Gold Forecast – Spreading Bank Failures Could Send Gold Soaring

Silicon Valley Bank (SVB) collapsed after experiencing an old-fashioned bank run.

It started Wednesday when the bank tried to raise $2.25 billion in equity to shore up its balance sheet.

Customers panicked and withdrew a staggering $42 billion - making them insolvent.

The FDIC took over operations Friday, and SVB became the second-largest bank failure in US history.

What Happened?

From what I can gather, Silicon Valley Bank didn't do anything wrong. They were flush with cash in 2020 and 2021 from covid stimulus, and they used some of their customer deposits to buy Ginnie Mae mortgage-backed securities (MBS). Regulators consider such debt risk-free and didn't require the bank to maintain reserves. It turns out that SVB was over-concentrated in extremely low-yielding MBS and didn't hedge for interest rate risk.

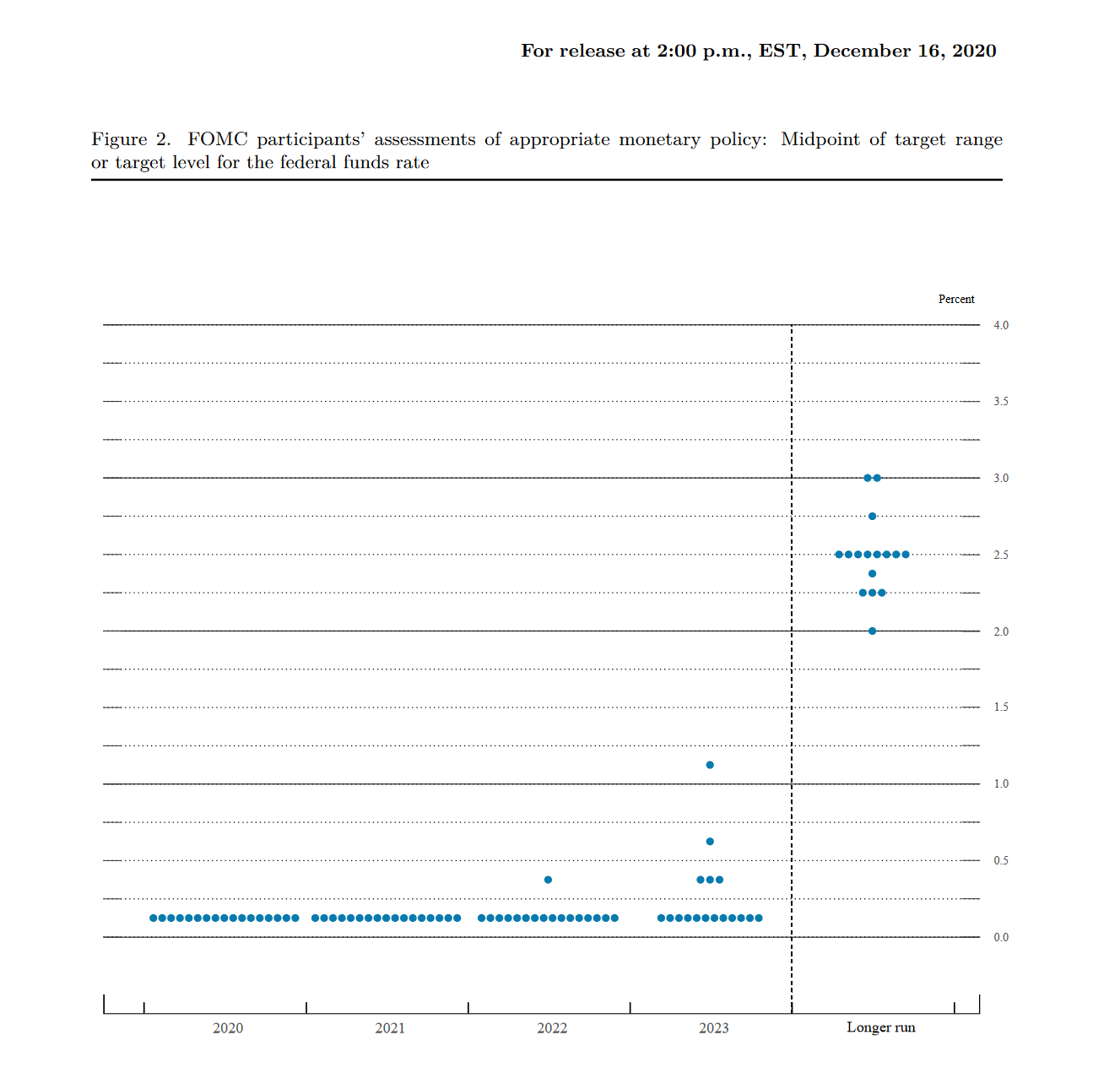

Who could have predicted the Fed would hike rates from 0.25% to 4.75% in just 12 months? The odds of that happening were well below 1%. From the dot plot dated December 16, 2020 - the Fed forecasted rates to stay at 0.25% through 2021 and 2022. They didn't see rates rising to 0.50% until 2023 and only 2.50% years after. Nobody expected rates to end 2022 at 4.50%!

https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20201216...

Take Away

The sudden increase in rates over the past year pushed the market value of SVB low-yielding paper lower by 20% or 30%; they were sitting on massive losses and needed to raise $2.25-billion to shore up their balance sheet. Instead of getting more capital, depositors panicked and withdrew their money at a record pace. The bank run made them hopelessly insolvent, and the FDIC took over.

Potential Systemic Collapse?

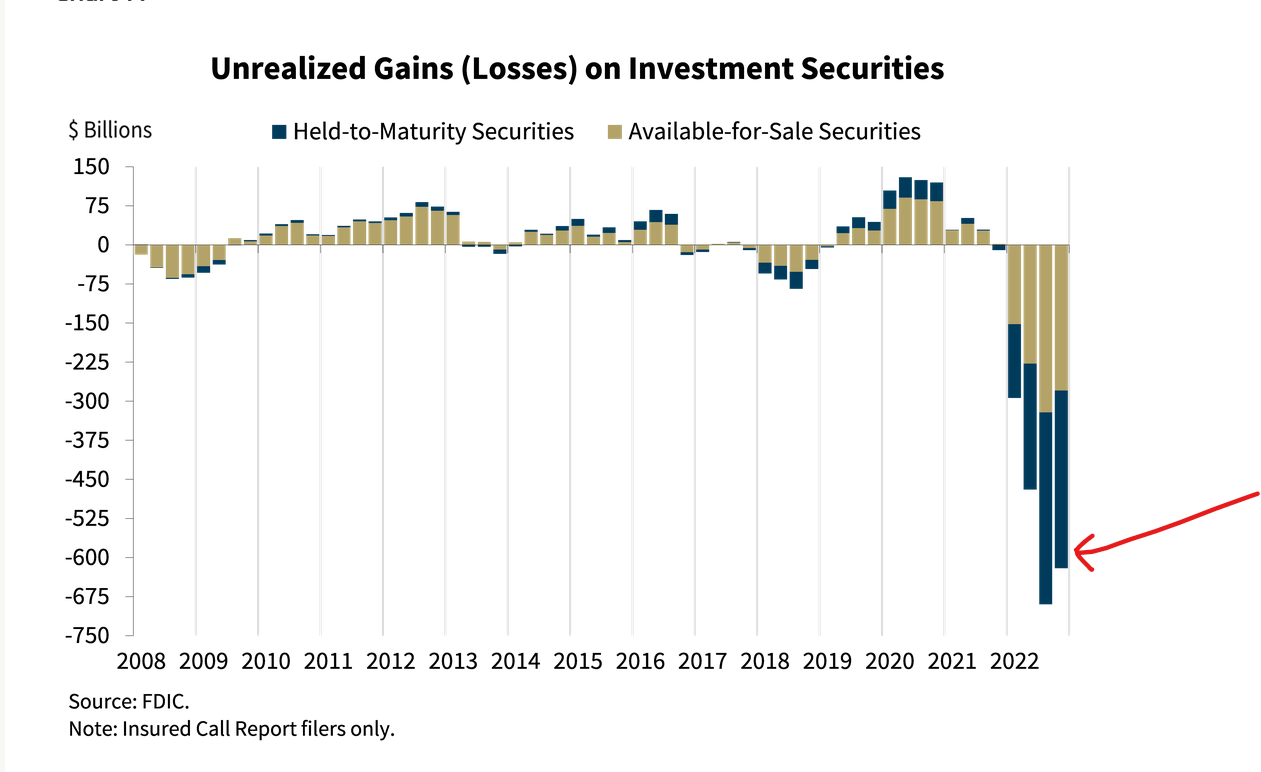

Everyone holding the low-yielding paper from 2020 and 2021 is sitting on unrealized losses. The FDIC reported unrealized losses of around $700 billion at the end of 2022. If rates keep rising, as they have, those losses will only grow.

source: https://www.fdic.gov/news/speeches/2023/spfeb2823.html

If fear spreads and more customers pull their deposits, we could see more failures.

The banks holding unreserved Ginnie Mae mortgage-backed securities would likely be next. SVB had the highest concentration and was the first to fall.

In a recent interview, banking expert Chris Whalen thinks the Fed needs to get ahead of this quickly and could cut rates next week instead of raising them.

SVB Crypto Fallout

Silicon Valley Bank services the tech and crypto sectors. The second largest stablecoin USDC reportedly held $3.3-billion in reserves at SVB. As I write, the par value of USDC has fallen from $1.00 to $0.92.

source: https://coinmarketcap.com/currencies/usd-coin/

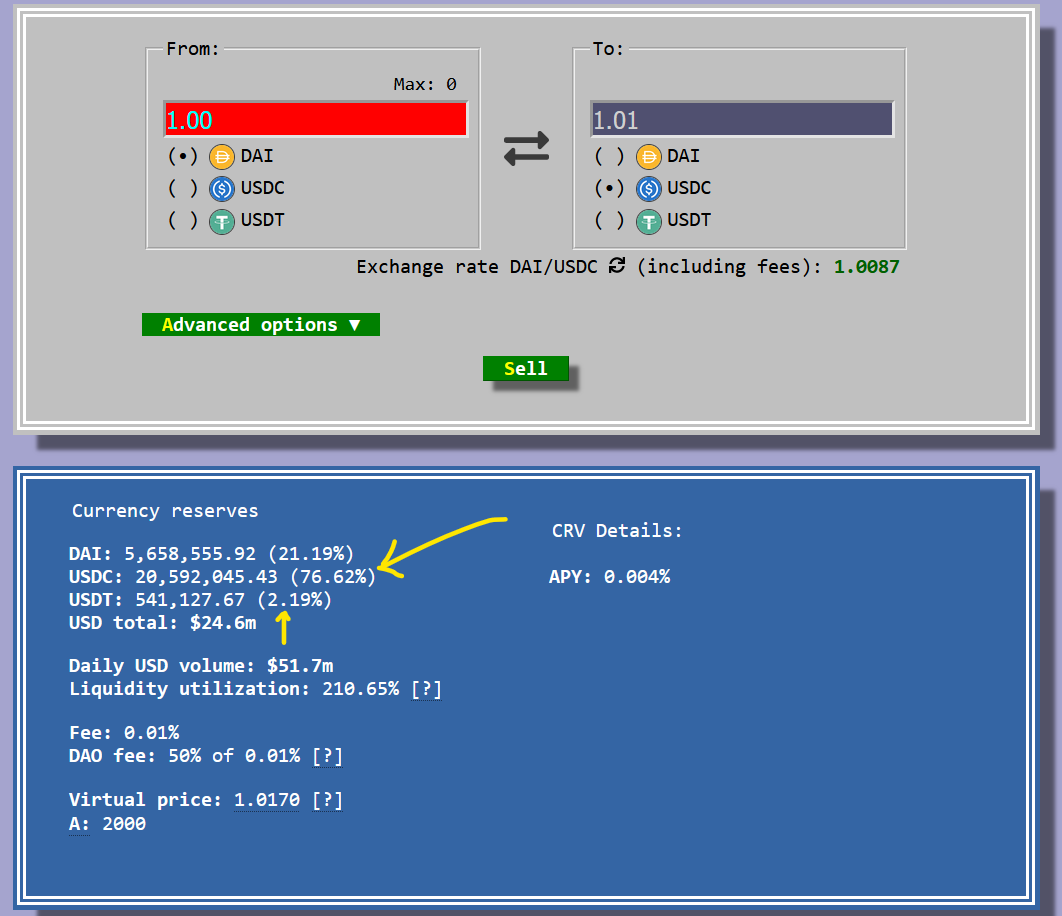

Curve Pool 3

To my disbelief, investors are rushing out of USDC and switching to Tether (USDT). The amount of Tether in Pool 3 has fallen to 2.19%.

source: https://optimism.curve.fi/3pool

The Gold Cycle Indicator finished at 164.

2-Year Yield

The 2-year Yield plummeted on Thursday and Friday over the crisis at SVB. Markets think the Fed may have to cut rates to prevent contagion. If the Fed does cut rates - gold could soar.

GOLD

Gold rallied sharply on Thursday and Friday as interest rates fell. If the Fed has to cut rates to contain a potential banking crisis, then I don't see gold dropping any further, and it could be up from here. If the Fed can support the banks and keep hiking rates as forecasted - then we could see a little more downside into April.

S&P 500

Stocks closed below critical support and may be breaking down. If prices fall below 3750 next week, I'd expect to see a downward acceleration through 3700. We should know early next week if the recent selloff is the beginning of a meltdown or just an isolated event.

BTCUSD

Bitcoin has been staging near the $20,000 level after closing below the 200-day EMA. Downside follow-through below $18,000 next week would support a breakdown to fresh lows. BTC needs to get back above $22,000 quickly to keep the bounce alive.

If Powell comes out early next week to announce a program to support banks, then we know it was serious - rates would plummet, and gold would soar, I think.

Expect increased volatility next week. I'll do my best to keep members informed.

AG Thorson is a registered CMT and an expert in technical analysis. He believes we are in the final stages of a global debt super-cycle. For more charts and regular updates, please visit here.

********