Gold’s Massive Plunge – Close, But Not Yet Here

Gold is likely to plunge, but not without an additional temporary upswing first.

Gold just plunged over $100 in one day, while silver declined over $4. Miners declined significantly as well. Many investors and traders were caught off-guard with these moves, but not those who read our previous analyses. Based on the proximity to the rising support line, we wrote that gold would likely bounce from it - at about $1,890. And what happened?

In today’s pre-market trading gold did exactly that. It moved to the rising support line, touched it, and rallied back up.

Gold declined in a specific zig-zag pattern, which is a consolidation pattern. This, by itself, is not yet a proof that the rally will continue, but it is a slight suggestion that it is indeed the case.

You probably know the saying that history tends to repeat itself to a certain extent. And it’s true – it does tend to rhyme, and that’s one of the foundations of the technical (chart) analysis. In this case, it’s important that we saw something similar to the current gold’s performance in late February.

The initial February decline was not THE decline yet. Gold first tested the previous high and then topped in the most profound way. The thing that confirmed the top was when gold failed to hold the breakout above the previous highs. Will we see something like that once again?

It’s unclear at this time, but it’s certainly possible.

Based on the fact that gold reached its support line, a rebound is likely.

We copied the early-2020 decline to the current situation, so that it’s clear that both took similar shape, and both took similar amount of time. The current decline was bigger and a bit shorter, so we might expect the corrective upswing to be also quicker.

We’ve been writing about a smaller corrective upswing after gold reaches the rising support line, but given the fact that the most recent major top (early 2020) and the most similar top with regard to price at which it was formed (2011), it seems that we shouldn’t rule out a move even back to the previous high, before the decline really starts.

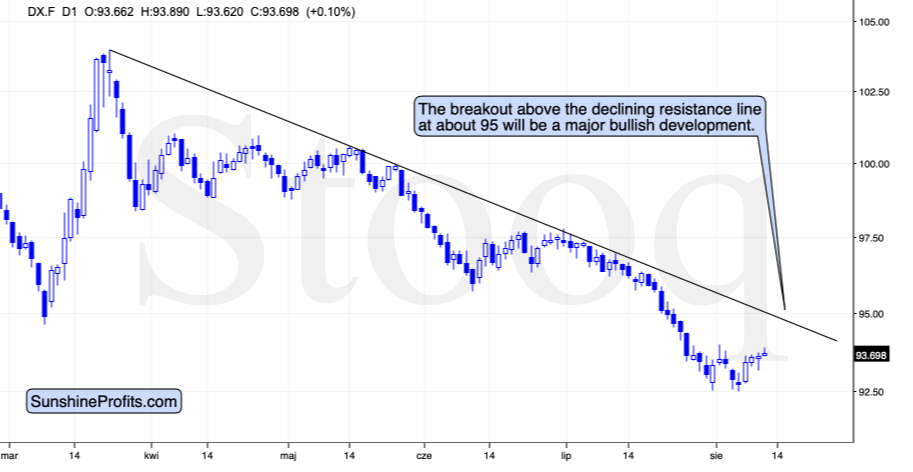

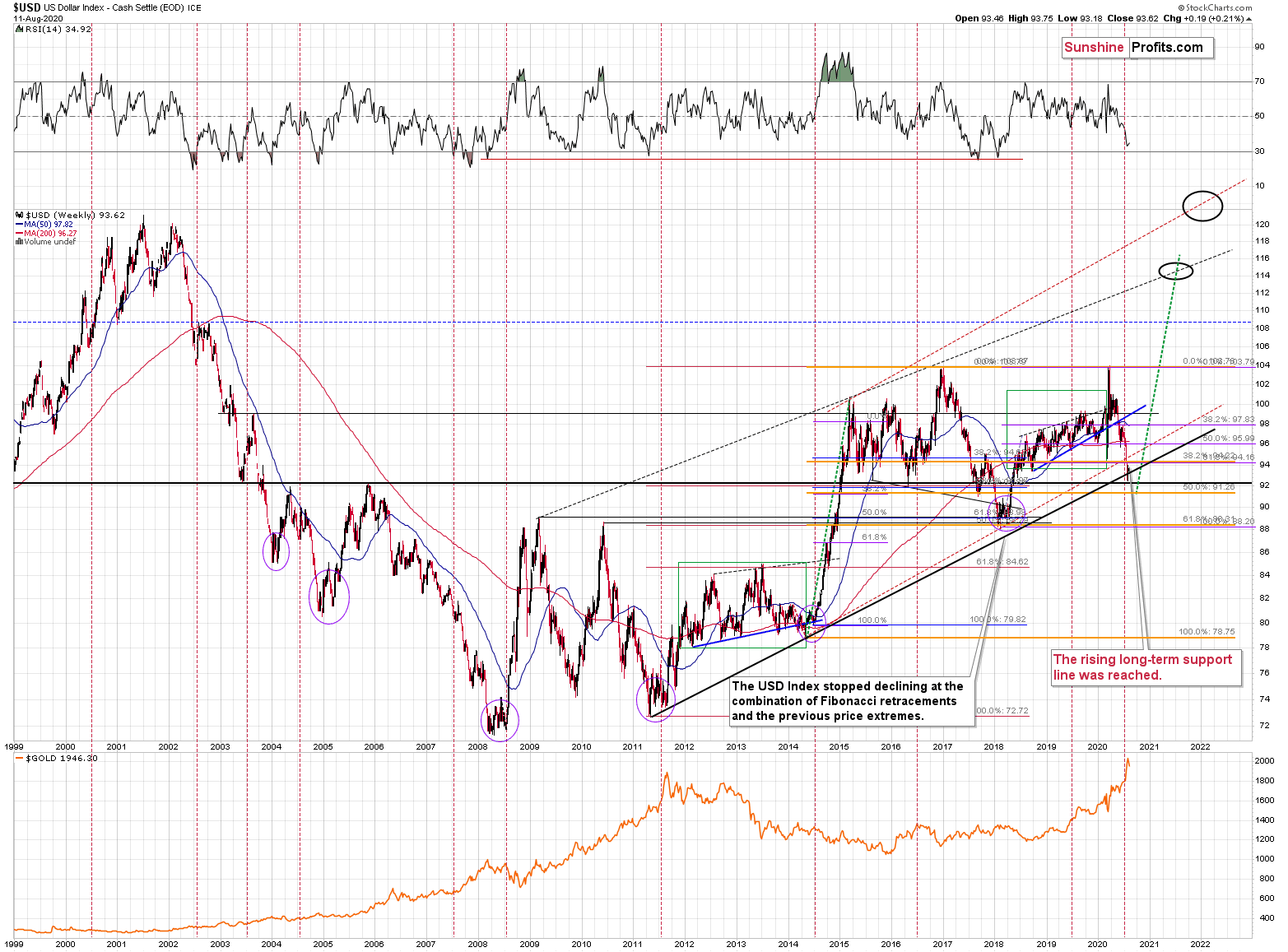

In today’s globalized economy, no market can move completely independently from other markets, and the gold-USD link is particularly important. In many (almost all) cases, major bottoms in the USD Index correspond to tops in gold, so looking at the former is very useful while forecasting gold’s prices. Let’s see how the USDX performed recently.

The USD Index seems to have formed a double-bottom pattern, but… We still can’t rule out a scenario in which the double-bottom pattern would turn into a triple-bottom pattern. The USDX just reversed and declined a bit, and gold reacted with another rally. So, it seems that if the USD Index continues to trade sideways, gold will do the same thing.

After all, most of the bottoms in the USD Index that formed mid-year (marked with purple ellipses) were rather broad, so we wouldn’t rule out something similar also this time.

Then again, gold has been very overbought in the short run (and so is silver and the rest of the precious metals sector), so it’s likely to be vulnerable to a meaningful show of strength in the USDX.

Will the latter finally rally soon? This seems likely based on the invalidation of the breakdown below the rising long-term support line (visible on the above chart), but a rally without another move closer to the recent lows is far from being a sure bet.

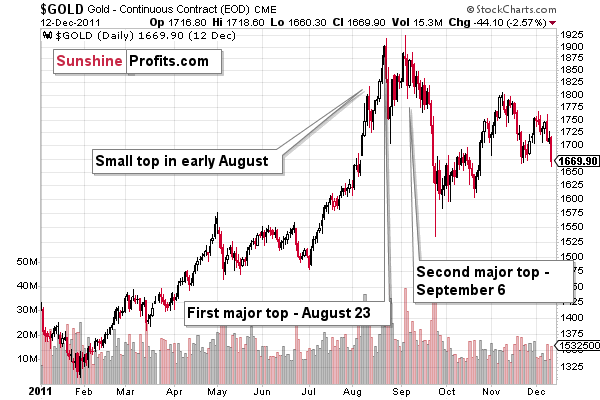

Gold is not likely to form a broad top here, as it’s not the kind of performance that gold exhibited after similarly sharp rallies in the past – in 2006, 2008, 2009/2010, and 2011. Interestingly, all the above-mentioned spike tops formed close to gold’s long-term cyclical turning point – which is also where gold is right now.

So, on one hand we could (but don’t have to) have a broader bottom in the USD Index (which might indicate a broader top in gold), and on the other hand, we could have a spike-high in gold based on analogy to similar short-term rallies and long-term turning points. What’s the most likely outcome here?

In my view, in addition to keeping in mind how gold performed in February and March, it would be most useful to look at gold’s top that formed at the most similar price levels – the 2011 top.

There was an initial top in early August, then an initial top, and then – after several days – the final top. Gold’s plunge was significant even after the first top. However, it was not significant after the initial early-August-2011 top.

The USD Index had been trading sideways, forming a broad bottom in 2011 and while the first decline in gold took place practically without USD’s help, it was the decisive move higher in the USDX that really changed the picture.

Will the USD Index rally significantly from here? That’s most likely in my view, and gold is likely to react to it with a big slide. But will this happen without an additional move to the previous lows? This is unclear.

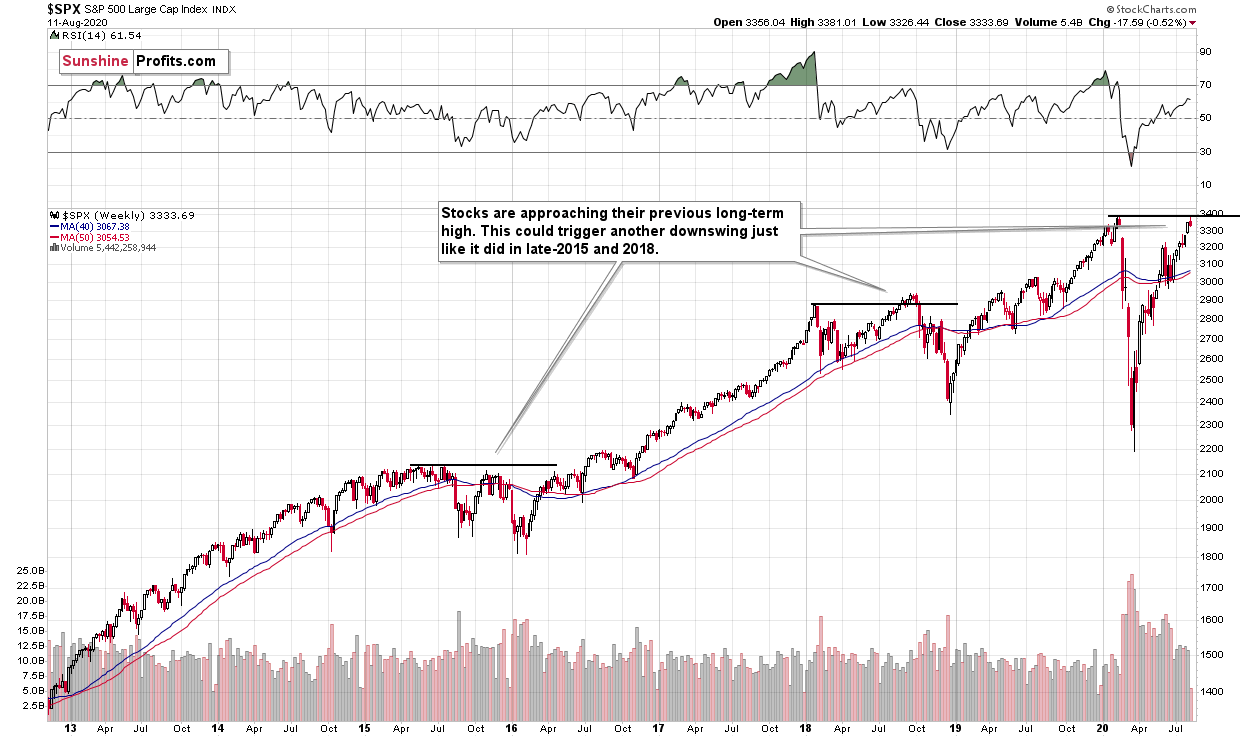

Since markets don’t move in isolation, we might get the final “go” signal from a different market. And this could be the stock market.

In my previous analyses, I wrote that all in all, gold is likely to rally far in the long run, but in the short run it’s vulnerable to a sizable decline, when the economic implications of the pandemic’s continuation become obvious to investors.

The S&P 500 is approaching its previous 2020 high. Given the economic background, I find this performance unfounded. But the markets can stick to a certain emotional trend for longer than many investors can remain logical, which would fit the above picture.

Back in 2015 stocks topped below their previous highs, and in 2018 they topped a bit above them, so the proximity to the previous is far from being a precise sell signal. It does indicate, that the stock market is likely vulnerable to sell signals coming from other markets and that this emotional rally could end rather sooner than later.

Do you remember what happened in February when the S&P 500 lost its upward momentum? They plunged, and that was when tops in mining stocks and silver formed. Gold made another attempt to move higher but ultimately declined profoundly in the following days.

As you can see on the above chart, the S&P 500 futures are already very close to the previous 2020 high. A move to this level, or – even better – a small breakout that is then invalidated, could be the perfect trigger for all above-mentioned moves. This could be what triggers a move higher in the USD Index, as investors turn to cash, which in turn could trigger a decline in gold, just like what we saw in 2011.

So far, we saw a daily reversal slightly below the previous high. This seems bearish at the first sight, but we doubt that it is really the case. Why? Because we saw this kind of “bearish reversal” several times in the past months and it was never the day when the S&P 500 topped. Indeed, the S&P 500 Index futures are already higher in today’s pre-market trading.

Consequently, it seems likely that stocks could continue to move higher until they reach their previous 2020 high. In fact, we wouldn’t be surprised if stocks move a bit above the previous high and then invalidate this move. It would serve as a perfect bearish confirmation of everything we wrote today.

…And if gold was to decline significantly here along with stocks, then silver and miners would be likely to truly plunge.

Summary

Summing up, it seems that after reversing $4 above our upside target, gold has finally topped. The opposite appears likely in store for the USD Index, which seems to have formed a double-bottom pattern. While we can’t rule out a situation in which the precious metals and miners move higher one final time before plunging, it seems that regardless of this move, the outlook for the next few weeks for the mining stocks is very bearish.

Thank you for reading today’s free analysis. Please note that it’s just a fraction of today’s full Gold & Silver Trading Alert. The latter includes multiple details such as the target for gold that could be reached in the next few weeks and our details of our trading position in the mining stocks.

If you’d like to read those premium details, we have good news. As soon as you sign up for our free gold newsletter, you’ll get 7 access of no-obligation trial of our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits: Analysis. Care. Profits.

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski,

Przemyslaw Radomski,