Gold Forecast – Fiscal Crisis and the Next Great Depression by 2030

In a recent interview, renowned investor Stanley Druckenmiller explained why he sees the potential for a financial crisis centered around 2030. His timing perfectly aligns with ITR economics prediction for the next great depression. Below are some highlights from his May keynote speech as USC.

In a recent interview, renowned investor Stanley Druckenmiller explained why he sees the potential for a financial crisis centered around 2030. His timing perfectly aligns with ITR economics prediction for the next great depression. Below are some highlights from his May keynote speech as USC.

The Rise of Entitlements

Fiscal spending on older adults has grown dramatically since the 1960s. Nealy 40% of all taxes are spent on seniors, and that trend is just starting. In 25 years, it will hit 70%.

Today, the U.S. spends 600% more on social security and entitlements than they do on children. The current $31 trillion in U.S. debt doesn't include future spending. If you incorporate unfunded liabilities - it's over $200 trillion.

Demographics

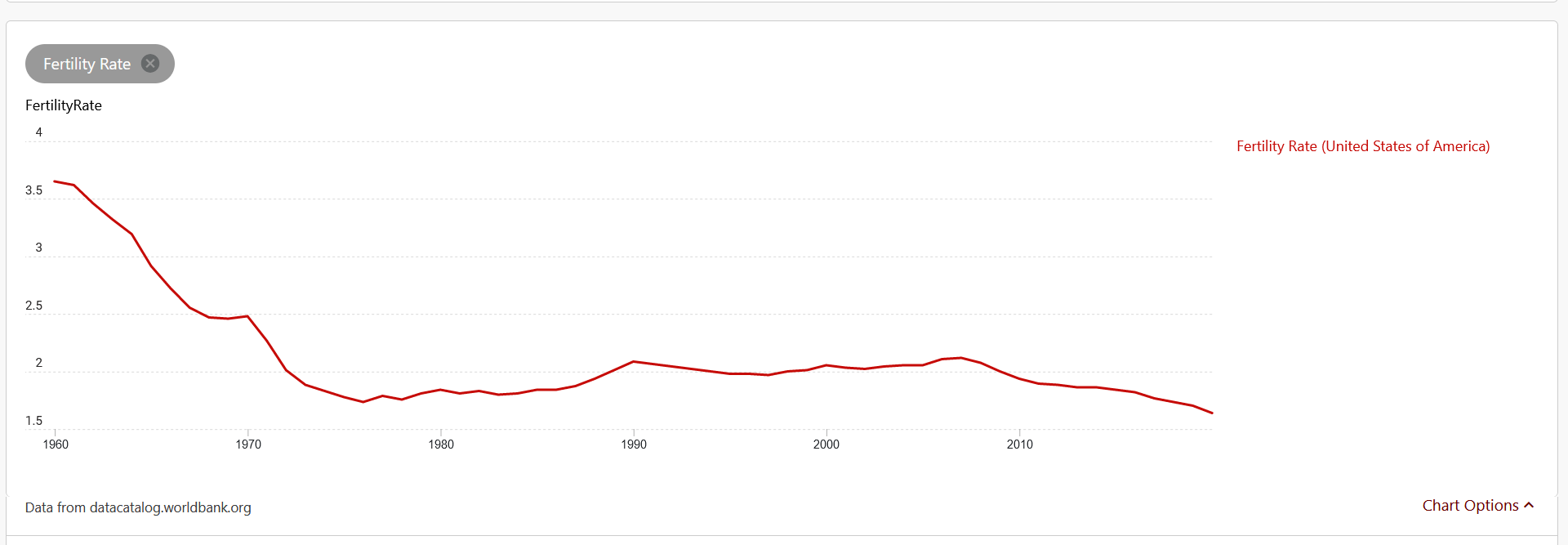

The birth rate in the U.S. peaked in 1957 at 3.7 and has fallen to 1.64 as of 2020. Because seniors are living much longer, we have an inverted pyramid where far more receive benefits than pay. We are just now entering the consequences of the baby boom generation.

According to the Congressional Budget Office (CBO), healthcare spending, social security, and debt interest account for 68% of all tax revenue. By 2040 it will reach 100%, and 117% by 2052. It's important to note that this data assumes a modest 4% interest rate.

Fiscal Gap

The fiscal gap required to fund these programs is 7.7% of GDP. That means to maintain this level of spending, the government would have to increase taxes by 40% or cut spending by 30%. Not just for a few years but forever.

To put this in perspective, France has a fiscal gap of 2.4%, less than a third of ours, and they are the poster child of a social welfare state. President Macron understood the urgency and raised the retirement age to 64 from 62. Meanwhile, the U.S. does nothing, making matters worse.

The outlook painted by Mr. Druckenmiller was indeed grim. He also believes that the DOW won't be much higher a decade from now than it is today. With a record of earning 30% compounded annually for 30 years, it's probably wise to take him seriously.

Inflation Update

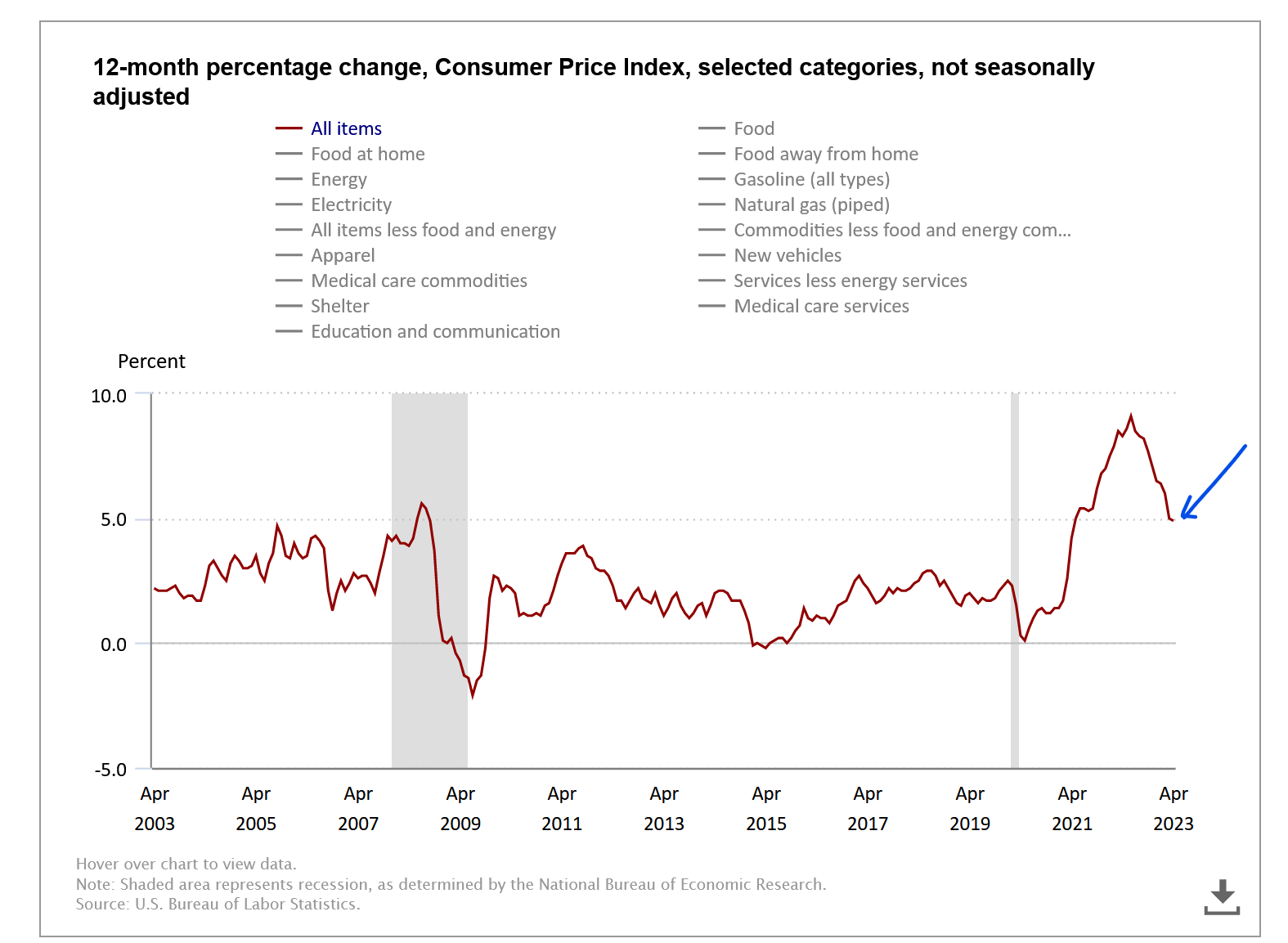

Month-over-month CPI for April came in as expected at 0.4%, causing the annual inflation rate to slip to 4.9% – the lowest level in 2 years. With massive numbers due to roll off over the next two months, I expect CPI to hit 3.7% by mid-year.

source: https://www.bls.gov/charts/consumer-price-index/consumer-price-index-by-...

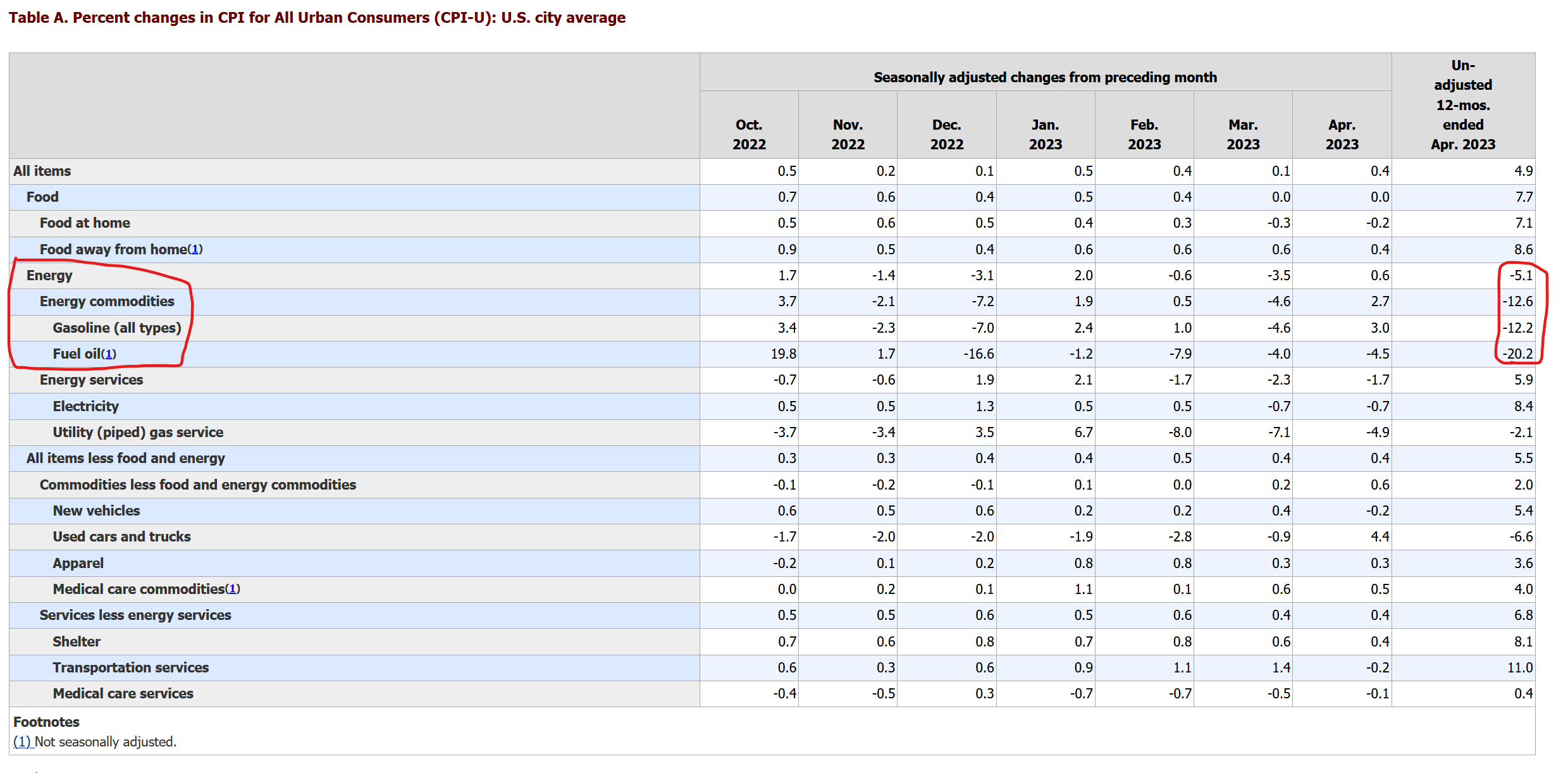

Breaking down each category; we see deflationary pressures across the energy complex. Forecasting energy demand heading into a recession is difficult, but underlying supply issues could keep fuel prices higher than expected, re-igniting inflation in the second half.

source: https://www.bls.gov/news.release/cpi.nr0.htm

Silver Supply

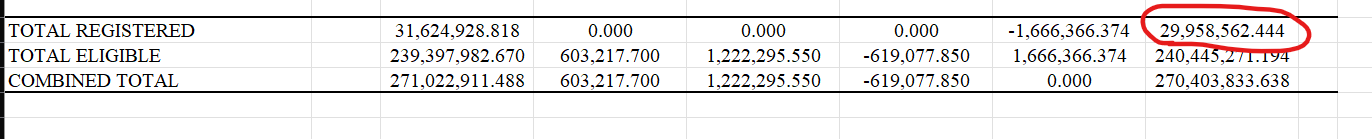

The total registered silver inventory at the Comex slipped below 30 million ounces. In a recent interview, Jim Puplava (clip below) explained how there are 26 times more paper contracts trading on the Comex than physical. Ultimately, he believes this could lead to a short squeeze.

source: https://www.cmegroup.com/clearing/operations-and-deliveries/nymex-delive...

Quick Metals Update

-GOLD- Gold slipped, and prices are consolidating. They could trade sideways to lower for a few more weeks. The next cycle low is due around the June 14th Fed meeting.

-SILVER- Silver fell 4.81% and closed just above the 50-day EMA. I still see significant support around the $24.00 level. Prices could dip further, but I wouldn't discount the possibility of a short squeeze emerging as Comex inventories fall.

-PLATINUM- Platinum needs to close above the April $1148.90 high to register a potential breakout. Physical platinum is also in short supply, and I wouldn't be surprised to see a short squeeze at some point.

There have only been 880,500 1-ounce Platinum eagles minted by the U.S. Mint since 1997 (26 years). To put this in perspective, 1,115,500 1-ounce gold eagles were minted just in 2021.

Takeaway

The entitlement reckoning is unavoidable, and a dollar devaluation is the most logical outcome. Demand for hard assets like precious metals will soar as this becomes evident to the masses. Expect shortages in commodities, especially silver and perhaps platinum. The prepared investor will preserve wealth and prosper during the next great depression.

********