Forecasting The Gold Price Is A Mug's Game

Most investors are totally ignorant of the purpose of gold or its historical significance.

After all, Gold is the only money that has survived in history but virtually nobody is aware of this vital information.

That’s why only 0.5% of global financial assets are invested in gold. Still most people put their trust in paper money.

In spite of the title, in this article I will be a Mug for a day and make some gold and silver projections.

Investment managers ignorance of gold is mainly due to the fact that they can’t churn commission by holding physical gold. Their primary job is to convince investors that they have superior skills and knowledge of the market. Still, 99% of these so called experts underperform the market by a wide margin.

Most of them, for example, are not aware that their clients could have put their money into gold at the beginning of this century and today would have seen their investment multiply 7 times or more depending on their base currency.

But that would have been too simple since it takes away the whole mystique of the asset management industry with their trillions of dollars of investments.

Ok, gold was up substantially in the last couple of decades. What about going forward? Should investors put their money with the experts who will then buy stocks, bonds and property investments which have had more than a century of printed money pushing values to bubble territory?

Well, the unequivocal reply to that is obviously YES.

Since governments and central banks are the biggest supporters of gold by continuously destroying the value of paper money, gold ownership is a SINE QUA NON (Must).

The Everything Bubble is likely to turn into the “Everything Collapse” (link below) with all the bubble assets declining between 75% and 95% in real terms.

After all; assets inflated by fake money must clearly be fake.

The biggest collapse will obviously be the $300 trillion debt market. But before this debt collapse, Western governments and central banks will have drowned financial markets in what my colleague Matt Piepenburg calls mouse-click money.

And they will wear out many batteries and mice before this is finished.

We saw during the Ides of March (Shakespeare), which is an ominous time in mid March when Julius Caesar was murdered. This Ides of March this year contained the death of 4 banks; one Swiss, and three US within a matter of days.

After the 2008 banking crisis, it was declared that there would be no more bailouts but only bail-ins. They were brave words at the time which we know wouldn’t hold.

The rumours of depositors withdrawing hundreds of millions or billions from Credit Suisse or Silicon Valley Bank meant that the central banks only had hours to save the system.

Bank runs are no longer made by depositors queuing at the door but by spreading the news in minutes via Social Media.

To stop an instant collapse of the system, the Central Bankers had to backstop everything. So we are back to bailouts again. And what we have seen so far is just the sheer beginning. The system is Rotten (BANCA ROTTA) as I wrote in a recent article –

To stop an instant collapse of the system, the Central Bankers had to backstop everything. So we are back to bailouts again. And what we have seen so far is just the sheer beginning. The system is Rotten (BANCA ROTTA) as I wrote in a recent article –

“FIRST GRADUALLY THEN SUDDENLY – THE EVERYTHING COLLAPSE” .

The outstanding $2+ quadrillion of global derivatives are very likely to turn into debt as counterparties fail. That’s when the real money printing starts. But there are so many areas of unprecedented global risk of a magnitude never seen before in history. (“WILL NUCLEAR WAR, DEBT COLLAPSE OR ENERGY DEPLETION FINISH THE WORLD?”)

Since Western Governments and Central Banks know that the system is on the verge of collapse, they are doing all they can to control the people. Covid vaccines, lockups, global warming were just the beginning. Next is CBDCs (Central Bank Digital Currencies). This will be the most perfect way for governments to control their people by having full control of their money. So especially the West is at a risk of coming under totalitarian control.

MITIGATE THE RISK BY OWNING PHYSICAL GOLD AND SILVER

There are obviously very few who have the possibility to escape what is coming but anyone who can, should really investigate all alternative options.

But what most people with savings can do is to own physical gold and some silver and store it in a safe jurisdiction outside the financial system. Then at least if your government becomes too oppressive, you can flee to your gold.

Because what is certain is that paper money in the next phase will reach its intrinsic value of ZERO as Voltaire said.

GOLD IS NATURE’S MONEY AND ETERNAL WEALTH

Paper money is ephemeral money and will therefore become worthless. But Nature’s Money – Gold – which has throughout history maintained its purchasing power, will be measured in paper money reach unthinkable heights.

So gold is Eternal Wealth. Therefore, if you hold gold as wealth protection, you don’t have to worry what happens to the value of your paper money. Gold will always reflect the debasement of paper money.

Therefore to give a forecast of the gold price is totally meaningless and a mug’s game.

It is not the future price of gold that we should forecast.

Instead, what is important is what will happen to your money. What will happen to the Dollar, the Euro, the Pound or the Yen. Will it go down by 50% or maybe 100%.

Since all currencies have lost 97-99% against gold since 1971, we are likely to experience at least the same decline in the next 5+ years.

EXPONENTIAL MOVES AND HYPERINFLATION

As I have explained in many articles, EXPONENTIAL MOVES ARE TERMINAL!

Just look at the illustration below which explains this phenomenon:

So the law of exponential moves is demonstrated above.

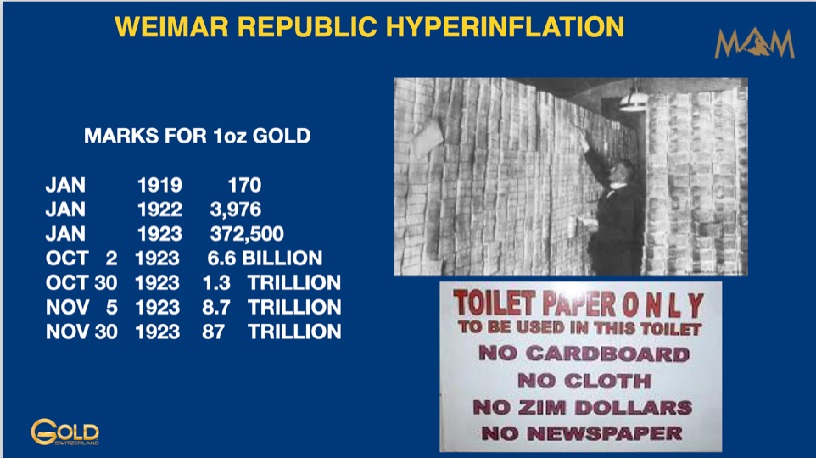

And this is what happens when hyperinflation sets in. Just look at gold in the Weimar Republic:

As the illustration above shows, paper money is not even acceptable as toilet paper.

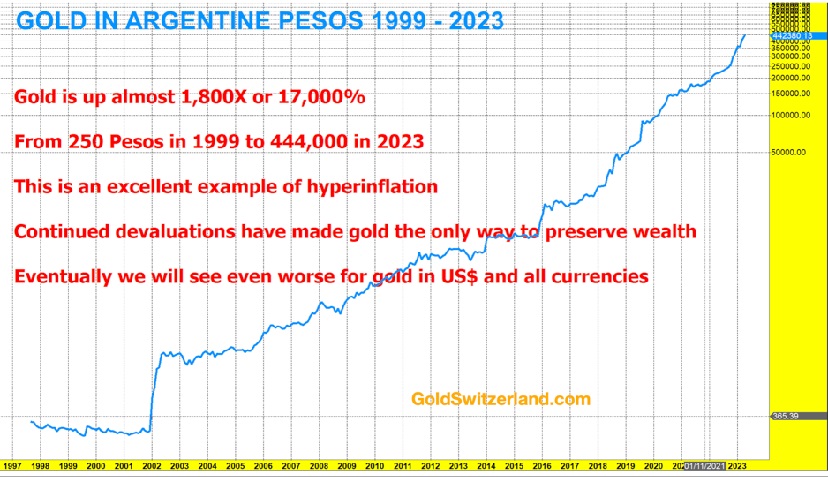

But we don’t need to go back as far as the Weimar Republic in the early 1920s.

Just look at the Pesos and gold in Argentina today

In the first couple of decades of the 1900s, Argentina was one of the wealthiest nations in the world. Since then the country has been destroyed by corruption and mismanagement.

For anyone who doesn’t understand what effects the coming hyperinflation will have on his life, just speak to someone in former Yugoslavia or Argentina.

Mark Twain understood it:

For example, a few years ago, my wife and I were in a restaurant in the Italian part of Switzerland. The owner recognised me and told my friends who were with me to listen to me and to buy gold. That is what saved him in Yugoslavia. Most of his friends and family lost everything. My friends who were with me still don’t own any gold!

So if you own a sufficient amount of gold, you care less if your currency declines by 90% or 99%. But if you don’t hold protection in gold, it is of course a matter of financial survival.

George Bernhard Shaw (Pygmalion) understood it:

DOW JONES TO DECLINE BY 90% AGAINST GOLD

And for anyone who believes that the stock market will protect him from the coming collapse of the financial system, I have bad news:

\The Dow – Gold ratio, currently at 17, is likely to reach at least the 1980 level of 1:1. That would mean a 94% fall of stocks against gold from here.

But I think it could easily reach the trend line of 0.5:1 which means that the Dow would fall 97% against gold.

SILVER – GOLD ON STILTS

So let’s look at gold on stilts which is SILVER. Silver is very volatile and not for orphans and widows. Silver normally goes both up and down at least twice as fast as gold. That means absolute euphoria on the upside but total misery when it goes down.

Currently both the fundamental picture (industrial demand, shortages etc) and the technical picture is superb. At some point, probably this year, silver could reach $50 on its way to much higher levels.

If gold reaches my very old target of at least $10,000 (remember I am now a mug) and the gold-silver ratio reaches its historical average of 15, silver would go to $666!

666 for gold is also a biblical number. In the Chronicles 9:13 it says:

“The weight of gold that came to Solomon in one

year was six hundred sixty-six talents of gold.”

666 Talents is 22 tonnes of gold which today is worth $1.4 billion

MUG FOR A DAY

I stopped making price projections in gold and silver some time ago since they are meaningless.

Measuring Gold – Nature’s Money and Eternal Wealth in what governments and central banks destroy on a daily basis clearly makes no sense whatsoever. Therefore price projections of gold are totally meaningless.

Still I decided to be a mug for a day and make the forecast that everyone wants to hear. So please ignore the gold “forecasts” above of $10,000, $20,000 or $200,000 or silver $666. Just take it as an oddity!

More importantly, remember that PHYSICAL gold and some silver are likely to give you protection in what will probably be the worst crisis in the history of the world.

And even more importantly, it could make it possible for you to help family and friends who will suffer in the coming difficult times.

Courtesy of Gold Switzerland

*********

Egon von Greyerz – Founder and Managing Partner of Matterhorn Asset Management (MAM) and

Egon von Greyerz – Founder and Managing Partner of Matterhorn Asset Management (MAM) and