Dollar Rally Continues To Threaten Gold

Summary

-

Stronger dollar has been gold's biggest problem lately.

-

The dollar's threat to gold could increase based on economic strength.

-

Traders should remain in a cash position until threat subsides.

Gold’s recent woes have been inversely tied to the latest reversal of fortune for the greenback. As I’ll explain in today’s report, the strengthening dollar is in part a result of rising Treasury bond yields but may also be part of a growing realization that the U.S. economy is stronger than many foreign investors believe. In any case, gold remains under pressure from the rising dollar and it’s immediate-term outlook remains negative.

Let's start with a quick recap of yesterday's trading action. Gold prices fell closer to five-week lows on Thursday as a stronger U.S. dollar and strong corporate earnings dampened enthusiasm for bullion. Spot gold was down 0.4 percent to close at $1,317, while June gold futures settled $4.90 lower, or 0.4 percent, to finish at $1,318.

A pullback in the 10 Year Treasury Yield Index (TNX) on Thursday after reaching the widely feared 3.0% level earlier this week was one catalyst in gold’s recent underperformance. The fact that U.S. bond yields finally snapped a 6-day rally allowed equity investors to breathe a collective sigh of relief. That, coupled with a slew of positive earnings reports from major companies, including Facebook (FB) and Advanced Micro Devices (AMD), pushed the major U.S. stock market averages higher for the day. This only served to further undermine safe-haven demand for gold as investors showed greater interest in riskier assets.

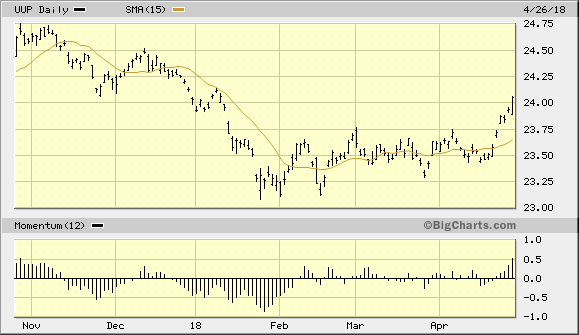

Additionally, higher Treasury yields in recent days pushed the U.S. dollar Index (DXY) out of a 3-month trading range and catapulted the greenback’s value to higher levels not seen since early January. The Powershares DB US Dollar Index Bullish Fund (UUP) reflects this demand for dollars as investors have been liquidating holdings of bonds and interest rate-sensitive securities as of late. The demand for dollars has accordingly been high, and this has been the primary reason for gold’s under-performance lately since the metal is priced in dollars.

Source: BigCharts

Beyond the immediate demand for dollars in consequence of rising T-bond yields, could there be another, more critical factor at work behind the dollar’s rally? Historically, higher U.S. interest rates have resulted in a stronger dollar due to the implied strengthening of the economy which typically underlies a rising rate environment. As long as rising rates aren’t a direct result of a tight money policy on the part of the Federal Reserve (and this one isn’t), the safe assumption is that rising Treasury yields are a result of a stronger domestic economy. Economic strength also typically increases the dollar’s value since currencies are essentially reflections of investors’ perception of the economy.

In his latest blog post, economist Scott Grannis acknowledges that higher U.S. rates usually reflect a stronger economy. Yet until very recently the dollar has failed to acknowledge the higher rates and corresponding economic strength. In fact, the dollar has largely weakened since the beginning of Donald Trump’s presidency as Grannis points out. Yet this situation could finally be on the cusp of reversing. Grannis observed:

Dollar bears and gold bulls are the ones who really need to fear the advent of higher US interest rates. Arguably, they have misinterpreted rising US rates (and Trump) to mean bad news for the economy, when in fact they are good news.”

While it’s too early to conclude that gold’s longer-term upward trend which began in 2016 will be seriously threatened by the rising dollar, neither are we justified in automatically assuming the best-case scenario. Smart investors adjust to changes in the global financial market dynamic, so it’s time that we at least begin to question our assumption that the longer-term gold uptrend is immune to higher interest rates. If the dollar index continues to climb in the coming weeks, it will serve as a cause to re-evaluate longer-term investment positions in the yellow metal.

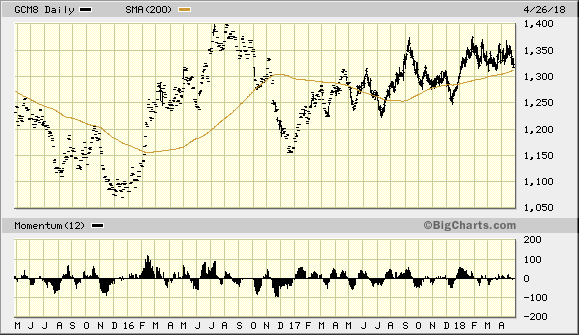

For now, longer-term investors can maintain a conservative position in gold since the rising 200-day moving average, the benchmark longer-term trend line, remains intact as shown in the June gold futures chart below.

Source: BigCharts

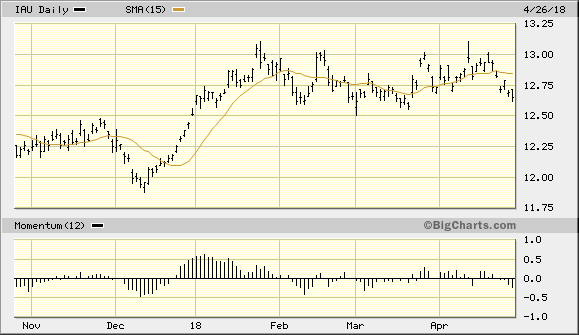

Meanwhile, I continue to recommend that short-term traders remain in cash after the latest whipsaw in the gold price. We exited a conservative trading position in the iShares Gold Trust (IAU), below, on Monday after our technical trading discipline confirmed an exit signal. IAU remains below its 15-day moving average but is still above the $12.50 level – the lower boundary of a 3-month trading range.

Source: BigCharts

Until IAU confirms a renewed immediate-term (1-4 week) buy signal, traders should keep their powder dry for now. A 2-day higher close above the 15-day MA is needed for the gold ETF to confirm a bottom, along with a reversal of the dollar’s immediate-term uptrend.

********

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.