Gold Bull Market vs Gold Bull Era

I’m getting a lot of emails to do more macro analysis of the gold market, and the time is ripe to do so.

“We need to continue to push for long-term capital inflows and therefore the FDI policy has to undergo a revamp…. We need to move in this direction quickly and it needs to be a paradigm shift in how we look at FDI.” –Arvind Mayaram, Economic Affairs Secretary of India, June 17, 2013, Bloomberg News.

FDI refers to “foreign direct investment in India”. The Indian government charges an 8% duty on gold that is imported into the country. There is also a 4% sales tax.

In the short term, the Indian government is applying a lot of pressure to its gold-loving citizens, but they are also working quickly to dramatically increase foreign investment in the country. I’m 99% sure that once FDI increases, exports will boom, the rupee will stabilize, and the government will reduce the import duties on gold.

Also, Indian gold dealers have tremendous experience handling situations like this. They are already working feverishly with partners in Dubai. Indian gold dealers are not shrinking their operations. They are expanding them, both at home, and abroad.

“An 8 per cent duty on gold import plus 4 per cent sales tax on gold purchases has made huge price difference between India and the UAE. There is 12 per cent difference in the cost of buying gold from the UAE and India. Hence more and more Indian jewellers will be setting up shop here. We are already positioned in this market, but others are likely to follow suit,” - Sham Lal, Managing Director, Malabar Gold and Diamond, Emirates 24/7 News, June 18, 2013.

More than 20% of the world’s gold already flows through Dubai. Volume is increasing, and Indian gold dealers are expanding their operations there.

Even Societe General (SOGEN), the most bearish of the Western bullion banks, believes that demand for gold jewellery will increase strongly.

April 12, 2013 was the beginning of a two day “super-crash” in the gold market. In my professional opinion, the gold bull market ended on that day.

The world changed on April 12, 2013, because the Western gold bull market ended, and the Asian gold bull era began. With all due respect to the Western gold community, it’s probably time to face the music. On April 12, 2013, the sun began to set on the relevance of the West to the POYG (price of your gold).

I’m personally planning to boycott the FOMC minutes release on Wednesday. I invite others in the Western gold community to join me. If nobody in Chindia (China & India) cares about Ben Bernanke’s relevance to the POYG, should you care? I don’t think so, and I mean that purely from a wealth-building standpoint.

Fundamental events in the West, like speeches from Ben Bernanke, will continue to move the POYG, to a degree. Traders can attempt to capitalize on those moves, but intermediate and long term investors should focus on the Asian gold bull era. In the gold market, Asian citizens have certainly “got your back”.

Chinese paper gold markets are beginning to take shape nicely, and the fund managers expect capital inflows toincrease on price drops. The decline of the Western paper gold markets is probably a good thing, because when gold falls in price, those weak markets see capital outflows.

Asian paper markets will be vastly superior entities, and I expect them to quickly overwhelm Western paper gold markets, in both size and power.

India is likely to soon see a new boom in exports, as the US economy continues to strengthen modestly. Every day, more Indians come off the farms into the cities. Every person in India wants to buy gold regularly. It’s just a question of whether they can afford to buy it. In the big picture, Indian gold demand is driven not by economic booms or busts. It’s driven by the ongoing exodus from the farms to the cities, and that has barely started.

As the standard of living increases in India, gold demand will increase accordingly. A decline in the gold price will trigger more buying, but a rise in price will still see Indians buy huge amounts of gold.

The Indian government doesn’t want to see a dramatically lower gold price, because that would cause a huge surge of buying by Indian citizens, putting greater pressure on the current account deficit. The bullion banks need to be careful in how they handle the current situation. Both the Chinese and Indian central banks could threaten to overwhelm comex selling with their buying, if there are further “attacks” on the gold price there.

If you believe that the world changed, on April 12, 2013, a relatively minor $100 price drop is not something to be afraid of.

The West owns very little gold now, so the ability of Western investors to drive the price a lot lower, is highly questionable. Also, the power of Asian media is something that the gold bears may be underestimating. My main sources of news are mostly Asian, and websites like “China Daily”, are beginning to get a following in the West.

China Daily’s site is growing fast. It reputedly has 500 million users. There’s also a US edition. Asian media is generally pro-gold, while Western media seems to feature a lot of “gold-haters”. People like Nouriel Roubini are arguably making themselves look ridiculous and ant-sized, with their angry gold-bashing.

I hope this update puts a shimmer on your gold, and takes you away from a lot of the unwarranted negativity that surrounds the mightiest metal.

Let’s take a look at the charts now, and see if they support my macro analysis. That’s the daily gold chart, and you can see that my stokeillator is on a light sell signal. Gold has broken down from a tiny triangle, likely because Western traders are betting that the Fed makes a statement that is negative for gold. I don’t see anything on that chart that gold investors need to be overly-concerned about.

That’s the monthly chart for gold. Note the “buy box” between $1266 - $1155. The two blue arrows highlight the congestion pattern that created this key HSR (horizontal support & resistance) zone. SOGEN’s technical analysts predict that gold will fall to $1200. I predict that I’ll buy it there, and so should the Western gold community, if it happens. I’m not so sure that much lower prices will happen. Note the action of the 4,8,9 series MACD green histograms. They’ve started to turn up, which is bullish.

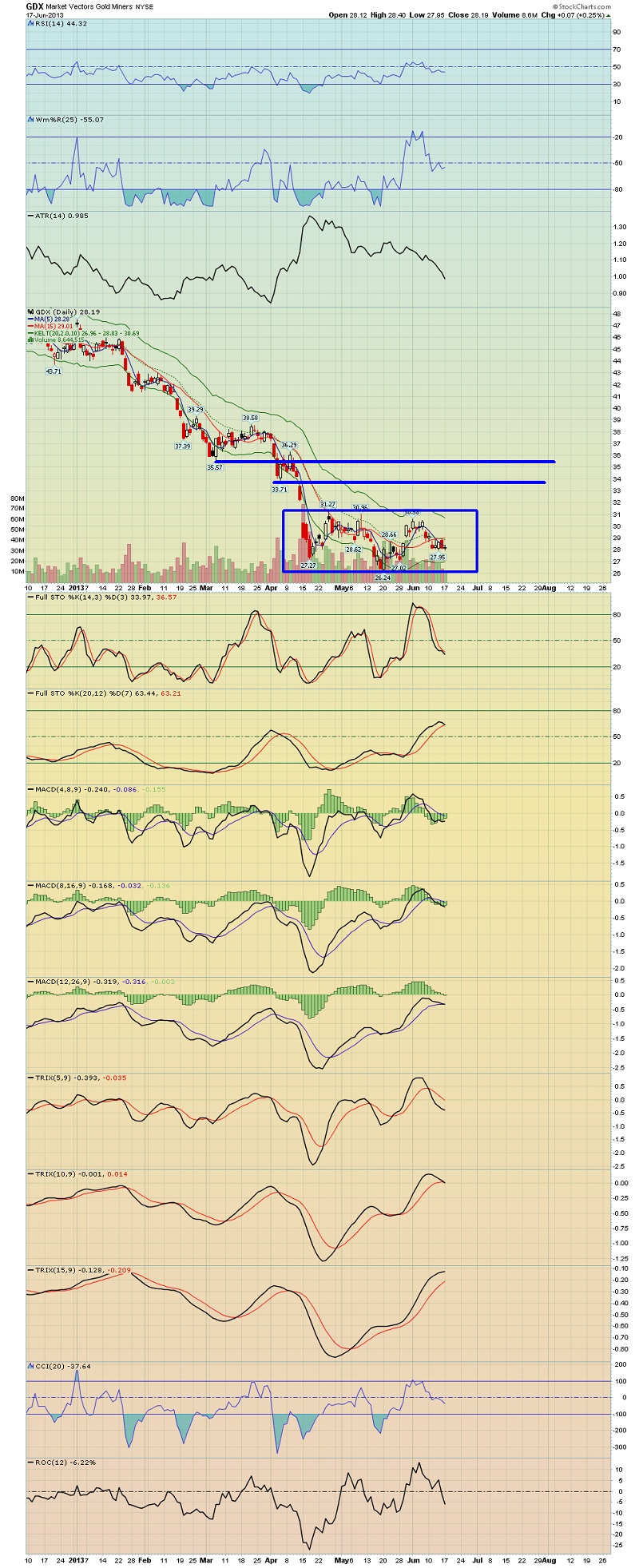

That’s the GDX daily chart. A lot of technicians believe there is a head & shoulders bottom in play, but it may be just a shape, rather than an actual chart pattern. Regardless, there is definitely serious resistance where these technicians have drawn the neckline, which is in the $30.50-$31.27 area. Asia will need your miners to get them more gold than they are currently mining, in the coming years. Technically, GDX could fall to $22 as easily as it could rise to $35. In the longer term, the gold bull era probably began on April 12, 2013. Asians don’t hate mining stocks. Give them time to prove it!

Special Offer For Gold-Eagle readers: Send me an Email to [email protected] and I’ll send you my free SRT report. Silver ratio traders need to be on the alert now. I’ll cover the basic rules of ratio trading for you! Also, while gold has really gone nowhere over the past 6 weeks or so, my long-only GUTrader intraday gold trading service has booked about $165 an ounce in trading profits. All trades are closed out by 5pm each day. If you’re a gambler that likes intraday action, send me an email to [email protected], and I’ll send you the details of this email-based trading service. Thanks.

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson” Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualifed investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: