Gold Braves The Blues, Moves Higher Still

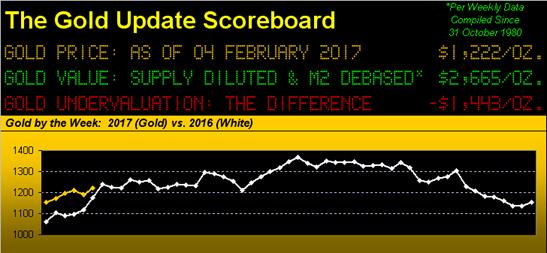

Six weeks into 2017, the above panel shows us Gold's being ahead of where 'twas over the same time frame in 2016, although the challenge of so staying appears dead ahead.

Still, you know you're sensing a serious commitment to the Gold market upon seeing it stay firm despite the dropping off of late by its "Baby Blues". For as shown below left across Gold's daily bars over the last three months, even with the falling blue dots being representative of the 21-day linear regression trend losing its upside consistency, price nonetheless is braving the blues by rising against their descending grain. And as for racy Sister Silver below right, the picture is similar, albeit her blues clearly must be equipped with Formula One-type carbon-fibre disc brakes, the falling dots there having stopped on a dime:

Better still, the ongoing swing back into Gold is keeping price on our anticipated track toward attacking at least the underside of the 1240-1280 resistance zone (the purple lines as next shown), the parabolic Long trend of the weekly bars continuing to unfold:

But as is their wont, our FinMedia friends are instead all again a-gaga as "The Dow" regains its five-digit milestone which begins with "2", the index itself +1.6% year-to-date. Nary a word 'bout the real leaders, (aka "The Precious Metals"), which one month plus three trading days into 2017 are leading the BEGOS Market Standings as we see here:

'Course our crony miner colleagues continue to crow over the leverage afforded them by their engaging in the metals equities, made evident by our year-over-year percentage track of comparably "sleepy old Gold" +6% versus those for GG (Goldcorp) +25%, FNV (Franco-Nevada) +37%, GDX (the prominent exchange-traded fund of the Gold miners) +52%, NEM (Newmont Mining) +57%, and SIL (the popular exchange-traded fund of the Silver miners) +98%! "Y'all here at the Circle K take stock certificates?"

'Course it helps when:

■ In leading the ugly dog contest, the almighty Dollar suddenly cowers back into its kennel, the Index posting a loss of -2.8% last month, indeed its worst January save for that of 1987 when the loss was -3.6%, (Gold going on to post a 20.2% gain for that year); and

■ The Federal Open Market Committee's policy statement issued last Wednesday being deemed as dovish, albeit if actually read, 'twas a bit different than what was reported it said, at least in our head, (Gold nevertheless applauding the FOMC's unanimous vote to stand pat); then again, perhaps they are finally giving our Economic Barometer some due:

"But mmb, we just had that blowout jobs number..."

Indeed so, Squire, and that it "purportedly" points to an improvement for the full-time payrolls side of the ledger, albeit growth of Hourly Earnings for January declined from +0.4% to +0.1%, suggestive of a part-time payrolls bias. But also, in just this past week, the Baro's incoming data recorded declines in the Chicago Purchasing Managers Index, Consumer Confidence, the Institute for Supply Management's Services reading, and actual shrinkage in Construction Spending. And with respect to the latter, should you happen to swerve by us here in San Francisco, skyscrapers are shooting up faster than dandelions, dwarfing the still-spreading population of street denizens. "For those of you sitting on the right, we've floor-to-ceiling glass structures rising 60 stories up into the fog, while over on the left, those occupied tents extend all the way along the next few blocks. Don't forget to grab a complementary box of our Handi Wipes as you get off the bus."

Meanwhile 'cross the pond, 'tis all being going from bland to grand, the EuroZone's economic confidence readings finding six-year highs astride growth pickups in gross domestic product, inflation and manufacturing. With presidential elections looming notably in France and Germany, 'tis curious to see this economic improvement, for 'tis similar to what we just saw StateSide in leading up to our own presidential election. (Who is that wizard behind the global economic curtain?)

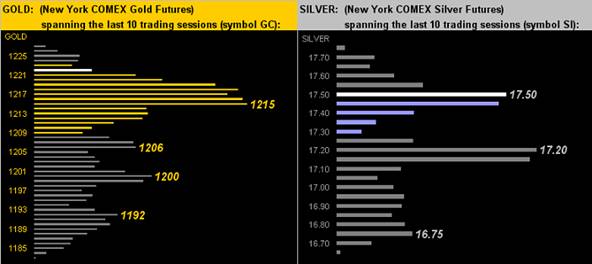

No wizardry needed here, as we've the traders who've created the following 10-day Market Profiles for both Gold (left) and Silver (right), the white bars being yesterday's (Friday's) respective closing levels of 1222 and 17.52, and the underlying support shelves at the most heavily-traded prices as labeled. Of note, when we've seen the metals toward the highest levels in their profiles, it oft seems a week hence that prices then have scampered back down; but the key of late is that the profiles themselves are pushing out to higher highs, both Gold and Silver having so done this past week in the young year-to-date:

So toward wrapping it up, this missive featuring our usual month-end graphics, we can't slink off to begin preparing for Sunday's Super Bowl without bringing up the Gold Structure's broad-based picture, the wee fellow down below clearly not understanding the Gold Story a wit:

In closing, with respect to America's aforementioned Big Game, (the results of which for you non-early bird website readers shall be in hindsight), we're hosting a few invitees here to feast upon our neighbourhood-reknowned "liquid hickory-smoked western bacon cheeseburgers with bacon." This fête having been in the planning stages for months, you thus can imagine the heart-stopping scare we endured upon NBC News reporting this past week on (in their words) the "aporkalypse" of a StateSide bacon shortage. Don't do this to me: my GOLD for a slab of applewood-smoked bacon! Well, maybe not: 'tis one thing to pig-out; 'tis quite another to maintain the means to so do. Or do both: pig-out on Gold!