Dr. Bernanke's Effects On Markets

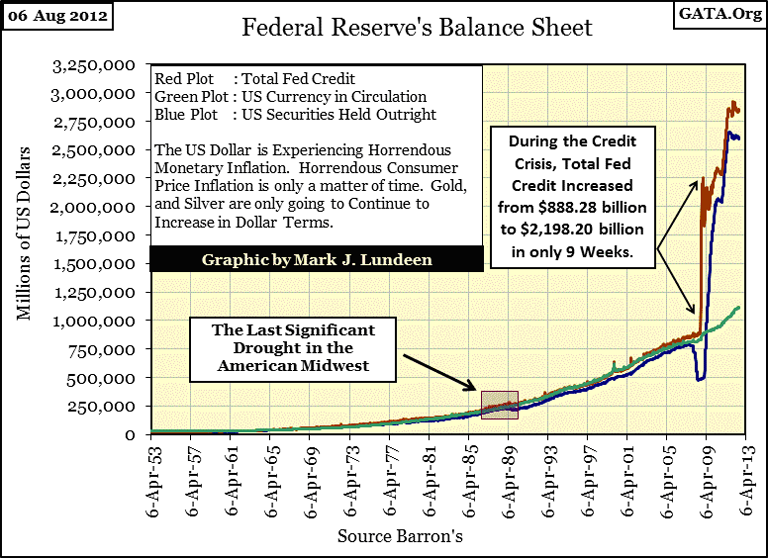

Below is the balance sheet for the Federal Reserve. Here we see the vast increase in the supply of US dollars flowing through the world's economy since 1953. This is the reason for bubbles and crashes in financial assets, and our current rising prices in commodities.

Remember, monetary inflation doesn't flow into gold, silver, corn, soybeans, or even copper. Monetary inflation is "injected" into financial assets like stocks, bonds and the mortgage markets by central banks, resulting in "bull markets" for these "policy" favored markets. But, while the ability of central banks to create currency is unlimited, the ability of financial markets to absorbed "liquidity" is not.

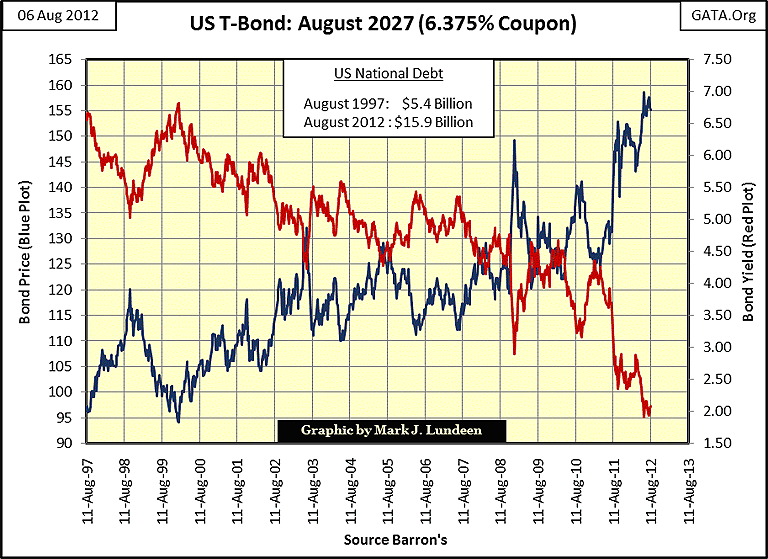

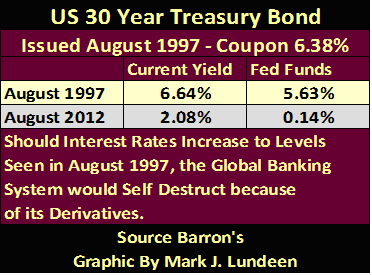

Look at this thirty year US Treasury Bond issued in 1997. Signs of "liquidity" saturation are very apparent in the chart below. Fifteen years after it was issued, its current yield (Red Plot) has collapsed from 6.64% to 1.91% in June, just weeks ago, but has increased to 2.08% at the end of last week. This decline in bond yields, in all markets, is not for reasons of natural supply and demand fundamentals. This decline in yield is from market intervention (manipulation) by the Bernanke Fed with their operation "Twist." Sure, Federal Reserve can create enough artificial demand in the US Treasury Bond market to make this US T-Bond's yield decline to below 1%, but at what cost to the financial markets, and ultimately to the cost of living in the years to come?

No doubt Doctor Bernanke believes that he and his "policy" now controls the prices and yields in the US Treasury bond market. But in the end, it will be the bond market that controls every aspect of "monetary policy" for the Bernanke Fed. Once the good doctor started manipulating T-Bond yields downward, he can't stop without allowing natural market forces to revalue the US T-bond market. T-bond yields would rise to levels that he and Washington will find unacceptable, for fear of another, but worse financial collapse on Wall Street than we saw in October 2008.

Should this manipulation in the bond market continue to its logical end (and it will), the Treasury bond market will consist of only two players; the US Treasury who issues T-bonds to fund a blundering Federal bureaucracy, and the Federal Reserve, and its banking system, who purchases Treasury debt with monetary inflation. In such a market, US Treasury debt (and the inflationary dollars used to purchase them), can in no real sense claim to be "financial assets." This realization will (at some unknown point in the future), result in a massive exodus of funds from the world's debt and currency markets, into something else; like corn, soybeans, copper and yes, gold, silver and the mining shares. The effect of this transfer of wealth will prove to be dramatic, as since 1981, the total volume of US dollars has exploded (see the Fed's balance sheet chart above), while the available supply of commodities has not.

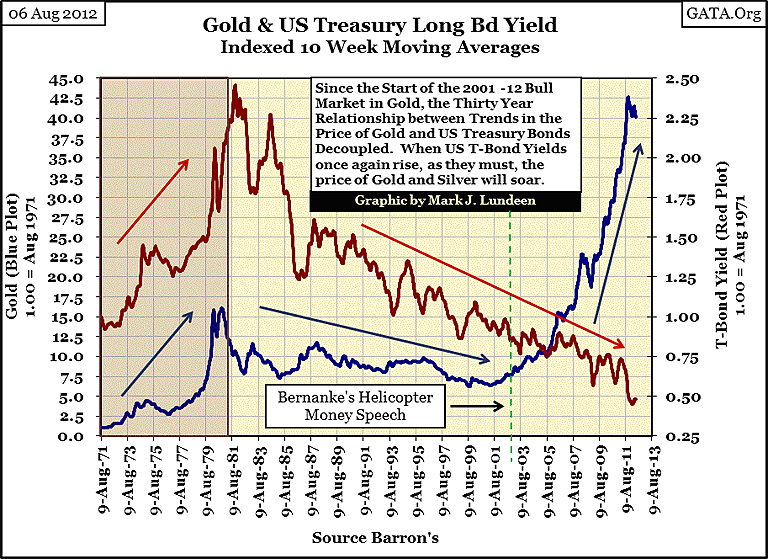

In fact, this shift from debt to gold and silver began eleven years ago. The precious metals market is minuscule compared to the global debt markets. Only a very small diversion of funds from the debt markets into gold will result in a significant increase in the price of gold, with no discernible effects on the bond market, which is evident in the chart below. A day is coming when wealth will begin to understand the need to flee counterparty risk, now chronic in the debt market, and begin flowing into the gold and silver markets. Expect the T-bond yields (Red Plot below) to once again recouple to the price of Gold (Blue Plot below).

The effect of hundreds of trillions of dollars, euros, yen panicking into gold and silver will result in amazing gains in the old monetary metals! I've predicted that gold will ultimately rise to above $30,000 an ounce and I'm sticking to it!

So, the driver of big primary bull-markets in commodities is deflation in financial asset markets, markets that were previously inflated by the Federal Reserve. When inflated financial assets begin to deflate in earnest, money that previously circulated in the stock and bond markets will be withdrawn from the financial markets by fear-full investors and money managers, looking for a positive return on their money someplace, any place other than deflating stocks and bonds. Historically, they have found such returns in the commodity markets.

Expect these bullish trends in commodity prices not only to continue, but to become out-of-control (out of the control of the "policy makers") when short and long term interest rates once again begin to rise to levels currently not believable. And they will do so without asking permission from Doctor Bernanke. How high could yields increase? The US Treasury in 1981 floated a 20 year bond with a coupon of 15.75%! But everyone one knows "that can't happen again!" Well, until then, the frequent reported demise of the bull market in gold and silver has been greatly exaggerated - the best is yet to come!

[email protected]