Gold’s Bottom or Gold’s Breather?

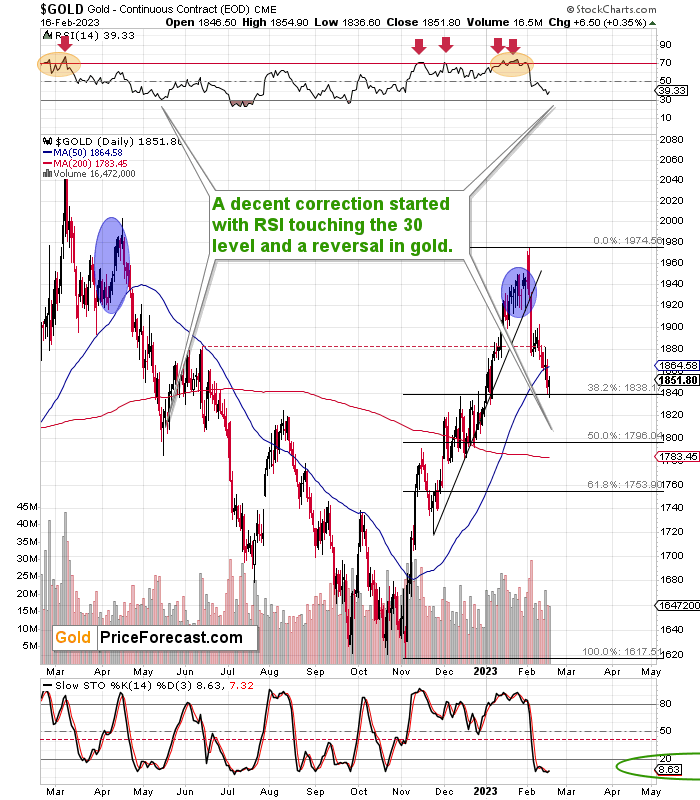

Looking at gold from the short-term point of view, we see that it paused for a brief moment at its 38.2% Fibonacci retracement level.

Some will even say that there was a “big reversal”.

However, that’s as far as the bullish narrative goes.

To be honest, a pause doesn’t seem to be that bullish, does it? After moving a bit below the retracement, gold moved higher and ended yesterday’s session in the green.

And… Was that really a profound reversal?

No!

If a reversal is to be taken seriously, it should be accompanied by huge volume. Big volume means that one side of the market (here: the bulls) overpowered the other side (here: the bears) and they won a major victory in a huge battle (session). This would imply that bulls' strength is likely to continue (a "enough is enough!" type of market reaction) and that prices are now likely to rise.

Now, since yesterday’s volume wasn’t huge, there was no “huge battle” to speak of.

This means that the reversal is not really meaningful.

In fact, we already saw the confirmation of the above in today’s pre-market trading as gold is trading significantly lower than it did yesterday (chart courtesy of https://goldpriceforecast.com).

The same goes for silver price and for the GDXJ’s price moves in today’s London trading (it just moved below its lowest Dec. 2022 close!).

So, where is gold likely to reverse, since moving to the 38.2% Fibonacci retracement level triggered nothing more than a breather? In my view, the $1,800 level or its proximity continues to be the most likely short-term target.

Why?

That’s where we have the 50% Fibonacci retracement based on the recent upswing (approximately), and it’s close to the mid-November high as well as the late-2023 intraday lows.

Moreover, please note that back in 2022, gold kept declining until the RSI based on it touched 30. Given where gold and gold-based RSI are right now, it seems that they would both need to move a bit lower in order to match the 2022 analogy.

Why would gold “want” to behave like it did in 2022? Because that’s what it’s been doing for some time now. Please note how similar the situation is in terms of the RSI indicator and in terms of the shape of the recent price moves. The size of the preceding upswing was also similar.

Since the 38.2% Fibonacci retracement level was just breached, the next serious support is provided by the 50% retracement – which is right next to the psychologically important $1,800 level.

This means that what I wrote in my analysis yesterday remains up-to-date:

So, will gold bottom at $1,800 or close to it? It seems quite likely.

Will this be the final bottom? It seems very unlikely given how high real interest rates have rallied recently and how far they are likely to rally in the future.

Will there be no other corrections before gold hits $1,800? It’s unclear – we might see a rebound right now given that the 38.2% Fibonacci retracement was reached, but it’s unlikely that this rebound would be big enough for most people to really care about it. Remember the late-April and early-May 2022 corrections? We might see something of similar size and length.

In fact, we just saw a small breather yesterday, and it’s in perfect tune with those previous pauses.

All in all, while the biggest opportunity lies in the junior mining stocks right now, it seems to me that gold is likely to provide us with a decline that also might be useful for those who choose to position themselves accordingly and benefit from this move.

Naturally, the above is up-to-date at the moment when it was written. When the outlook changes, I’ll provide an update. If you’d like to read it as well as other exclusive gold and silver price analyses, I encourage you to sign up for our free gold newsletter.

Thank you.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits: Effective Investment through Diligence & Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

********

Przemyslaw Radomski,

Przemyslaw Radomski,