Gold and the Mighty Dollar

Many newer subscribers to our service are not familiar with the ongoing long term outlook we have on the gold sector in the past two years. It has always been my belief that the gold bull market as we have witnessed from the $255 low four years ago was essentially a US dollar gold bull market, and when gold finally rises against all major currencies, we will have a global gold bull market and that is when the "phase two" of the gold bull market begins.

Folks, from all current indications, such a time has arrived.

Much has been said about the inversed relationship between gold and the dollar, and it is obvious. Dollar up, gold down. Dollar down, gold up. But since early this year, gold and the dollar has a new found relationship, and that is good news for all investors, and even better news for gold investors. Gold investors are enjoying a "double dip" if this relationship continues. You buy gold, it appreciates 10%. In the same period, dollar appreciates also by 10%. Your gold investment has now appreciated 20% measuring against foreign currencies. The dollar is now our friend, and lets hope this new relationship is the beginning of a long term trend, we've been waiting a long time for this.

The global gold bull market

If you live outside the USA, the gold bull market in the past four years hasn't meant much, because the price of gold in foreign currencies have remained subdued due to the relative strength of these currencies. Until now.

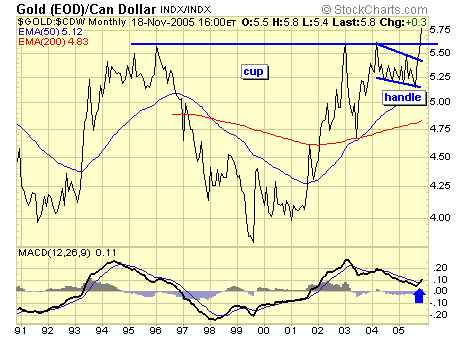

Canada, America's largest trading partner, is now seeing gold making a new high since 1996, the gold bull market has finally arrived in Canada.

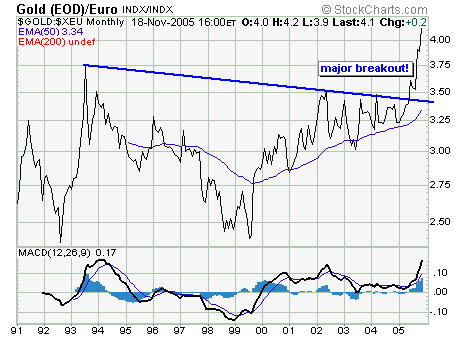

The gold bull market has also arrived in Europe.

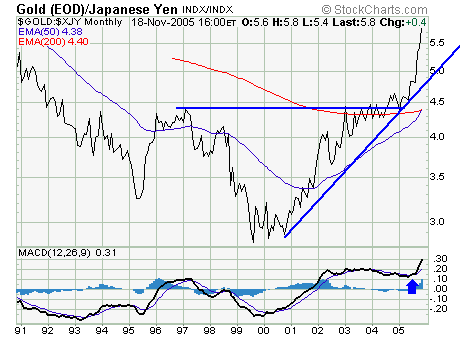

And in Asia where love of gold is in the DNA of its people.

Summary

Phase two of the gold bull market has arrived, but don't expect $1000 gold overnight. A true bull market climbs a wall of worry and is a grinding process. How long will it last and when will it end is pure speculation at this point, but until there is a 24 hour gold channel on TV, we are far from reaching saturation point.

Jack Chan at www.traderscorporation.com

25 November 2005