Gold ETFs Hit A 7-Year High

Strengths

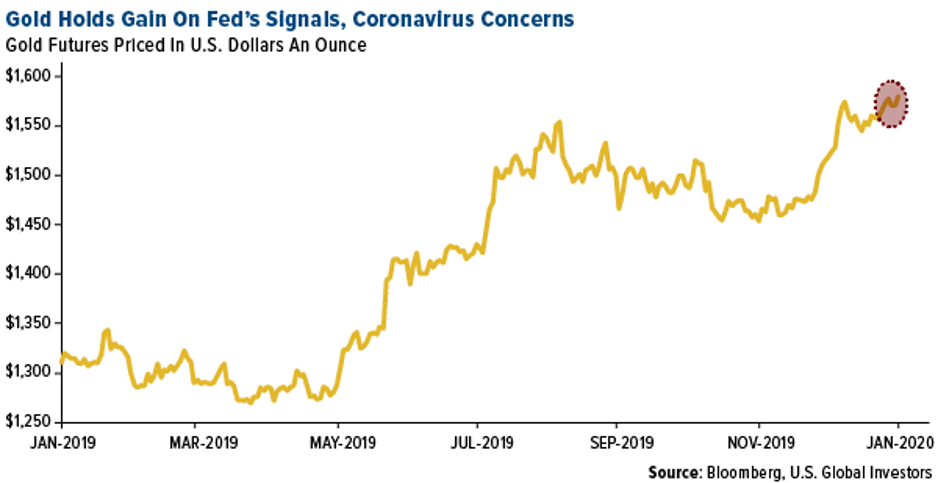

- The best performing metal this week was gold, up 1.12 percent. The majority of gold traders and analysts were bullish in the weekly Bloomberg survey as concerns mount regarding the coronavirus spreading out of China. The yellow metal had a second monthly gain as investors flock to safe havens amid the global health emergency. China’s gold imports rose in December to the highest level since April, according to customs data. Total imports of non-monetary gold rose to 146,758 kilograms.

- Gold ETFs hit a seven-year high this week and it’s not just because fears of the coronavirus spreading. Bloomberg’s Ranjeetha Pakiam writes that gold has been in favor because the Fed had signaled interest rates are likely to remain low for some time. With real rates negative, it cuts the opportunity cost of holding gold. Bullion is historically lower after Chinese New Year when buying spikes before celebrations, but it might skip that seasonal lull this year.

- Saudi Arabia is set to pass a new mining law that will improve clarity and security for investors and include incentives, reports Bloomberg. The diamond industry has shown a glimmer of hope. De Beers reported that diamond sales jumped in January after a horrible 2019. Anglo American Plc said its unit sold $545 million of diamonds in its first sale of the year. AngloGold Ashanti Ltd reopened the century-old Obuasi gold mine in southern Ghana after operations were halted in 2016.

Weaknesses

- The worst performing metal this week was palladium, down 5.71 percent as hedge funds cut their net bullish view to a 16-month low. According to the World Gold Council (WGC), purchases of gold jewelry, bars and coins fell by 11 percent last year. However, most of that drop was offset by strong central bank and ETF buying. Total gold demand fell just 1 percent from 2018. The WGC also expects gold demand in India to slowly recover in 2020, with demand in the first half of the year likely not showing any significant growth. This follows the worst year for demand out of India in three years amid high bullion prices. Standard Chartered Bank’s Suki Cooper notes that gold jewelry sales out of China could take a hit from the coronavirus, just as it dropped following the SARS outbreak in 2003.

- According to data from the National Association of Realtors, pending home sales unexpectedly decreased by 4.9 percent in December from the prior month. Norilsk Nickel, the world’s biggest palladium miner, said a bubble has been created and that it’s bad for the industry. The company plans to ease market tightness by shifting sales to more investment-grade bars, instead of the powdered form used by industrial consumers, reports Bloomberg.

- Newcrest Mining said that production at its flagship Cadia operation in New South Wales, Australia could be impacted by the end of this year if the crippling drought continues in the region. The area has seen record low rainfall for the past two years.

Opportunities

- Heraeus, a palladium refiner, said that the palladium market should remain in a deficit of more than 500,000 ounces in 2020 due to stricter emission legislation boosting demand for use in autos. Bank of America sees rhodium peaking at a record $12,000 an ounce this year and averaging $10,500. Bloomberg’s Sungwoo Park writes that silver may resume its rally as a cheaper alternative to gold. Park notes that silver is still trading 64 percent below its all-time high, while gold is trading just 18 percent lower than its record, which means silver should benefit disproportionatly from any sustained flight to safety.

- Sibanye could finally pay a dividend for the first time in three years this August. The gold miner acquired Stillwater Mining Co. three years ago and critics said it overpaid for the palladium producer. However, the $2.2 billion investment could now pay off, reports Bloomberg. CEO Neal Froneman said in an interview that the company has almost entirely been de-risked. “I don’t want to be so bold as to say I told you so.”

- Nano One Materials announced that it has arranged a private placement for gross proceeds of up to $5 million that will be used for fast tracking testing and co-development activities including those with existing collaborators Volkswagen, Pulead and Saint-Gobain. The company said in a press release that the placement “positions us very well to execute on our business plan.” Nano One has developed patented technology for the low-cost production of high performance lithium ion battery cathode materials used in electric vehicles, energy storage and consumer electronics. Roxgold announced an increase of 7 percent increase in mineral resources at its Seguela Gold Project in Cote d’Ivoire.

Threats

- According to research released by the Harvard Joint Center for Housing Studies, the U.S. housing crisis is making its way to the heartland of the nation. Bloomberg reports that the study showed from 2011 to 2018, the proportion of households making $30,000 to $45,000 a year that were “cost-burdened” on rent rose the most in metros including Nashville, Greenville, McAllen and Austin. The data highlights the harsh reality of a decade-long expansion where there are fewer and fewer places to go for people who don’t make big salaries. The report also showed that about 48 percent of all renters were cost burdened in 2018.

- Two of the biggest gold miners are taking different approaches to making shareholders happy. Newmont is focusing on high dividends and improving operations at some of the mines it acquired in its deal for GoldCorp, while Barrick is looking at expanding its copper holdings, which has some shareholders concerned. Barrick has outperformed Newmont in the time since both of their megamergers; however, it will be interesting to see which takes the lead with these different investment strategies.

Bloomberg’s Edward Bolingbroke reports that participants in the eurodollar market have been ponying up cash to buy options that hedge against the Federal Reserve cutting benchmark rates to zero, should a “doomsday” economic scenario occur in the next year. The gap between the yield on three-month and 10-year Treasuries inverted this week, which many see as a warning signing as it inverted before each of the past seven U.S. recessions.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of