Gold Forecast: Is Gold’s War-Based Rally Nearing Its End?

Based on the behavior of gold and the dollar, it can be concluded that the influence of geopolitical turbulence on the precious metals market is starting to fade and that it was only temporary.

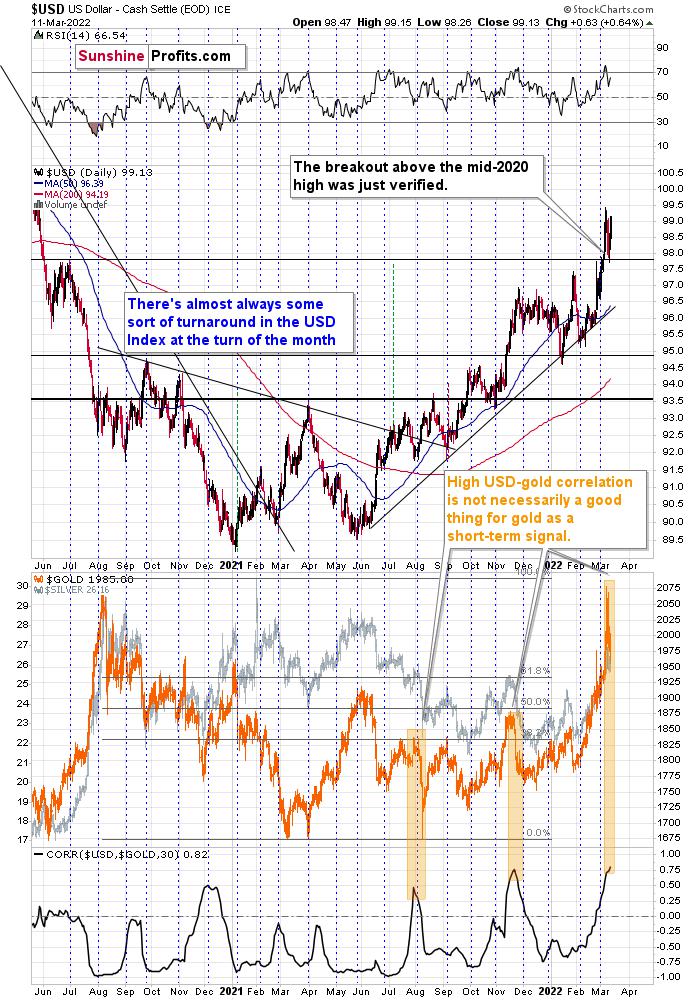

Friday’s session was particularly interesting when we compare what happened in gold to what happened in the USD Index.

Gold invalidated its important breakout above $2,000, thus flashing a medium-term sell signal.

The USD Index, on the other hand, confirmed its breakout above its mid-2020 high by moving back to it and then rallying once again.

This major difference on the technical level tells us that the key driver behind rallies in both assets is starting to wane. The key driver was, of course, the fear and uncertainty regarding Russia’s invasion of Ukraine. I’ve been writing about both points for many days:

Geopolitical events have only a temporary impact on gold prices.

Based on the analogies to how gold performed after previous military interventions (Russia annexing Crimea, the U.S. invading Iraq, the U.S. invading Afghanistan), it was likely that the rally would be a short-term phenomenon that would be followed by a decline. In fact, based on the “oil factor,” the situation might be particularly similar to the U.S.’s invasion of Iraq. Back then, mining stocks gave away their war-tension-based gains rather quickly.

What we saw on Friday appears to be an indication that history is rhyming.

Also, please note that if one looks at the correlation between the USD Index and gold (lower part of the chart), high values tend to coincide with tops in gold, especially when the latter is after a short-term rally. The correlation just moved to the level that it reached when gold topped in late 2021, so we have yet another factor pointing to lower gold prices in the coming weeks.

Before moving to the fundamental part of the analysis, I would to like quote what I wrote after gold invalidated its breakout above $2,000 for the first time, as it applies today as well:

So much for gold’s move above $2,000. Congratulations on avoiding the mania – it was not easy. The volume readings show that many people were caught up in the “inevitable rally” in gold. You, however, kept focused on what’s most important in the medium term, and over this time frame, this approach is likely to prove most beneficial.

As gold tried to rally to new all-time highs, I sent out an intraday Gold & Silver Trading Alert, and in it, I emphasized the likely temporary nature of this move. I wrote the following:

Yes, the situation in Ukraine is critical.

However, the two key drivers of gold price continue to point to lower gold prices, and at the same time we know that geopolitical-event-based rallies don’t last and very likely to be reversed.

These two key drivers are:

real interest rates;

the USD Index.

The USD Index is already soaring, and real interest rates are likely to increase as the nominal interest rates are about to increase – and given the recent rally in prices they might increase more than most investors expect them to.

Consequently, while – given today’s rally – it might seem like there’s no stopping gold, silver, and mining stocks, please keep the above in mind. This rally is likely to be reversed, and when it reverses, junior gold miners are likely to decline in an epic manner, leading to epic profits for those who didn’t succumb the mania during the parabolic upswing.

Summary

To summarize, as with other armed conflicts in the past, gold is beginning to stop benefiting from the turmoil of war and is no longer responding as vigorously to shocking headlines as it did a few weeks ago. The changes can also be noticed in the USDX, and they mean one thing for gold – that it’s likely to decline in the following weeks.

Despite the ongoing Russian invasion of Ukraine, and despite gold being the traditional safe haven in times of turmoil, the overall outlook for the precious metals sector remains bearish for the next few months, and the medium-term outlook for the yellow metal remains pessimistic.

Since it seems that the PMs are starting another short-term move lower more than it seems that they are continuing their bigger decline, I think that junior miners would be likely to (at least initially) decline more than silver.

From the medium-term point of view, the key two long-term factors remain the analogy to 2013 in gold and the broad head and shoulders pattern in the HUI Index. They both suggest much lower prices ahead.

As silver often moves in close relation to the yellow metal, when gold falls, silver is likely to decline as well – it has probably already started its slide. The times when gold is continuously trading well above the 2011 highs will come, but they are unlikely to be seen without being preceded by a sharp drop first.

Thank you for reading our free analysis today. Please note that it is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the outline of our trading strategy as gold moves lower.

If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

********

Przemyslaw Radomski,

Przemyslaw Radomski,