Gold Cycle Analysis Update

Note: Both the Gold and Silver markets keep traders on their toes by producing fake or false moves occasionally. They present enough evidence that price will move a certain direction only to reverse after several investors were committed to a definite direction. It is difficult but critical to exercise patience and stick to a particular set of trading/investing rules.

Click here for a 14-day Free Trial to our Basic Newsletter service

News

Tomorrow, the February Nonfarm payroll numbers will be released at 08:30, there may be volatility before and after its release. Usually by mid-day markets calm down, and direction can be determined.

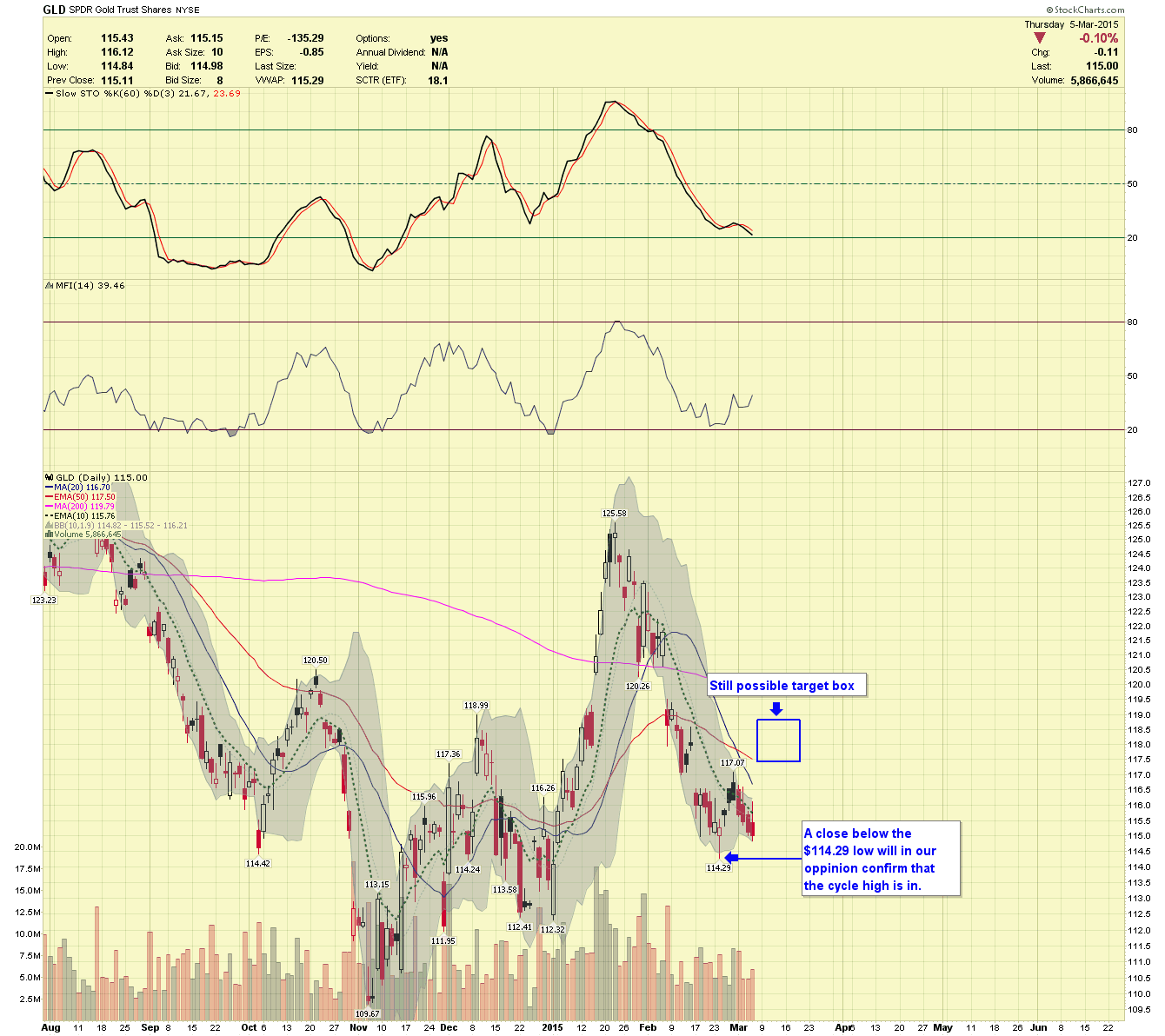

GLD Daily Chart

There was a move higher in the morning today that was immediately reversed. Gold will have to close below $1,190 to confirm a cycle high is in place. There may be wild swings in either direction, but the closing price is what matters. We could see a c-wave move higher into the target box or a swift move lower, confirming a cycle high. It is still a coin flip at this point, and as stated on Tuesday, there currently is no edge to be positioned in either direction. If price approaches the target box, the (EP) will take a position.

