Gold And Silver Demand Is Spiking Higher

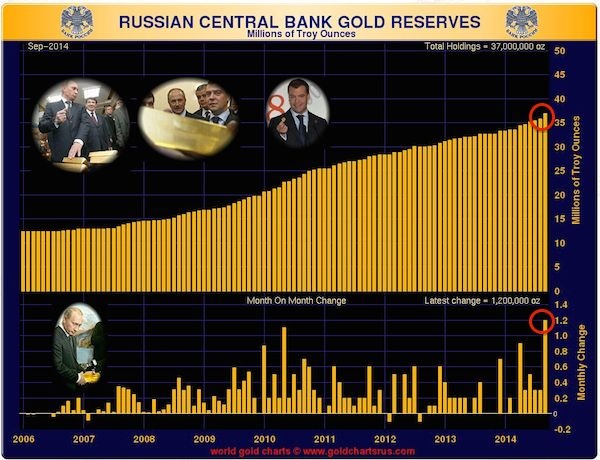

Russia has added another 1,200,000 ounces of physical gold to their reserves during September, the largest month-on-month increase EVER.

Gold imports into India in September were a staggering $3.8 billion. This figure is almost double the $2 billion spent by Indians in August and roughly 5X the $739 million spent the previous year. The appetite for gold in India only continues to grow as prices have fallen.

This comes amidst increasing de-dollarization by both Russia and China. The United States is beginning to lose the power of printing the world reserve currency and the petro-dollar may soon be a thing of the past. Strategically, the weakness and potential collapse of the U.S. dollar is indeed the Achilles heel of a country that otherwise cannot be harmed militarily. The new warfare is economic, with two powerful adversaries and a number of BRICS nations lining up to throw off the shackles of U.S. imperialism and global dominance.

The rapid accumulation of gold reserves by Russia and China may eventually lead to China challenging the dollar for world reserve currency status. Many have speculated that China will back their currency with gold. This would give the Yuan a clear advantage over the dollar in terms of stability and the ability to preserve purchasing power over time. It is believed that China has doubled their gold reserves over the past few years, although official numbers have not been released. Being that China is now the largest producer and importer of gold, such a feat would not be hard to accomplish.

And while the United States may officially claim to have the world’s largest gold reserves at over 8,000 tones, many doubt the accuracy of this number. Indeed, there has not been a complete audit of U.S. gold reserves in decades and the resistance to such an audit only raises suspicions that the gold may have long ago been sold, leased away or stolen. It is quite possible that China at this very moment holds greater gold reserves than the United States for the first time in modern history.

* * * *

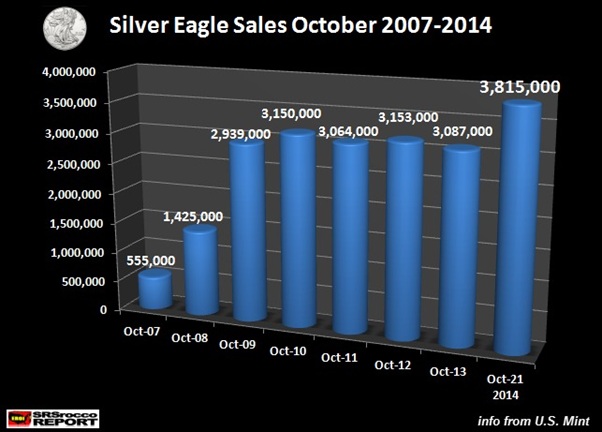

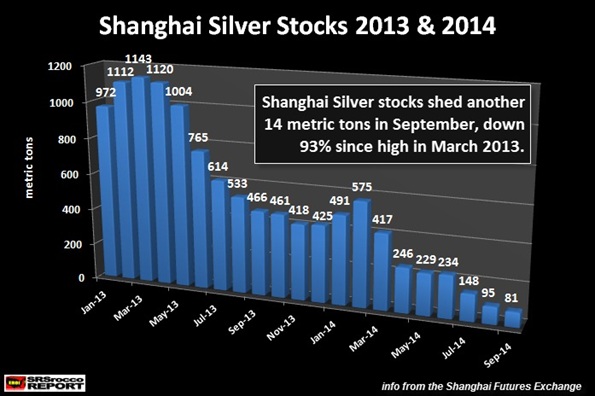

Silver demand has also been picking up lately. Investors took advantage of the dip in the silver price by purchasing a record amount of Silver Eagles in October. Sales of Silver Eagles this month will be one of the strongest in the year and the highest October on record. The following chart is courtesy of SRSrocco.com.

The Canadian Mint is also reporting an increase in demand for Silver Maples, which are on track to hit a new record in 2014. Depending on how robust silver coin sales are for the remainder of the year, we could see a new all-time record in the making for combined Eagle/Maple sliver coin sales.

Lastly, the Shanghai Gold exchange has seen inventory levels drop precipitously. Eastern investors are taking delivery and wiping out supplies available for sale. Where will the new supplies come from and how can the exchange restock without sending prices soaring higher?

It is difficult to reconcile rising demand for precious metals from both central banks and individual investors with a sharp drop in prices. Whether you point to deflation, a strong dollar, manipulation or other causes, the bottom line is that rising demand and flat to declining supply can not result in lower prices forever. Eventually, precious metals will become so undervalued that the investing public will rush in to buy up as much as they can. We have already seen premiums start to increase in recent months.

The precious metals market is so small that it would only take a few large buyers to soak up all available supply and push prices much higher. China, Russia and others are more likely to be purchasing in a slow and quiet manner as to allow time to continue accumulating at discounted prices. I say discounted because both gold and silver are trading at or near their respective all-in cost of production. But these conditions can not persist for much longer and the buying opportunity may soon be over.

This spike higher in gold and silver demand is occurring as precious metals are entering their highest seasonal period. After an unusually weak September, prices bounced back a bit in October and are now set for what is usually four months of strong gains.

While gold will often outperform during periods of economic crisis, I am increasing my allocation to silver. This is because the gold-to-silver ratio has climbed above 72 recently. This is the second highest level in the past decade, with the only higher period being at the depths of the financial crisis of 2008-2009. Perhaps silver is signaling that the stock market is about to collapse and the ratio will spike even higher. But eventually I expect the gold to silver ratio to drop back below 30. This suggests that silver is likely to outperform gold by a margin of at least 2 to 1 in the coming years.

If the inflation-adjusted price targets from John Williams are correct, gold needs to climb roughly 7X ($8,800) and silver 30X ($512) to match their previous highs from 1980. I have no idea when this might happen or what the world might look like when it does, but it gives context the upside potential in precious metals. Only time will tell, but my money says that investors will soon wish they had bought more silver under $20. We are likely to look back at this time period as one of the greatest buying opportunities that silver has ever presented.

What do you say dear readers? Are you buying at current prices or do you believe there is more downside ahead?