Gold 1, Bitcoin 0

Coinbase, a publicly traded cryptocurrency company, recently announced that it will sell 1.5 billion worth of bonds (then revised it to 2 billion). Dollars. A leader of the crypto revolution is borrowing dollars.

Without any awareness of the irony, crypto promoters say that this validates crypto. That a crypto company borrowed dollars supposedly validates crypto.

Think about it, take as long as you need.

I have been saying for over four yearsthat bitcoin is not suitable for borrowing. And now the crypto bellwether demonstrates that they agree!

Bitcoin is Not Suitable for Borrowing

If anyone could borrow bitcoin, surely a company who handles large quantities of it for large numbers of passionate investors would. They chose not to. As any bitcoin enthusiast can tell you, it would be foolish to borrow bitcoin as the cryptocurrency is expected to go up to many multiples of its current price. Better to borrow dollars, which are expected to fall.

To be more precise, anything that rises or falls rapidly will have volatility. This is because dramatic price action attracts speculators, who bet (with leverage) and overextend the move. Then it snaps back, and they hit their stop-loss orders, and sometimes reverse their positions.

A borrower needs stability, not drama. Bitcoin provides plenty of the latter, but not so much of the former. Bitcoin is not suitable for borrowing.

Is Bitcoin “Digital Gold?”

Bitcoin is often called “digital gold”. Well, here is one difference. Gold can be used to finance productive businesses.

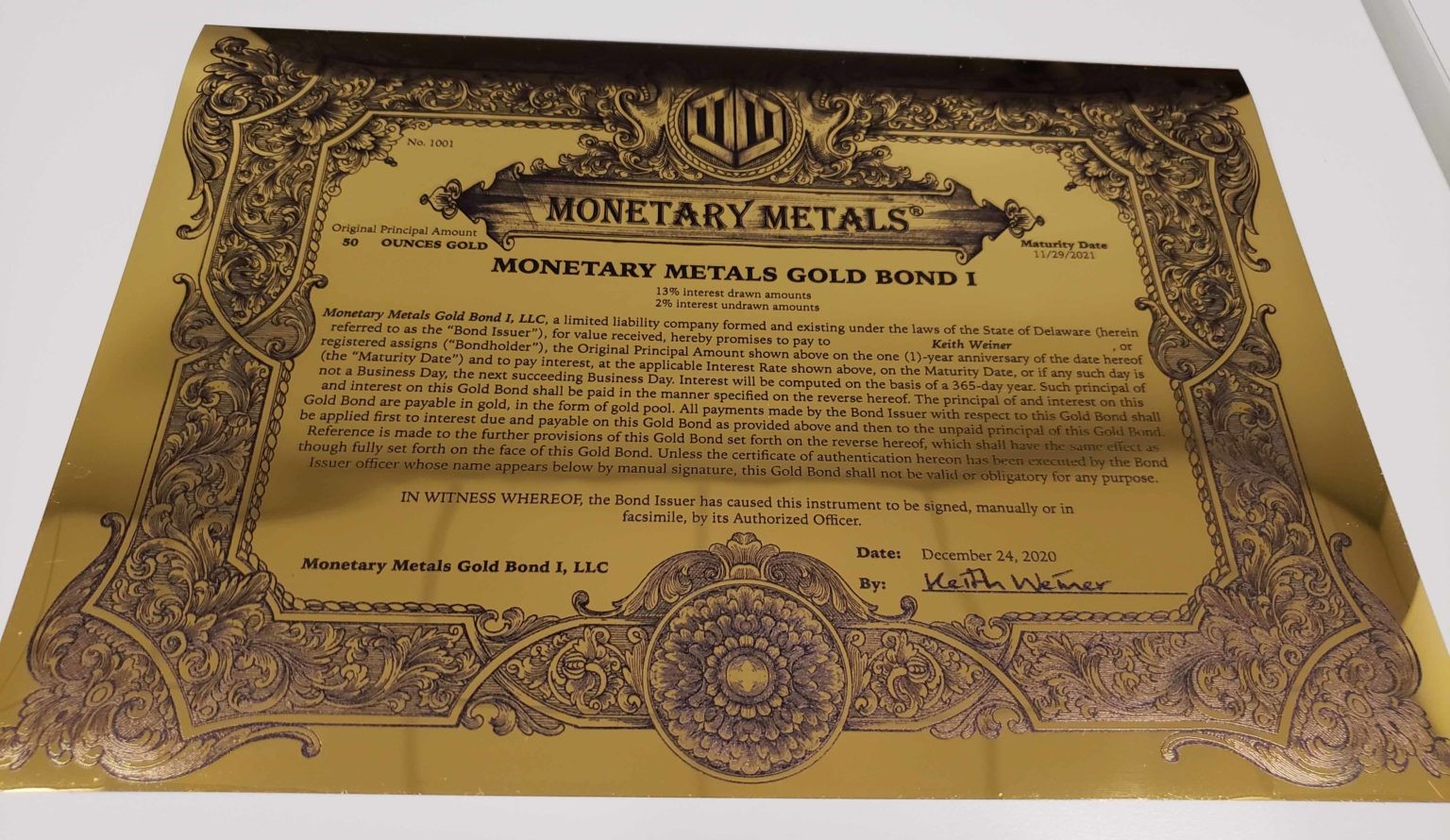

Not only can it be used to finance. It is being used to finance. My company, Monetary Metals, recently announced the maturity and repayment of the first gold bondsince President Roosevelt wrecked the gold bond market in 1933. We will issue many more gold bonds(and have been leasing gold—which also pays interest to investors—since 2016).

The below photo is an example of the certificate investors received for investing in the Gold Bond. The certificates were printed on special 24 karat gold film manufactured by Valaurum Inc., a company we lease gold to (investors earn 2.25% interest in gold in that lease).

Is Bitcoin Better than Gold?

It is obviously better at skyrocketing (and also crashing). Much better. But price appreciation is just a means for sellers to get buyers’ capital. You see, when you buy, you fork over your hard-earned savings to the seller. He can spend some of it, as it is his winnings. You do this, of course, in the expectation that the next guy will hand you even more of his savings.

All bitcoin trading profits come out of someone’s accumulated wealth.

But gold can finance productive enterprise. Gold can enable businesses who make real things in the real world, to buy the equipment and pay the expenses to start or increase production.

This is why the next monetary standard will be gold, not bitcoin.

Additional Resources:

Check out our research section on Bitcoin: Postmodern Money

*********

Dr. Keith Weiner is the CEO of Monetary Metals and the president of the

Dr. Keith Weiner is the CEO of Monetary Metals and the president of the