The Gold Bull Era: Key Tactics Now

The thrill of victory and the agony of defeat. Gold investors focused on the Western markets and government debt fear trade tend to feel the same kinds of thrills and agony that professional athletes regularly experience.

Here’s a good example: For a few days, silver soars higher on what appears to be the guaranteed start of a long-term uptrend. Within days or just hours, the gains are suddenly gone, and the price appears to be going much lower with absolute certainty.

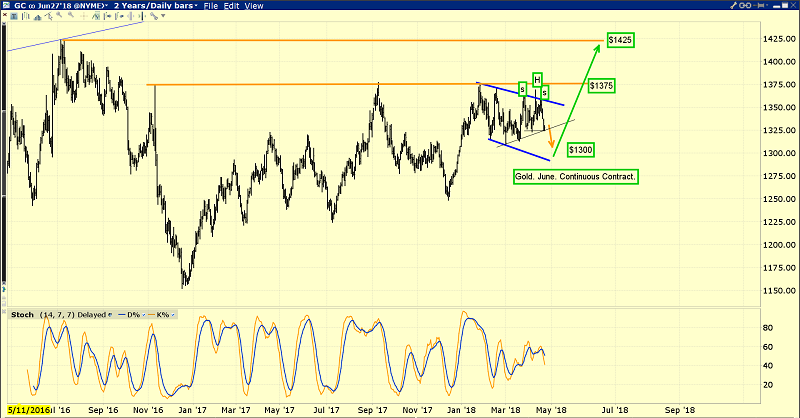

This is the positive-looking gold chart.

Bullion banks around the world arguably have the most effect on gold price discovery and they focus on physical supply versus demand.

Given that India’s gold-focused Akha Teej festival ended April 18, and Chinese jewellery demand is slightly soft (with dealer interest at $1320 - $1300), it’s clear that gold is not quite ready to surge above $1370 and begin a new era of sustained trading above $1400.

Also, some Fed speakers have hinted that the pace of Fed rate hikes could be slower than expected. At first glance, that would seem to be positive for gold, but fear trade price discovery is about how rates affect risk.

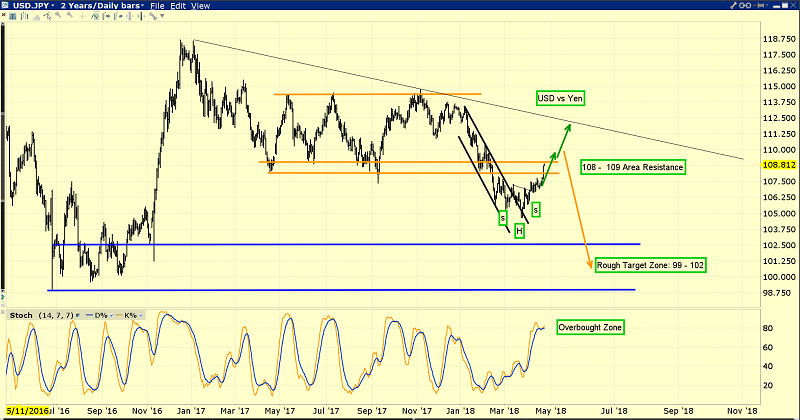

In the current environment, modest rate hikes support a “risk-on” theme. Here is a closer look at what I mean, on this US dollar versus yen chart.

Bank FOREX traders view the dollar as risk-on and the yen and gold as risk-off, and rightly so. Given the beyond-insane financial state of the government, aggressive rate hikes from the Fed put the government at serious risk of being able to finance itself. In that situation, the dollar falls against the yen and gold.

In the immediate time frame, money managers believe that Powell will hike rates very gradually. That incentivizes money managers to take risk and invest in the dollar, because it will pay a higher rate of interest without putting too much pressure on the government’s ability to make its principal and interest payments on its debt.

Gold peaked in February as Chinese New Year buying peaked. Now it’s made another modest peak as Akha Teej buying peaks, with Western money managers believing that the Fed cares about the US government’s debt problems. These money managers also believe the Fed cares about the stock market.

Under Greenspan, Bernanke, and Yellen, the Fed cared. I don’t believe Powell cares what the ramifications of his actions are for the “spendaholic” government or for the Wall Street vampires that require low rate policy for their stock market buyback programs.

This is the key bond market chart.

This chart tells me that the Fed is going to become vastly more aggressive with rate hikes and inflation is going much higher. The current price and time zone is the calm before that storm.

I expected Trump to launch tariffs, and he’s done that. Most investors are focused on whether the tariffs are good or bad for growth, rather than on the fact that they are inflationary.

