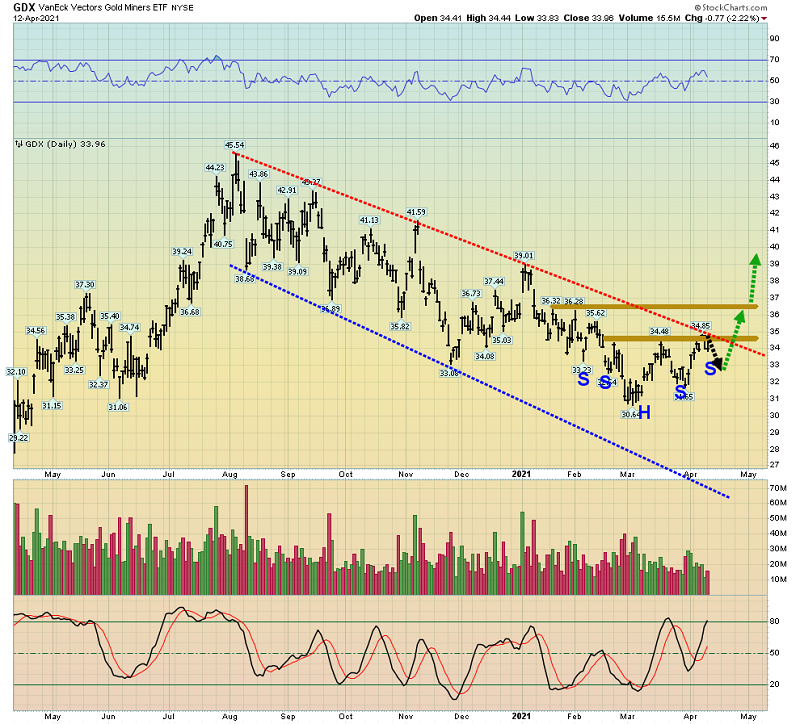

The GDX chart. There is some nice inverse H&S bottoming action, but more right shoulders may be built before a major rally occurs.

As noted, Tuesdays are often soft days for the metals and miners, and the next right shoulder on the charts of many miners could form today. A potential “Edwards & Magee” pattern of higher lows and higher lows is beginning to take shape, and that’s also positive.

The GDX versus gold ratio chart is beginning to tell a cash cows story that should have been told in mainstream media a long time ago:

$1700 gold (and $1500 gold for that matter!) is a great price for lean and mean mining companies. Many of them sport AISC numbers that are under $1000/ounce.

The stock market will continue to get a boost from fresh government debt and central bank QE. The government calls their abhorrent debt “Economic stimulus for the American people!” and the Fed says their ongoing fiat printing operations are about “doing hard work and good deeds for the little guy.”

The United States emperor has clothes, but they are clothes of debt and photocopied fiat. Gold mining companies have clothes, in the form of sub $1000 AISC soldier of fortune uniforms. Investors should decide which set of clothes to wear. Inflation is the catalyst that puts the soldiers into action, and the GDX versus gold ratio chart suggests … action time is almost here!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Under Five & Coming Alive!” report. I highlight key gold miners trading under $5 that may be “must own” stocks for hard money investors. Key buy and sell tactics are included for each great stock.

Stewart Thomson

Graceland Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line: Are You Prepared?

*********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: