With Gold Above $2,000, Bulls Triumph! What’s Next?

The triumph of the gold bulls has finally come, as gold jumped above $2,000. But what’s next for the shiny metal?

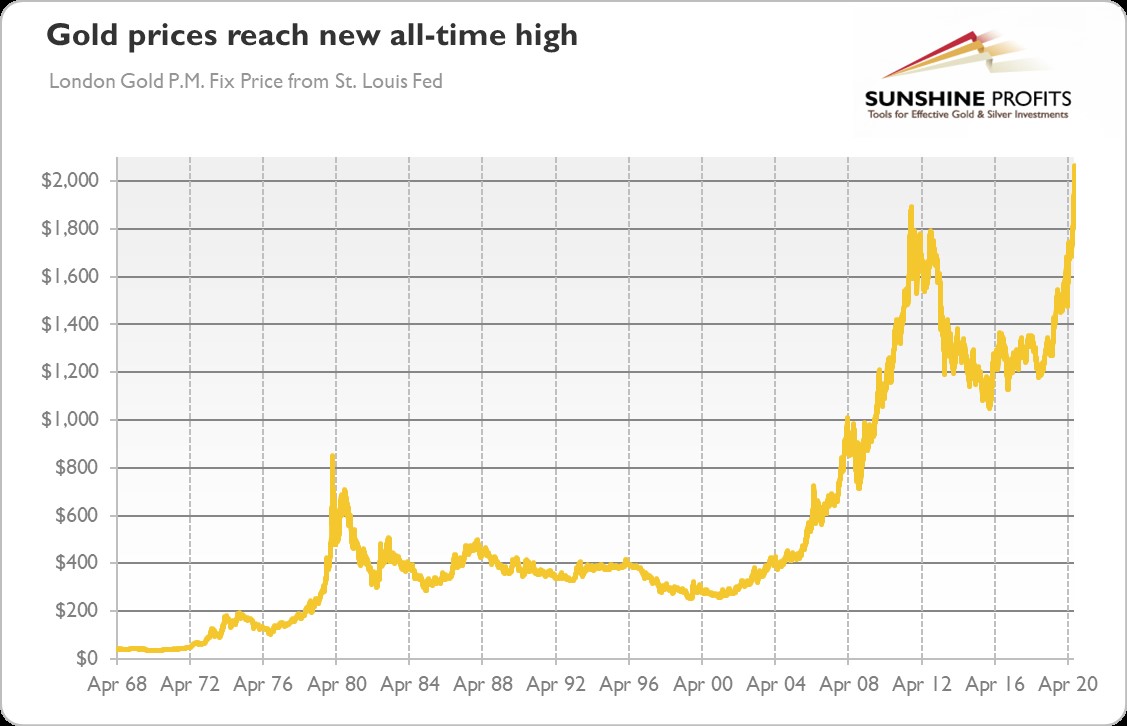

Well, that escalated quickly! At the end of July, when gold was still below $1,900, I went on a short vacation, and when I’m back, the yellow metal is above $2,000. Whoa, it was a real blitzkrieg! Just please take a look at the chart below – as you can see, gold soared in early August, surpassing the psychologically important level of $2,000 per ounce.

Am I surprised? Should I be? Is anyone surprised that the sun rises in the morning and sets in the evening? Yes, the pace at which gold has broken above $2,000 is astounding, but I’ve been bullish on gold since 2019, when the yellow metal escaped the sideways trend and jumped above $1,400 per ounce. When the Fed started to cut interest rates, even before the pandemic, I’ve become convinced that the bull market in gold had really set in. And when the epidemic of the coronavirus and the following economic crisis occurred, I’ve become even more bullish.

As a proof, this is what I wrote in the last two editions of the Fundamental Gold Report, just before my vacation:

the repercussions of the coronavirus recession could be more inflationary than the Great Recession, and (…) gold is in the bull market that could last for a while.

The coronavirus crisis and the following economic crisis and the response of the central banks and governments significantly shifted the already bullish fundamental outlook for gold prices into even more bullish, also potentially strengthening the role of gold as a strategic asset.

And this is what I wrote in the last edition of the Gold Market Overview:

even without the next crisis, the yellow metal should thrive in the current macroeconomic environment of dovish central banks, low real interest rates, high public debts, and uncertain economic outlook.

And indeed, we can say many things about gold, but one thing is certain: it is thriving right now. Thriving as hell!

Please pardon my French, but these are the facts: gold has risen more than $500 this year, and about $200 in the last two weeks alone! In percentage terms, the shiny metal has gained more than 34 percent in 2020, or more than one third! It means that gold is one of the best performing mainstream assets, if not the best, this year.

What’s Next for Gold?

Now, the key question is what happens next for gold. Some analysts fear the correction– and they might be right. Until July, the rally in gold has been very gradual and steady. So, after recent amazing acceleration, correction would not be something strange.

However, I will repeat what I said in July: from the fundamental point of view, there is further room for gold to go higher in the long-run. The obvious reason for this is the macroeconomic backdrop with fragile recovery and a lot of uncertainty about the future path of pandemic and economic growth, extravagant fiscal policy, dovish Fed that will maintain lax monetary policy and negative realinterest rates.

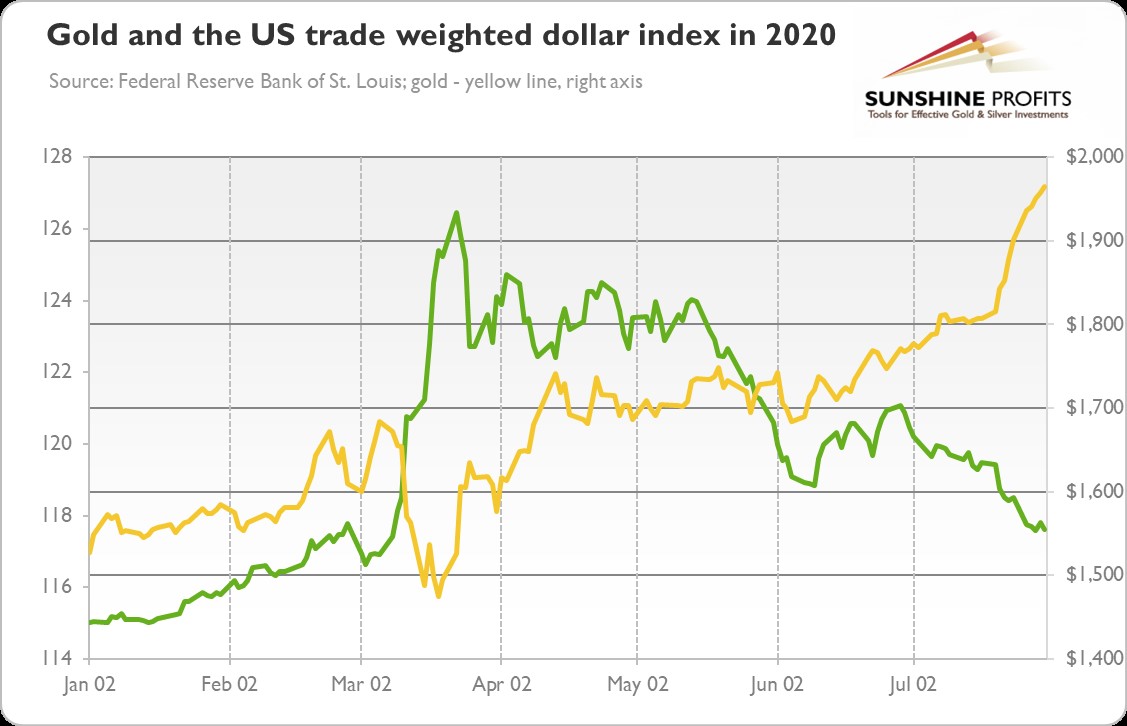

The second argument for the bull-run in gold not ending soon is the situation in the forex market. As you can see in the chart below, the U.S. dollar has softened recently against the euro, which fueled the rally in gold.

To be clear, I’m not saying that the bull market in gold will end as soon as the greenback rebounds. After all, as you can see in the chart below, gold has been rallying recently in both U.S. dollar and euro, and in pound sterling as well. Having said that, the weakness of the U.S. dollar has definitely helped gold to reach $2,000 so quickly.

Last but not least, investors shouldn’t forget about the positive momentum. After all, what has happened is not that gold has merely crossed another important level. No, gold has surged to a record high, surpassing the previous peak from September 2011, as the chart below shows.

That’s a big achievement. A triumphant moment for all gold bulls. Something that will confirm the gold bugs’ belief that gold prices can only go up. Breaking the previous all-time record is definitely something that could affect imagination of many people who will join the bulls’ party, strengthening the positive momentum. Fear of missing out is strong and can attract many people, who normally don’t invest in precious metals to gold. Hence, although correction in the short-run would be totally normal, or even desirable, the underlying bull market should continue, at least for a while, i.e., until the dominant economic narrative changes, which is not yet happening.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.

********