I didn’t predict the sanctions that have been applied to Russia by the US government, although I’m not really surprised.

That’s because most of what all governments do involves the insane use of sticks much more than the sane use of carrots. Regardless, sanctions are here and they are inflationary. I view sanctions as nothing more than aggressive tariffs.

More are coming as governments (especially the US government) seek new sources of revenue to pay their debts as inflation and rates rise.

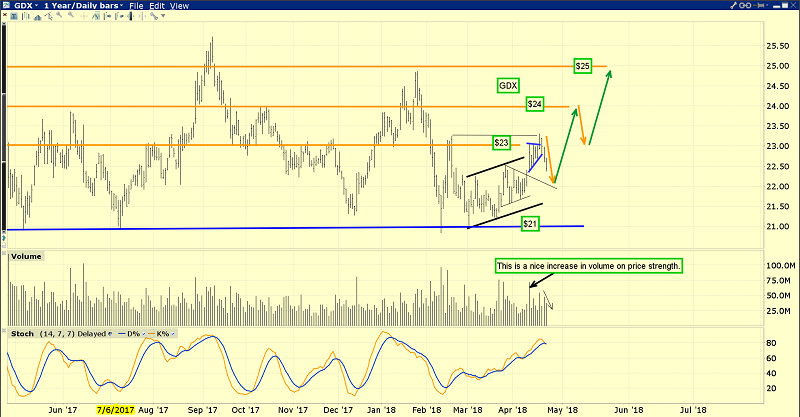

This is the GDX chart.

While many fear traders involved with gold stocks are nervous today, I don’t see anything to be concerned about. I suggested GDX would make a short-term peak at about $23.25 as Akha Teej demand peaked with the Fed in between rate hikes.

It’s done that and investors who have insured their “bull era ride” with GDX put options in that $23 area are now looking very good indeed. Some of these options rose 15% just in yesterday’s trading. The bottom line: Insurance works, whether it is home, auto, or price insurance for gold stocks.

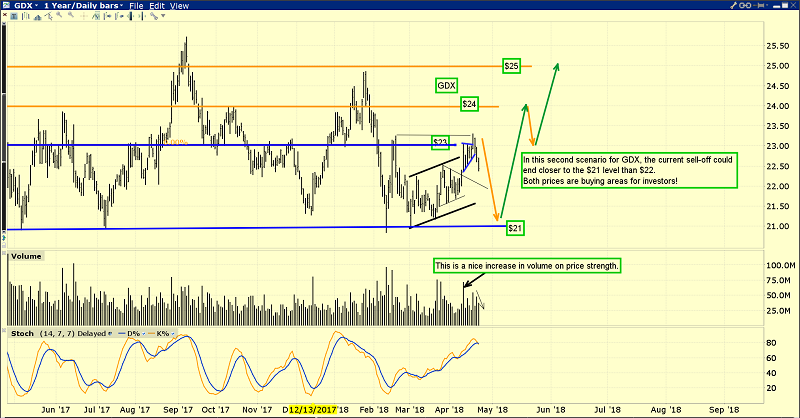

I have two short term scenarios for GDX. The first involves the current pullback ending in the $22 area, and the second one shown here has the pullback end at around $21. Put options enthusiasts and those carrying a short position in GDX against their portfolio of individual miners could cover off half the puts at around $22 and the rest near $21.

As with gold and silver bullion, I have no concerns at all about the current price action in gold stocks. Most have staged huge rallies recently and many are above their February highs. A pullback is normal and expected as major Chindian festival demand peaks at a time when the Fed is in between major policy action.

Chindian income growth versus limited mine supply is the main driver of higher gold prices for the long term. There are no “upside breakouts” in that process. It’s ongoing and relentless. The inflationary policies of the debt-plagued US government and the Fed’s increasingly aggressive QT and rate hikes in response to that will generate significant institutional interest in gold stocks as gold trades above $1400.

All the fundamentals are in place to create significant inflation and debt financing problems for the West. They are also in place to create significant income growth in the East for a long period of time. The only thing that astute investors need to build sustained and significant wealth in the coming gold bull era is a very modest amount of patience and rational thought. It’s the greatest time in history to be invested in the precious metals asset class, and getting greater by the day!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Golden Bull Era Titans” report. In this report I suggest a portfolio of “reserve and resource monsters”. The big money in gold stocks is going to be made by the players with the biggest deposits that can be mined for the longest amount of time, because the gold price is going to trade far above the cost of mining for a long time. I highlight the potential champions as this theme develops, with suggested tactical action for enthusiastic investors!

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

https://www.gracelandupdates.com

Email:

Rate Sheet (us funds):

Lifetime: $999

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: