The GDXJ Has a Choice: Rise With the S&P 500 or Fall With Gold?

The S&P 500 is blooming, while gold cannot hide its weakness. Both have an impact on junior miners, but which lead will gold stocks follow?

It’s Fed decision day! Will the rally in stocks continue? Will miners follow stocks higher or gold lower? Charts provide hints.

Let’s start with something that usually happens at this time of the month.

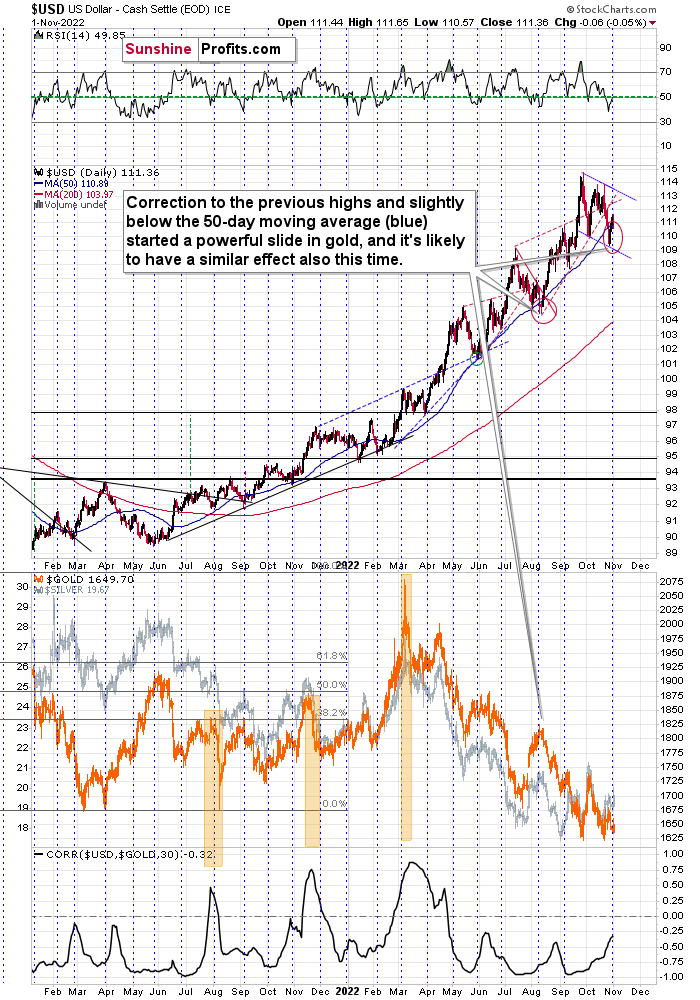

The USD Index tends to reverse its direction.

It seems that’s exactly what we saw recently. The USDX dipped below its 50-day moving average, and each time that happened since mid-2021, it meant that a bottom was in or just around the corner.

At the same time, the USDX moved to the lower border of the flag pattern and approximately to the previous (July) high.

This is all bullish, not just per se, but also because we saw something very similar in early August, earlier this year. What happened next? Well, not only did the USD Index rally, but gold fell like a stone in water.

The main difference this time is that gold (the lower part of the above chart) is not after a rally that’s as big as the July rally was. In other words, gold is now weaker, and the situation is now more bearish for gold than it was in early August.

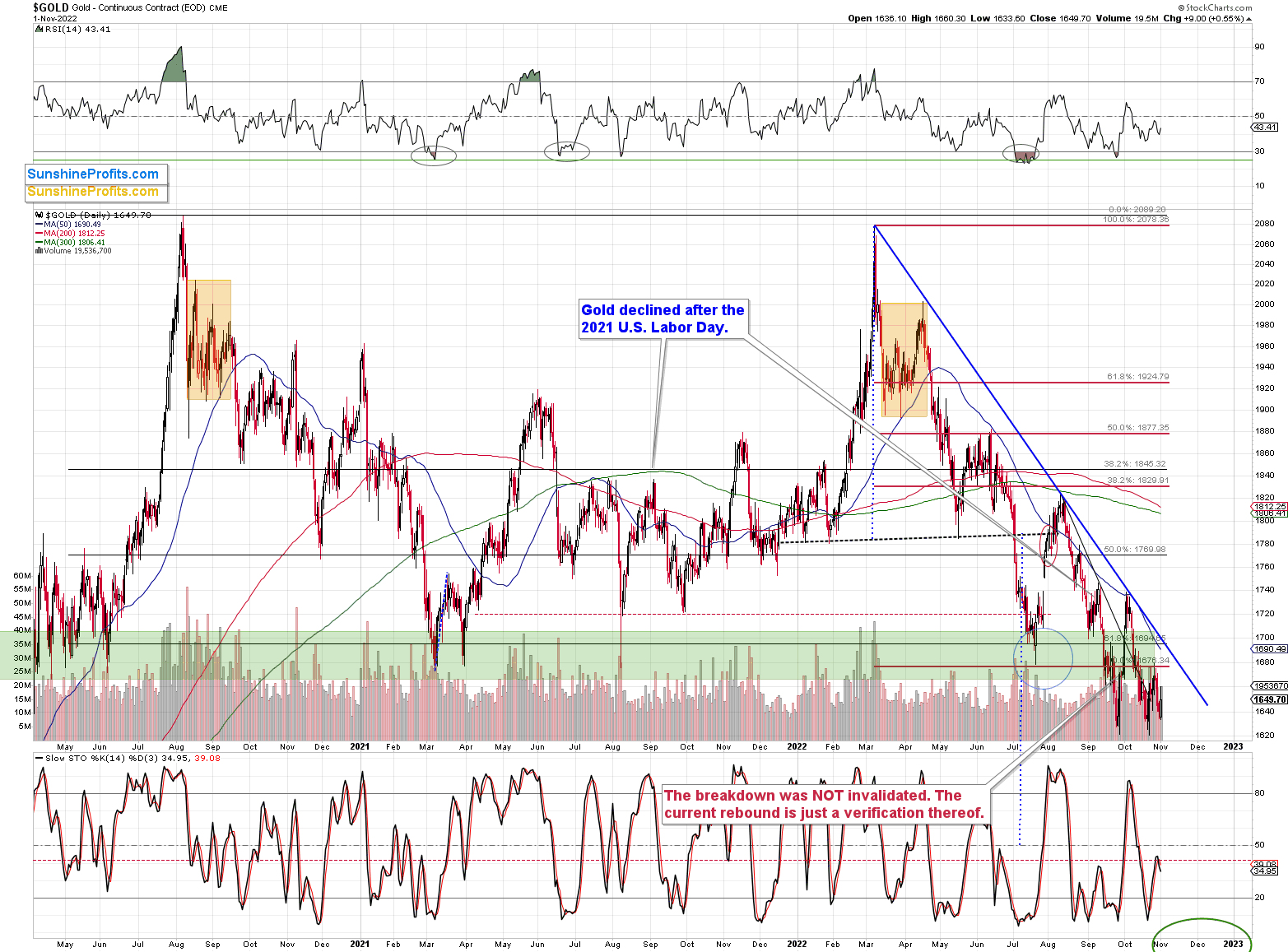

During its most recent run-up, gold wasn’t even able to get back above the $1,700 level. It’s weak, and it’s all really, really bearish.

Instead of moving back above $1,700, gold verified its breakdown below this level, and we saw a fresh sell signal from the stochastic indicator. Yes, it’s a bearish combination of factors.

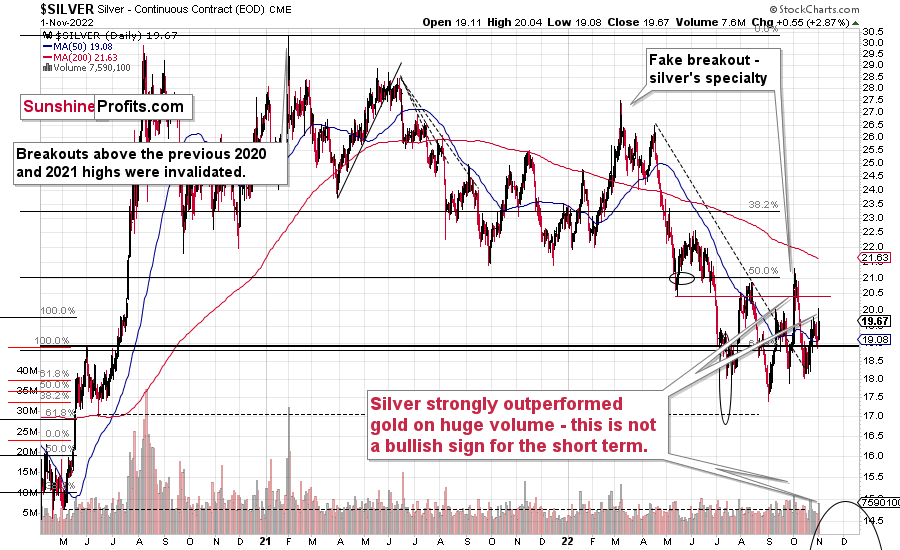

If it wasn’t enough, we just saw a major sell indication from the silver market.

The signal comes from silver’s very short-term outperformance of gold. Whenever something like that happens (especially on strong volume) after a rally, it’s an indication that the rally is either over or about to be over. And yes, yesterday’s rally (and intraday reversal) took place on relatively strong volume.

Remember the fake early-October rally? That was yet another example of this technique in action.

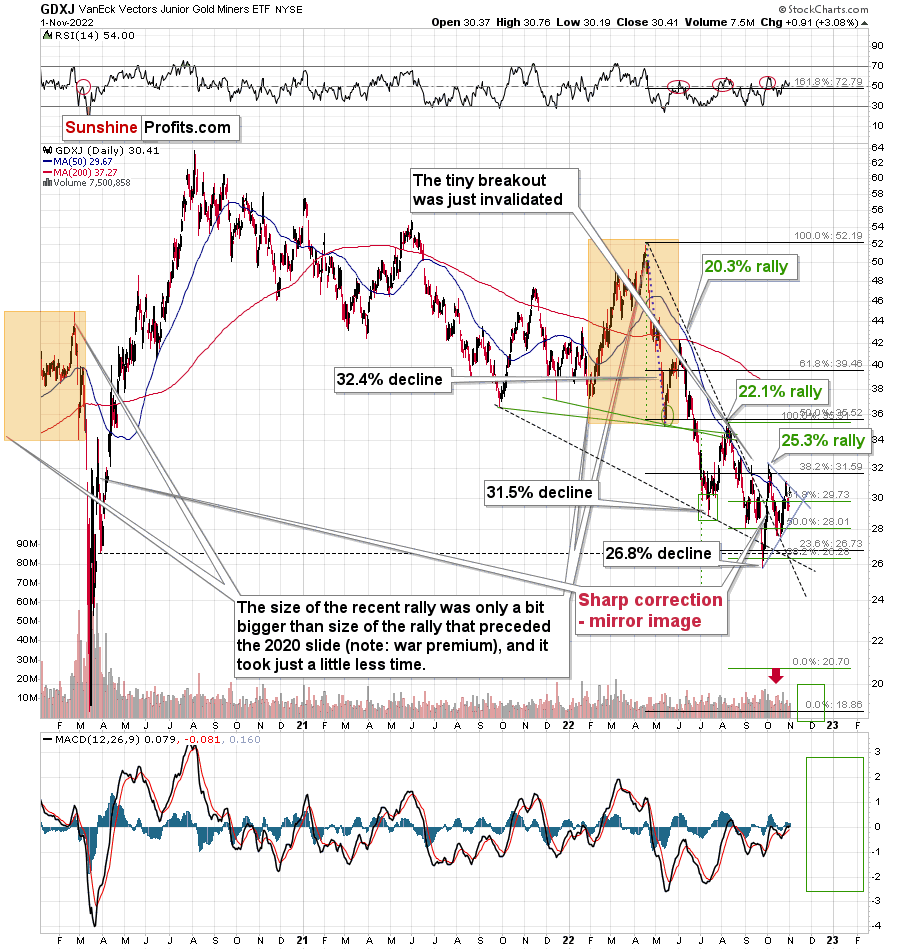

Junior miners moved a bit higher yesterday, but our short positions in them remain profitable nonetheless (and we keep the 100% profitability in the 2022 trades, at least as long as one uses the GDXJ).

Interestingly, the most recent short-term upswing materialized practically right at the vertex of the triangle, based on the two black, dashed support/resistance lines. The vertexes tend to mark reversals, and the most recent move was to the upside, which means that the implications are bearish here.

And now for the part that I get most questions about – the stock market.

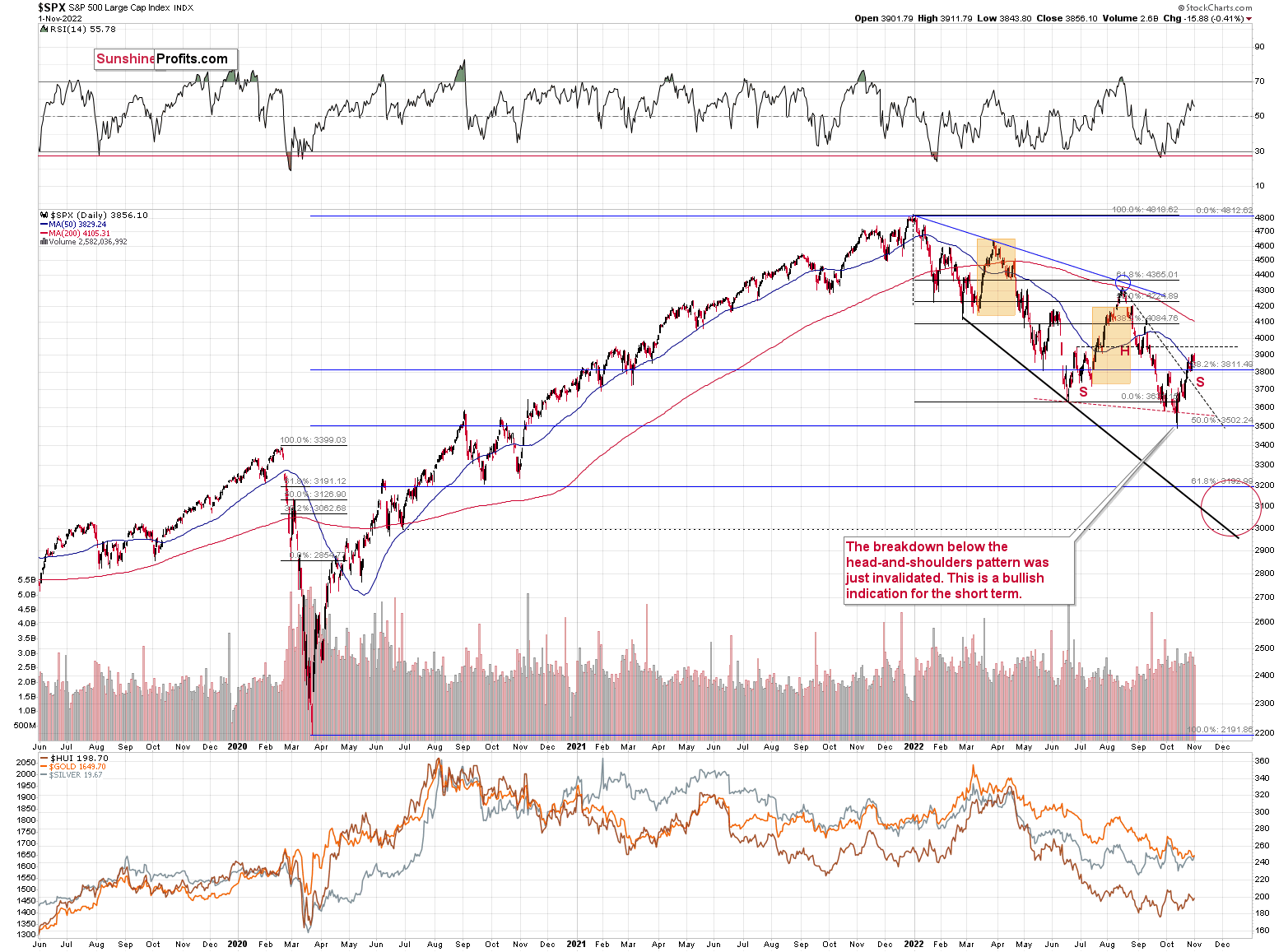

The S&P 500 recently rallied to new monthly highs, which caught investors’ eyes. However, as the index didn’t move above its June 2022 high, the head and shoulders formation could still be completed.

In the case of the S&P 500 index, there is a visible breakout above the declining dashed resistance line based on the August and September 2022 highs.

However, once we zoom in and focus on S&P 500 index futures, it becomes clear that the situation is much more bearish than it seems at first glance.

The index futures have longer trading hours than the index, so the above chart includes a broader data range. In many cases, the U.S. session would be key and overnight trading wouldn’t be that important, but in the case of the S&P 500 index futures, those trades are important as this extremely popular index/futures is being traded all over the world, and the sizes of those transactions are not minor.

In other words, paying attention to the S&P 500 index futures is a good idea.

The above chart shows that we just saw a failed attempt to break above the declining resistance line, the October highs, and the 50% Fibonacci retracement based on the August-October decline. This is a powerfully bearish combination.

On top of that, yesterday’s session took the form of a daily reversal.

And yes, this is all bearish news for the stock market.

This, in turn, means that the positive impact that the stock market had on the prices of mining stocks is likely to be reversed. This, plus the bearish implications of gold and silver charts, tells us that the very bearish outlook for mining stocks (especially junior mining stocks) remains up-to-date – at least for the next few weeks-months. In my view, they are likely to rally in the very long run, but not without a bigger decline first.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the targets for gold and mining stocks that could be reached in the next few weeks. If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits: Effective Investment through Diligence & Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

*******

Przemyslaw Radomski,

Przemyslaw Radomski,