Gold: Another 2-way Intersection

December gold has arrived at another one of the tell-tale crossroads and will be forced to make a decision early this week as to whether to continue onward with its 2-day rally or reverse sharply beneath the combined weight of a 4-week line of supply in the daily chart and a parabolic dome in the tick chart.

You can see from the above gold futures daily chart the crossroads that gold has arrived at as it enters a new week. Friday's (Oct. 25) intraday high touched precisely the 1-month downtrend line we referred to in the previous paragraph. Gold will be under strong pressure from this trendline Monday morning but an early successful penetration of this line (above $314.20) would effectively break the immediate downtrend and lead to a continuation of last week's relief rally. The measuring implications of a trend line penetration point to a minimum upside target of $318.

The $318 level is also where the outer rim of a 2-month type parabolic dome will be met. Once gold penetrates its immediate downtrend line in the daily chart (see dashed line in the above chart), and once the parabolic dome is penetrated gold will have enough impetus from the underlying parabolic bowl in the daily chart to rally to anywhere from 33%-50% off its recent lows near $310. If realized that would mean an immediate-term upside target of $320.

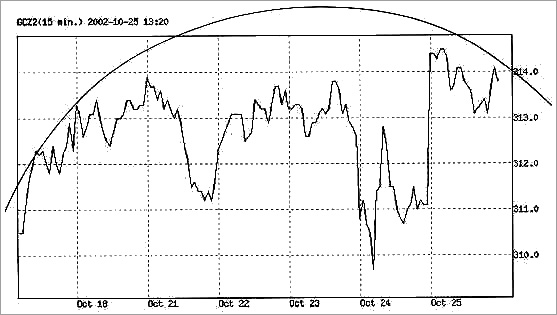

But first gold must overcome that strong overhead supply at $314.20. And while gold carries some momentum from Friday heading into Monday's trading session, the penetration will take a big exertion from the market to successfully penetrate the immediate supply. Note also the latest tick chart for December gold (below) which shows a parabolic dome immediately overhead at about the $314.20 area, coinciding with the above-mentioned trendline. If gold can pierce through this dome in early trading on Monday it will surely provide enough impetus for a rally up to the $318 area over the next couple of days. Failing to penetrate the dome/trendline, however, will mean a likely snap-back to $312-$313.