Forecast: Gold Looking For Bullish Start In 2022

Recapping Last Week

Recapping Last Week

Last week's action saw the gold market selling down into Tuesday's session, with the metal dropping down to a low of 1785.00. From there, however, a resumption of the short-term uptrend was seen into later in the week, here pushing back up to a Thursday high of 1812.00 - also ending the period at or within earshot of the same.

Gold Forecast: Short-Term

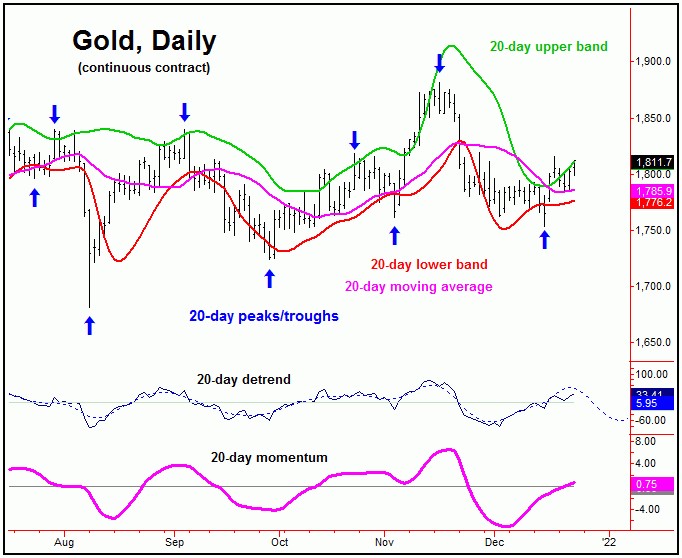

For the shorter-term view for gold, the last good swing bottom came from the 20-day cycle, which is shown again on the chart below:

As mentioned last weekend, with the upward phase of the 20-day cycle deemed to be in force, the probabilities favored additional strength short-term - some of which we saw with the action into late last week.

Having said that, the ideal path favors a continuation of the late-week strength into the coming week, with the upward phase of the larger-tracked 34-day cycle also now seen as in force. Here is that particular wave:

In terms of time, the upward phase of this 34-day wave is only 6 trading days along, with the normal rally phases having taken some 10-18 days before topping. With that, the inference is looking for additional strength in the days ahead, before either of the 20 or 34-day cycles next attempt to peak.

Gold Forecast: 72-Day Cycle

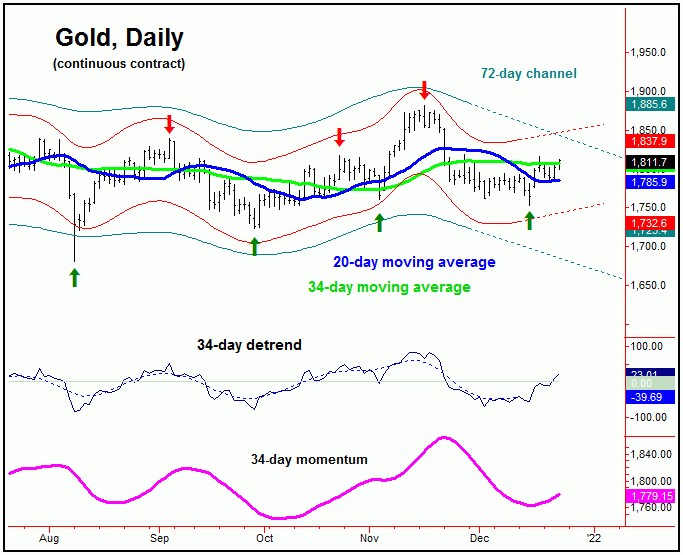

Stepping back, as mentioned in past articles, the bigger action is currently being dominated by our 72-day time cycle, which is shown again on the following chart:

Also mentioned in past weeks, the last key low was due to materialize with this 72-day cycle, which was projected to bottom into the mid-to-late December timeframe. The lowest low so far was seen on December 15th - right into the projected range.

Going further with the above, the weakness into mid-December saw our 72-day 'oversold' indicator making a tag of its upper reference line - which is something we like to see on or before this wave troughs. That is, moves above the upper reference line - if and when seen - are ideal spots to be looking for 72-day cycle bottoms to form.

Once the next upward phase of the 72-day cycle assumes control, we are looking for a bullish start to the year 2022 for gold. That path is looking for strength into the mid-January to mid-February range (the latter being ideal), a move which should top the metal once again, for what is looking to be another sizeable decline in the months to follow - with more precise details noted in our Gold Wave Trader report.

In terms of price, some try at the 1882.10 swing top seems favored to play out into the mid-January to mid-February timeframe. Overall, the indications with our larger 310-day cycle tend to favor only a countertrend high as the 72-day cycle next tops, though this is too early to say with certainty.

Here is that larger 310-day component:

The last trough for this 310-day cycle was registered back in the Spring of 2021. Until proven otherwise, the downward phase of this wave is currently deemed to be in force, ideally remaining intact into late-Spring or early-Summer of 2022. The position of this 310-day cycle is what favors the upward phase of the smaller 72-day wave to end up as a countertrend affair. Only a reversal above the 1882.10 swing top would negate this assessment - and thus offer up a more bullish view for the mid-term.

For the bigger picture, from whatever low that ends up forming with this 310-day cycle, a minimum rally of 15% is likely to play out into later next year, though the average rallies with this particular wave have been closer to 25% off the bottom. This gives us some early idea of how the action could play out in the coming year, based upon the current cycle positioning.

The Bottom Line

The bottom line with the above is looking for additional strength into early-2022 for the gold market, based on the position of the 72-day cycle. Until proven otherwise, the upward phase of this wave seems favored to end up as a countertrend affair, giving way to weakness again into late-Spring, before the next mid-term trough attempts to form - coming from the larger 154 and 310-day cycles. More on all as we continue to move forward. Happy holidays!

Jim Curry

The Gold Wave Trader

http://goldwavetrader.com/

http://cyclewave.homestead.com/

********