Forecast: Key Gold Cycle In Bottoming Range

Recapping Last Week

Recapping Last Week

Last week's action saw the gold market locked in a choppy consolidation, with the metal forming its peak in Wednesday's session - doing so with the tag of the 1794.30 figure. From there, weakness was seen into an early-Friday low of 1770.40 - before bouncing off the same into the weekly close.

Gold Market, Short-Term

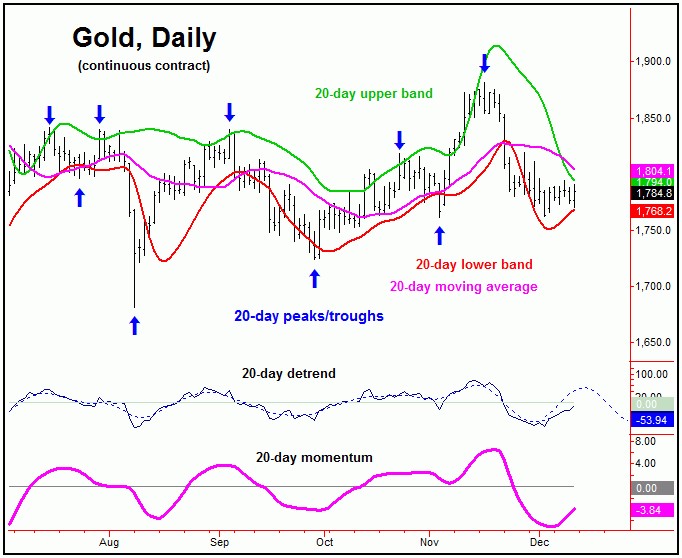

For the near-term picture, the next decent rally has been expected to come from the 20-day cycle, which is some 27 trading days along - and may well have bottomed with the recent tag of the 1762.20 figure. Here is that 20-day cycle:

In terms of price, gold needs to see a reversal back above the 1796.00 figure (February, 2022 contract) to actually trigger the next upward phase of this wave to be back in force, making this a key number to watch as we head into the new week.

Otherwise, below the 1796.00 figure will keep the metal in a short-term bearish configuration, while above that number will favor additional strength on up to the 20-day moving average or higher. Until proven otherwise, the patterns do tend to favor the next upward phase of this 20-day wave to end up as a countertrend affair.

Stepping back slightly, a countertrend rally with the 20-day cycle in the days ahead, if seen, should favor a drop back to lower lows into this mid-to-late December timeframe, where the next trough is projected for the larger 72-day wave.

Gold's 4-8 Week View

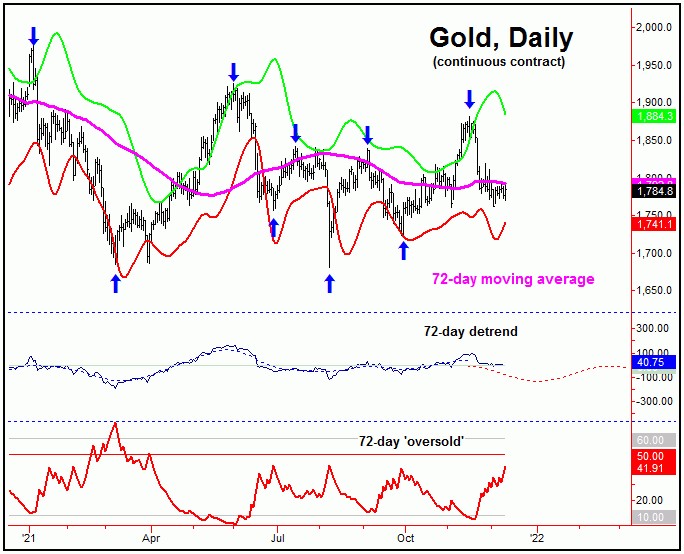

For the stepped-back picture, the overall action is dominated by the 72-day time cycle, which is shown again on the chart below:

On our 72-day cycle chart, of particular note is that the mid-November drop below the lower 'oversold' reference line nailed the top for the last upward phase of this wave, which we were able to use to exit our prior open long position in the GLD.

Going further with the above, the 72-day 'oversold' indicator moves inverse to price action. That is, drops below the lower reference line are spots to be on the lookout for peaks with this cycle, while moves above the upper reference line - if and when seen - are ideal spots to be looking to play the long side.

With the above, it will be interesting to see whether our 72-day 'oversold' indicator is able to spike back above the upper reference line in the days ahead. If seen, we would be looking for that pattern to mark the next key low for gold, which we think will come from this same 72-day cycle.

In terms of price with the above, the ideal path is looking for the current 72-day cycle downward phase is looking for a drop back to the lower 72-day cycle band, which is currently at the 1741 figure - but which is also moving daily.

Going further, a drop back to the lower 72-day cycle band - and/or accompanied by a spike above our upper 72-day 'oversold' reference line - would be seen as a buying opportunity, in the anticipation of a sharp rally playing out into the first few months of next year. In terms of price, that rally is likely to see the upper 72-day cycle band acting as the eventual magnet, and may also provide resistance to that move.

In terms of price, we now have a key price level, which - if taken out to the upside - would trigger in the next rally phase of the 72-day cycle to be back in force, with exact details noted in our thrice-weekly Gold Wave Trader market report.

Gold's Mid-Term Picture

Stepping back further, the next key wave for the gold market is the larger 154-day cycle, which is shown again on the chart below:

With the action seen in recent weeks, there is now the potential that our peak for the 154-day cycle was registered back in November - though this has yet to actually be confirmed. Either way, we should get a decent rally into early next year, once the smaller 72-day cycle bottoms out.

Of key note with our 154-day cycle chart is that the lower (extrapolated) cycle channel is currently around the same level as our lower 72-day cycle band indicator - around the 1740's. Will the next key low be made around that figure? Right now, there is no way to guarantee that, though it is a key number to watch as we move along.

The Bottom Line

The overall bottom line with the above is that the next key bottom is expected to come from the 72-day cycle, and is due to materialize at anytime going forward. From whatever low that forms with this component, the probabilities should favor a sharp rally playing out into early next year, with more precise details on how we expect this to play out noted in our Gold Wave Trader report. Stay tuned.

Jim Curry

The Gold Wave Trader

http://goldwavetrader.com/

http://cyclewave.homestead.com/

********