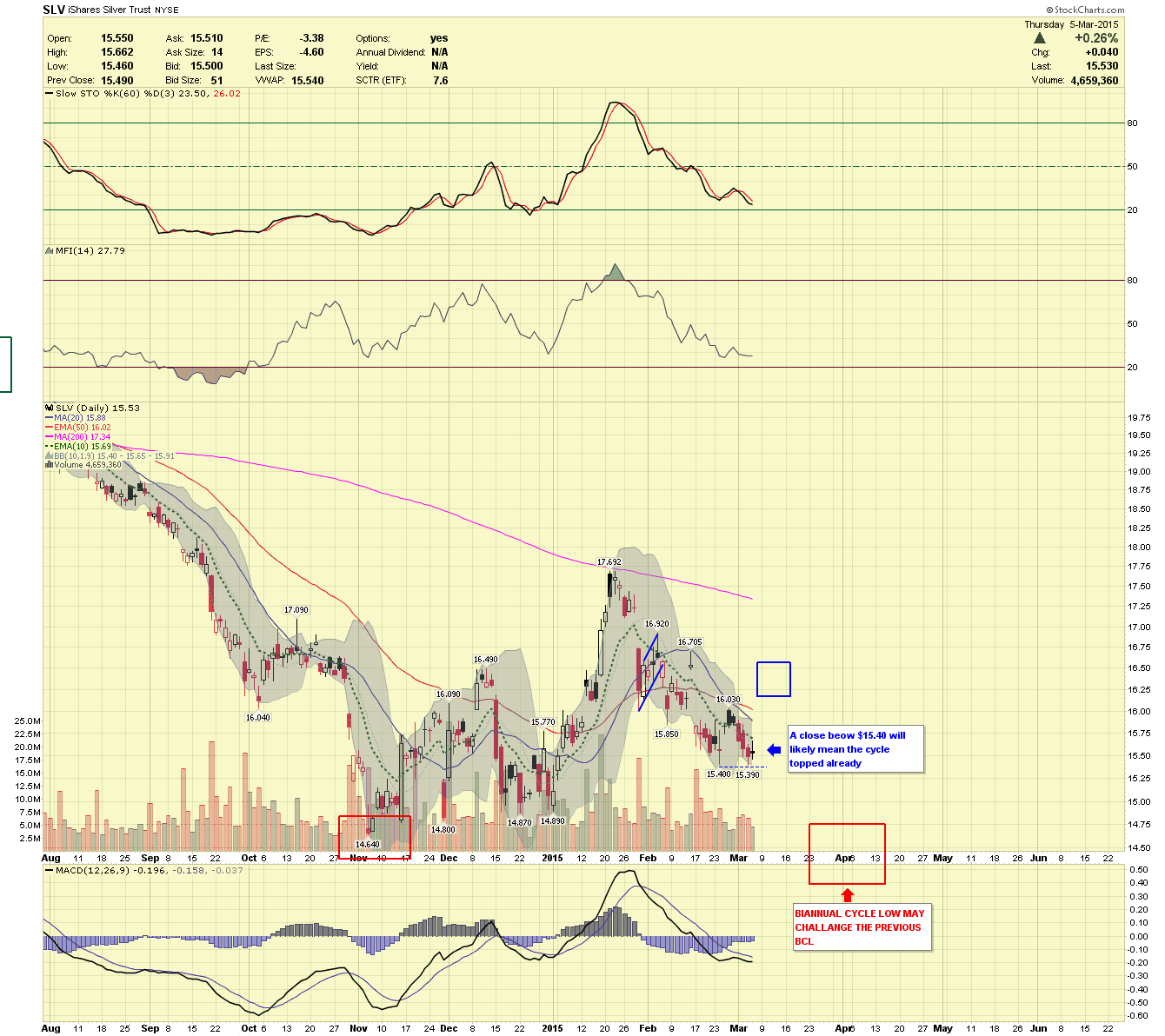

SLV Daily Chart

As with GLD there could be a quick move higher into the target box area or the cycle high has already been made, which will be confirmed by a close below $15.40. Like with GLD we see no distinct edge at this time, the action tomorrow will likely deliver the information needed in determining an actual market direction.

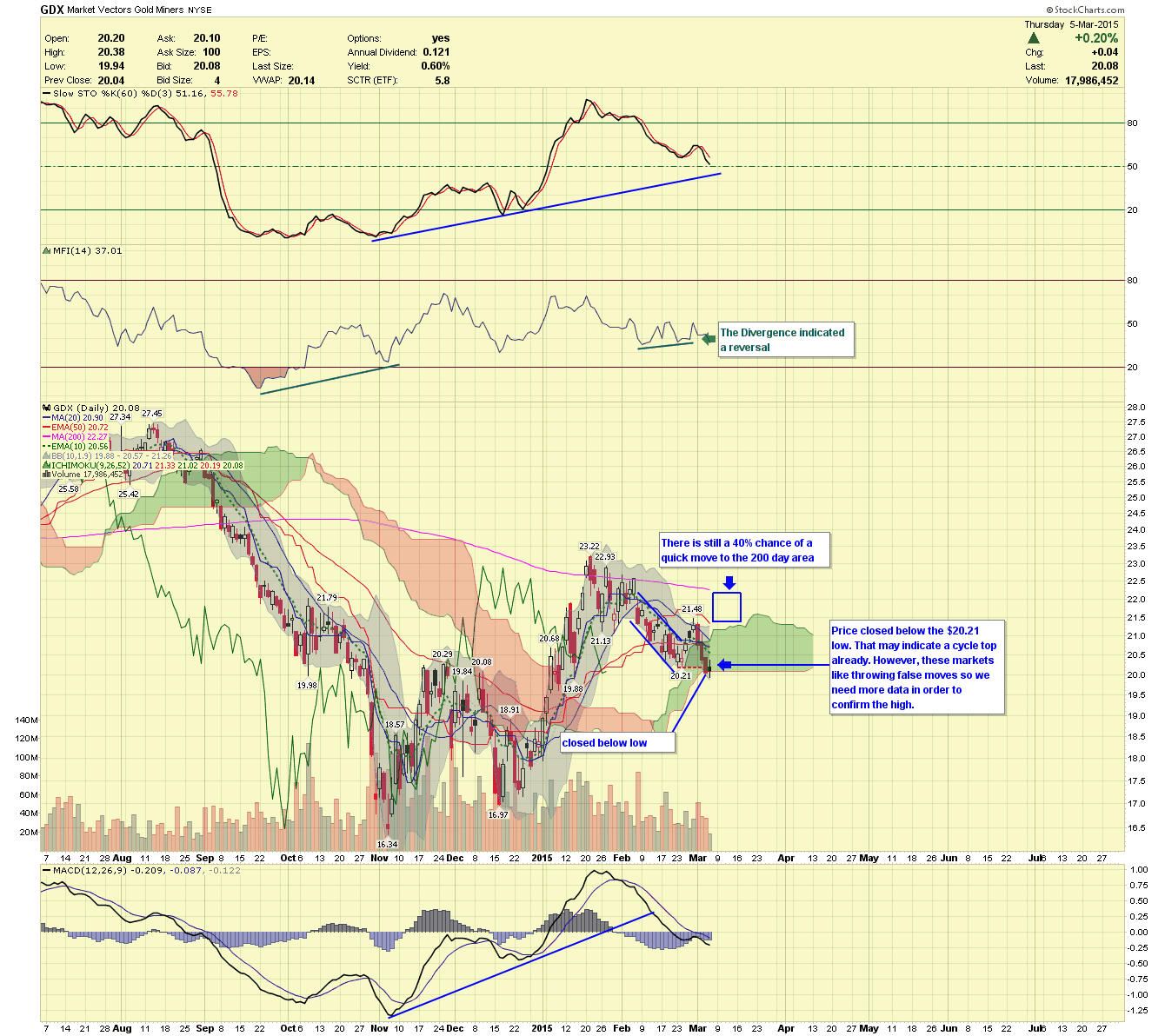

GDX Daily Chart

Price closed yesterday below the previous cycle low. Often GDX will lead the precious metals in direction, meaning GDX may have tipped its hand by closing below that low yesterday. Regardless, after running multiple scenarios, the (EP) was unable to find a risk/reward profile favorable to today’s circumstances. After tomorrow, we will run them again, and we are expecting to find one or two decent trade setups.

GDXJ Daily Chart

Price has had two consecutive closes below the previous $25.35 low. It is showing relative weakness to GDX but could move higher quickly like GDX. The overall chart looks more bearish to us, placing some evidence into the “top is in camp” but we can’t confirm anything until the closing data tomorrow.

Tomorrow may be a very exciting day, if need be we will release updates as necessary.