Gold, Dollar and the Yield Curve

Introduction

My last article was titled "the good, the bad, and the ugly". It was about gold, the dollar, and the Euro. The article stirred up a lot of interests, and I have received a great deal of emails, from average folks and from academics. There are many opinions and theories offered by the experts as to the inter- market relationship between gold and the dollar, and it is not my intention to involve in such a debate, simply because I am not smart enough, not to mention it gives me headaches if I spend too much time dwelling on the subject. What was interesting though, was a self proclaimed economist, asking me why it was that I thought gold and the dollar could rise together. I don't know why, I'm just telling what I see, I can guess I suppose, like everyone else. Obviously this economist is not believing what he sees, that is why he is an economist. He also mentioned inflation and deflation, disinflation and hyper-inflation, ouch, my head is hurting already…..

Just because I see something, doesn't mean it is visible to others. And by sharing my findings with others, and reading others' findings, we become more objective and learn from one another.

Today's article is a follow up.

The yield curve

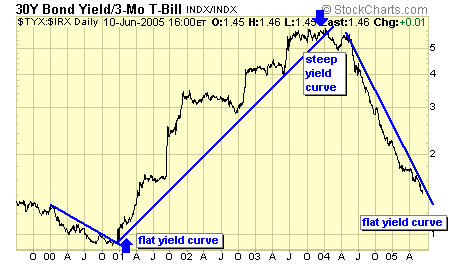

To me, the most important factor driving the financial markets is interest rates. The cycles of rising and falling rates affect every aspect of business, and the cost of doing business. But what is more important to me, is the yield spread. Specifically, the yield spread between the 30 year bond and the 3 month T bill. I'm sure most folks are familiar with the term "carry trade". That is the term to describe taking advantage of the difference between the long and short term interest rates. When the spread is wide, we have a steep yield curve, by borrowing short and lending long, the carry trade makes a killing. But when the spread narrows, we have a flat yield curve, and there is little or no money in the carry trade.

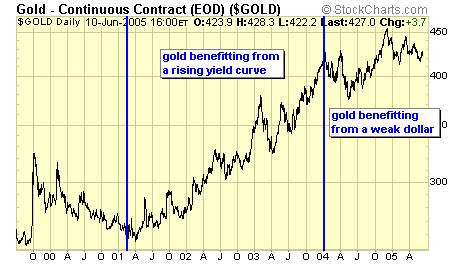

Here we see the yield curve began to rise in 2001, to late 2003, then dropped like a rock since. This is the direct result of the Feds lowering short term rates from a series of events beginning with the tech crash and then 9/11, and as short rates fell at a rate faster than long rates, the yield curve steepened. Then the Feds began to tighten by bumping up short rates, with long rates still falling, it didn't take long for the yield curve to flatten again. We have heard just recently a rumor that some large hedge funds might have been in trouble due to their heavy exposure in the carry trade, enough to give the market a quick hiccup. Hedge funds obviously benefit from a rising yield curve, and so does gold.

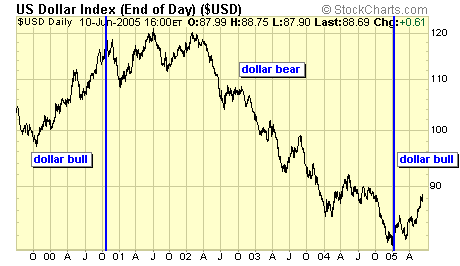

There is no question that the steepening yield curve has helped the rise in bullion from the bottom of 2001, but the collapse in the yield spread did not send gold back into a bear market, why? When we talk about the price of gold (POG), we are talking in terms of US dollar. Therefore, the weakness in the dollar was enough to keep gold in a holding pattern since 2004, the price practically unchanged from Jan 2004 to today, well in the middle of a trading range between $380 and $450 US.

As my previous article suggested, the dollar is now in a bull market, then why is gold not falling? My speculation is that market makers are already expecting the yield curve to rise once again. This can be achieved by either lower short rates, or rising long rates, or a bit of both. As to why, I'll leave it to the economists. Therefore, from my technical perspective, I see the possibility of the dollar and gold rising together. The strengthening of the dollar is more influenced by foreign currencies than interest rates.

Foreign currencies have an inverse relationship with the dollar, simple as that.

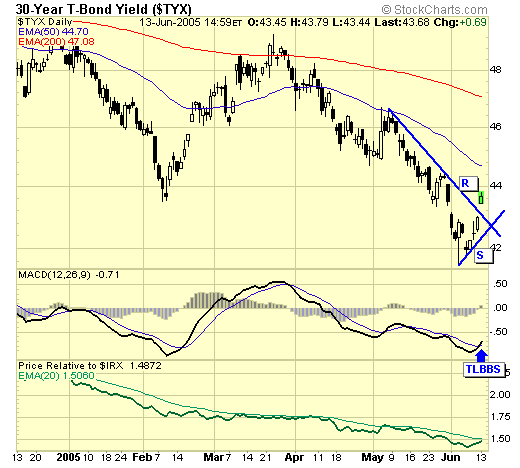

This article was written on June 12, but I have to wait until market close on June 13, to confirm the last piece of the puzzle.

$TYX - the long bond yield indeed broke out for a buy signal today as expected, therefore confirming what market players were anticipating : the bottom of long rates. And if long rates rise faster than short rates, the yield curve steepens once again and the carry trade can breathe a sigh of relief, and that is why gold and the dollar are rising together.

Summary

Inter-market relationship is very intricate, and like all markets, are subject to constant change, and therefore, does not need to be predicted or forecasted, just followed. What is promising though if you are a gold bull, is that the combination of a steepening yield curve and a rising dollar could be very beneficial to the POG. A steepening yield curve is the main ingredient, and a rising dollar means falling Euro and most other foreign currencies; and when the foreign currencies fall, the POG in these falling currencies will rise. That is when finally the POG rises against all currencies, and that is when gold will finally be in a real bull market, a global gold bull market, not just a US gold bull market as it has been the past four years.

Remember, analysis is nothing more than an educated guess, do not trade based on anyone's analysis, trade only according to price action.

Jack Chan at www.traderscorporation.com

16 June 2005