Earnings Dubious History In Predicting Stock Market Trends 1929-2012

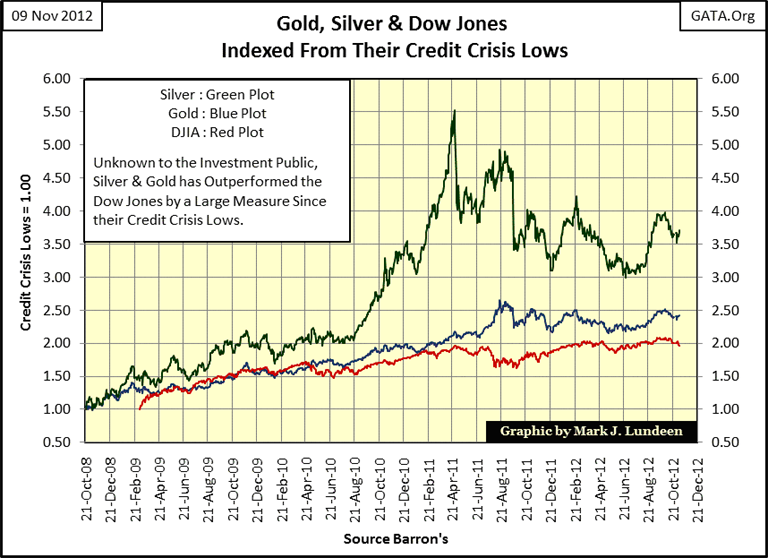

No better way to see what the Dow Jones has done since its credit crisis lows, than to compared it to gold and silver with a chart, so here it is. I indexed these plots to their credit-crisis lows, so the metals began their ascent in October - November 2008, while the Dow Jones bottomed on March 9, 2009. The Dow Jones takes bottom honors. But over the past four years, gold has only exceeded the Dow Jones' performance by 45% since. Current government "policy" has been to constrain price advances for gold (and silver) in a major bull market, while supporting the Dow Jones' valuation above the 10,000 level in a massive, extended bear market.

If you ask me, had the US Government kept its meat-hooks off the credit crisis markets, the Dow Jones could have fallen 70%, or more, from its high of October 2007, sometime in 2009-10. Even with all the assistance Washington has given the stock market since October 2008:

- Accounting Rules changes

- See-No-Evil Regulation

- Pseudo-Demand funded by the Federal Reserve

The stock market is still a total mess in November 2012, much worse than in October 2008. You may think me wrong, but that is how I see it. So I'm pushing my 2007-201X bear-market bottom forecast for the venerable Dow Jones down to a 90% decline from its October 2007 top before it will be safe to enter the stock market again. I hope I'm wrong, but I fear I'm right. That means a Dow Jones valuation of 1XXX at the bottom would not surprise me.

But that could be years from now. The question on my mind is when is Mr Bear coming back? Well, this week the stock market was feeling a bit under the weather, and not surprising it began to slip the day after the election.

In the Bear's Eye View (BEV) chart above, on October 5th the Dow Jones came within 3.91% of taking out its high of October 2007. But grand-pa's heart couldn't stand the strain, so the old guy once again retreated towards the oxygen rich air found at the BEV -10% line. Between you and me, I'm thinking that history will record the Dow Jones' advance from March 9, 2009 as a dead-cat bounce that came within 3.91% of making a new all-time high before Mr Bear came back to drag grand-pa back below his BEV -50% line.

Will this really happen? Did America re-elect a socialist to the White House? This means that massive new taxes are soon to be levied on business as the Bush tax-cuts are allowed to expire, and new "health care" taxes will soon shock private sector business. Things are hard enough without taxing consumers and their employers into extinction. Are you looking for job security? The new health-care law provides for something like 17,000 new IRS agents to hound business, to make sure they pay for the privilege of doing business in the United States. Unemployment? Not for employees of the IRS! We'd be fools not to understand why many American jobs will soon be going to overseas factories.

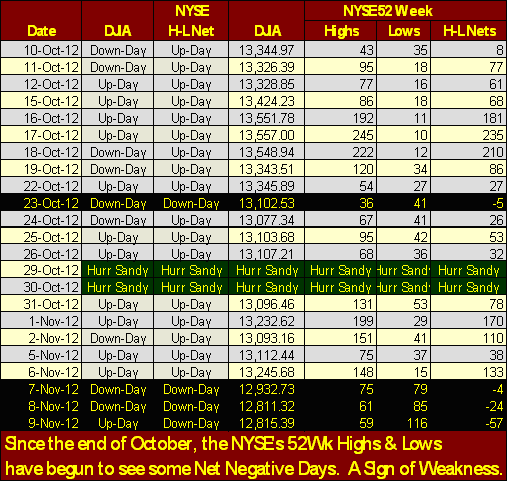

We are beginning to see net-down days in the NYSE 52Wk High - Low data. This is a change! Since June, (97 trading days ago) there have been only four net down days, all of them occurring since October, 22.

Does this mean a crash is at hand? Nope! But this recent development is certainly a sign of weakness should it continue. Here is my chart for the NYSE 52Wk High-Low ratio. The next six months could be very interesting, and this is an excellent graphic to see how the entire NYSE holds up under the strain of a massive attack by Mr Bear. During the credit-crisis bear market, this ratio spiked down to -87.45%.

On Wednesday of this week, we also saw a "day of extreme volatility", meaning that the Dow Jones moved 2%, or more, from its previous day's closing price. Up or Down 2% makes no difference to Mr Bear. It was during the Great Depression bear market where the Dow Jones saw it largest positive day to day advance (see chart below). Last week, the Dow Jones fell 2.36% below its previous day's closing price. What that means is that the current cluster of Dow Jones 2% days (which began in February 2007), is still building. That is not good for the bulls.

Up until this point in 2012, we have seen a total of only four Dow Jones 2% days. Maybe that's why the Dow Jones is up a BIG 3.37% for the year. But during a bear attack, the Dow Jones will see three or more days of extreme volatility in a running 8-day count, as seen below.

Having one day of extreme volatility occurring during a running 8 day count is no big deal, but should the Dow Jones' 8-count begin to rise to 3 or more, we'll see pressure on the Dow's valuation. Sometime in the next year, I expect to see this happen. Currently Doctor Bernanke is buying stocks at overvalued prices. If he wants them that bad, you have my permission that to sell him yours, and move the proceeds into gold and silver coins. This is especially so in the case of silver!

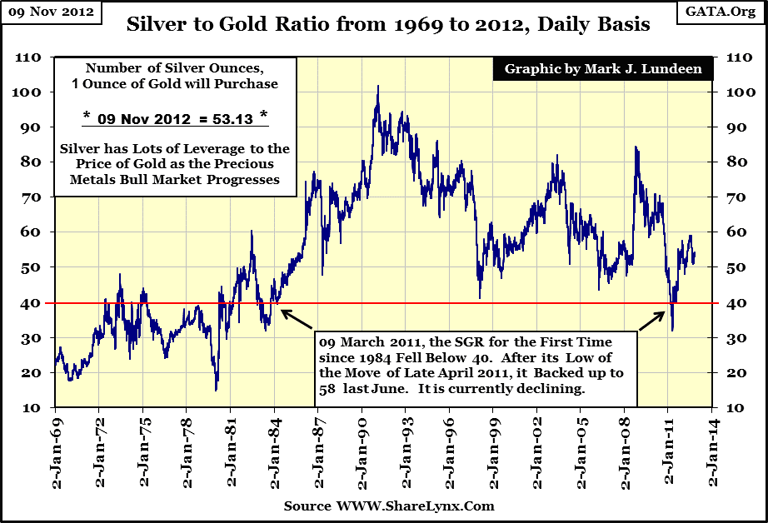

Look at the Silver to Gold Ratio below. For the price of an ounce of gold, you can buy 53.13 ounces of silver. This isgreat, because during a bull market in gold, the big money is made in buying silver, which is a leveraged play to the price of gold.

As the price of gold and silver continue to rise in their bull market, silver will outperform gold, causing the ratio above to descend ever lower. That means, had you purchased silver when this ratio was at 60, for example, and at some future point the ratio declines to 10, every dollar made in gold silver investors will see six dollars. That's really huge leverage! The only problem with this would be if the bull market in precious metals is over. But no matter what you hear on TV, it's not.

In fact, just this week, the gold and silver's step sum charts flashed a STRONG BUY signal. Look below; see how both Gold's price and step sum trends broke upwards this week? This is an unambiguous buy signal in step-sum analysis.

How far could this buy signal send gold up? I expect that it will take gold up above its previous all-time high. Well why not? Look at gold's BEV chart below. At its Friday's close, it was only -8.35% BEV points from taking out its all-time high of August 2011. Go back and have a look where the Dow Jones BEV value was at the close of the week: -9.52%. At the end of this week, on a percentage basis, gold is now closer to making a new all-time high than is the Dow Jones!

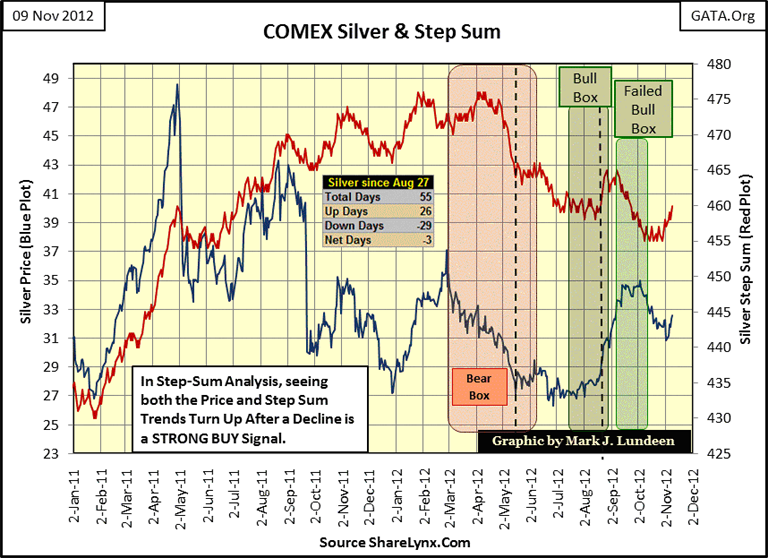

Last Friday, we were concerned that silver was building a new bear box in its step sum chart. What a difference a week can make! Like gold, silver's step sum chart (below) has also flashed a STRONG BUY signal. How far can silver rise up from here? I don't know, but I expect it will make people who purchased silver even at $35 in early October very happy. Can it send silver to its first new all-time high since January 1980? I doubt it, unless a panic in the debt or stock markets begins.

I'm not saying that silver needs a panic in the US Treasury market to exceed its old closing high of $48.70 on January 17th 1980; it really doesn't as three digit silver prices are already baked into the cake. What I really mean to say is that unlike October 2008, should a panic develop in the financial markets, it's very unlikely that silver and gold could go lower, a price explosion would be much more likely.

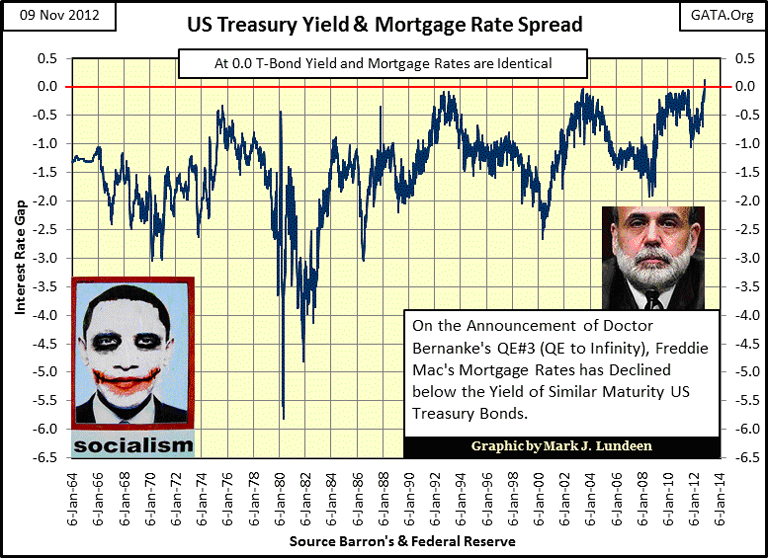

So, how likely is a panic in the financial markets? Well, Washington and Wall Street are doing everything necessary to make it happen! Look at the chart below, for the past three weeks, my data from Barron's has the Freddie Mac's mortgage rate lower than the yield for the US Treasury's long bond - this is not only incredible, but incredibly dangerous.

The multi-trillion dollar US mortgage market ultimately has only one buyer of mortgages; Doctor Bernanke. As we see above, he is not only "monetizing" every illiquid mortgage Wall Street has, but he is buying these worthless "bank reserves" at top dollar. QE to Infinity? You better believe it as Doctor Bernanke is doing it as we speak!

Do you want to know something, there is nothing stopping old Doc B from bailing out the little-people who entered into these overpriced mortgages. That would solve the banks' mortgage problems too, as they could then extinguish these bad assets off of their books! But this would never do, as the whole purpose of government these days is to destroy the American middle-class by keeping them ensnarled them with debt, price inflation and rising taxes.

[email protected]