Gold Forecast: Gold Prices Could Explode Higher, and Soon

We see the potential for a strong breakout in gold in the coming weeks.

We see the potential for a strong breakout in gold in the coming weeks.

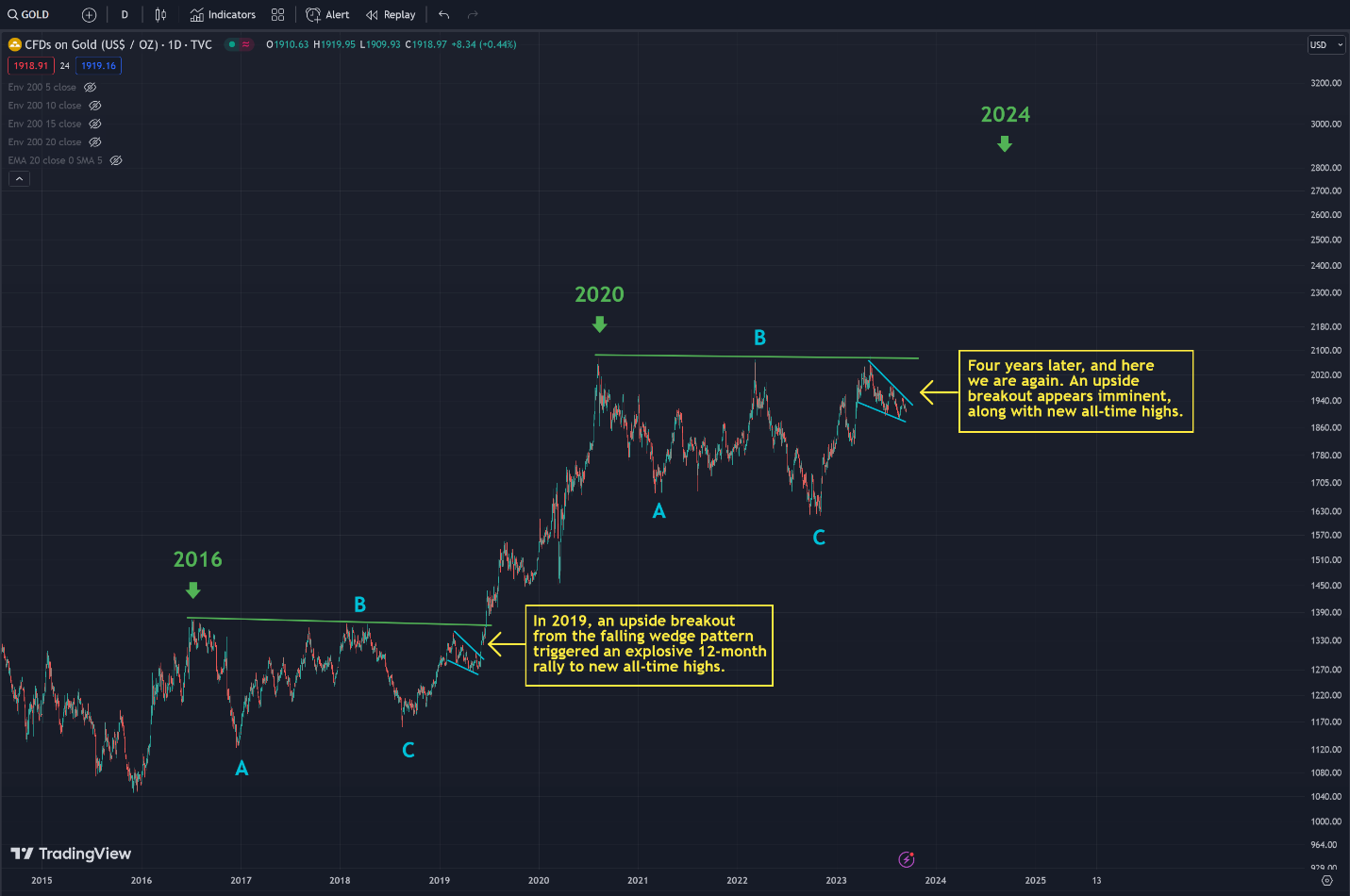

The next time prices break above $2000 - they may never look back.

Once gold clears $2100 it will be drawn to $3000 like a magnet.

Overview

Gold is on the launch pad, waiting for a catalyst to send prices soaring. Two potential candidates are the UAW strike or the Fed going on permanent pause. A breakout in September or October is plausible.

Gold Big Picture

Gold consolidated in a tight range for nine months before it launched through the $500 level back in 2005 (never to return). I believe prices are on the launch pad once again, and an explosive breakout is imminent. The exact timing is tricky, but if we use nine months as a guide, we could see new all-time highs by December or January, followed by a jaw-dropping rally towards $3,000 in 2024.

Falling Wedge

On the daily chart of gold, I'm watching this falling wedge pattern. We had the same setup in 2019 before the breakout. The current pattern seems complete, and a decisive rally (with good volume) above the $1980 level would signal a bullish breakout.

Fed Watching

The Fed will announce its next rate hike decision on September 20th: no hike is expected. All eyes will then turn to the November 1st meeting, which currently has 35% odds for a rate hike. If they stay on pause in November, that could be the catalyst to send gold higher. If they hike in November, gold may have to wait until January for a breakout.

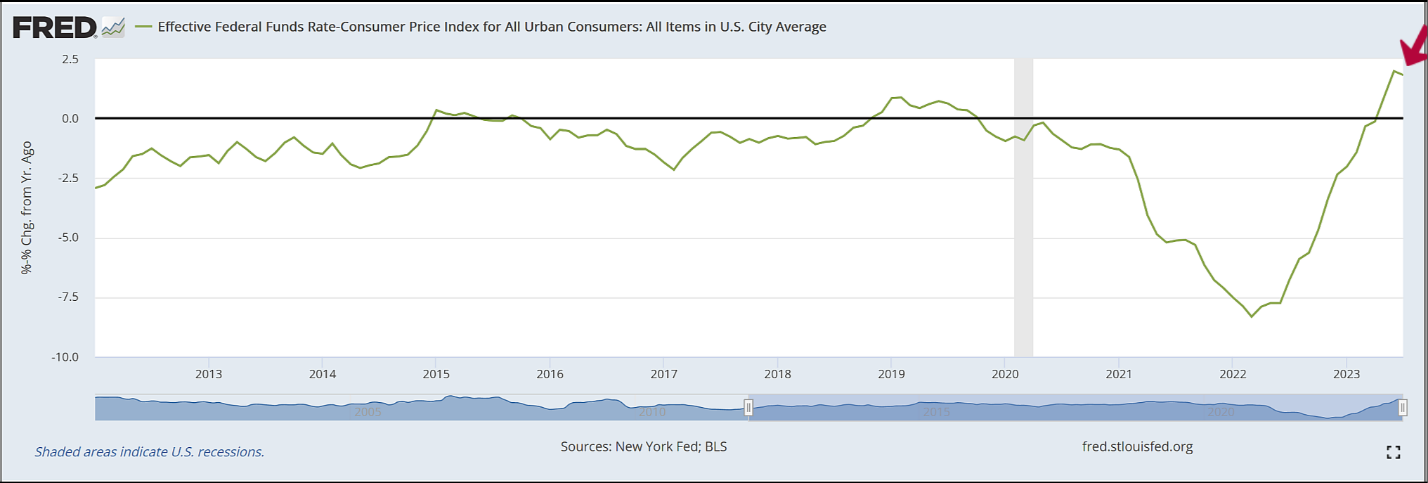

Sufficiently Restrictive

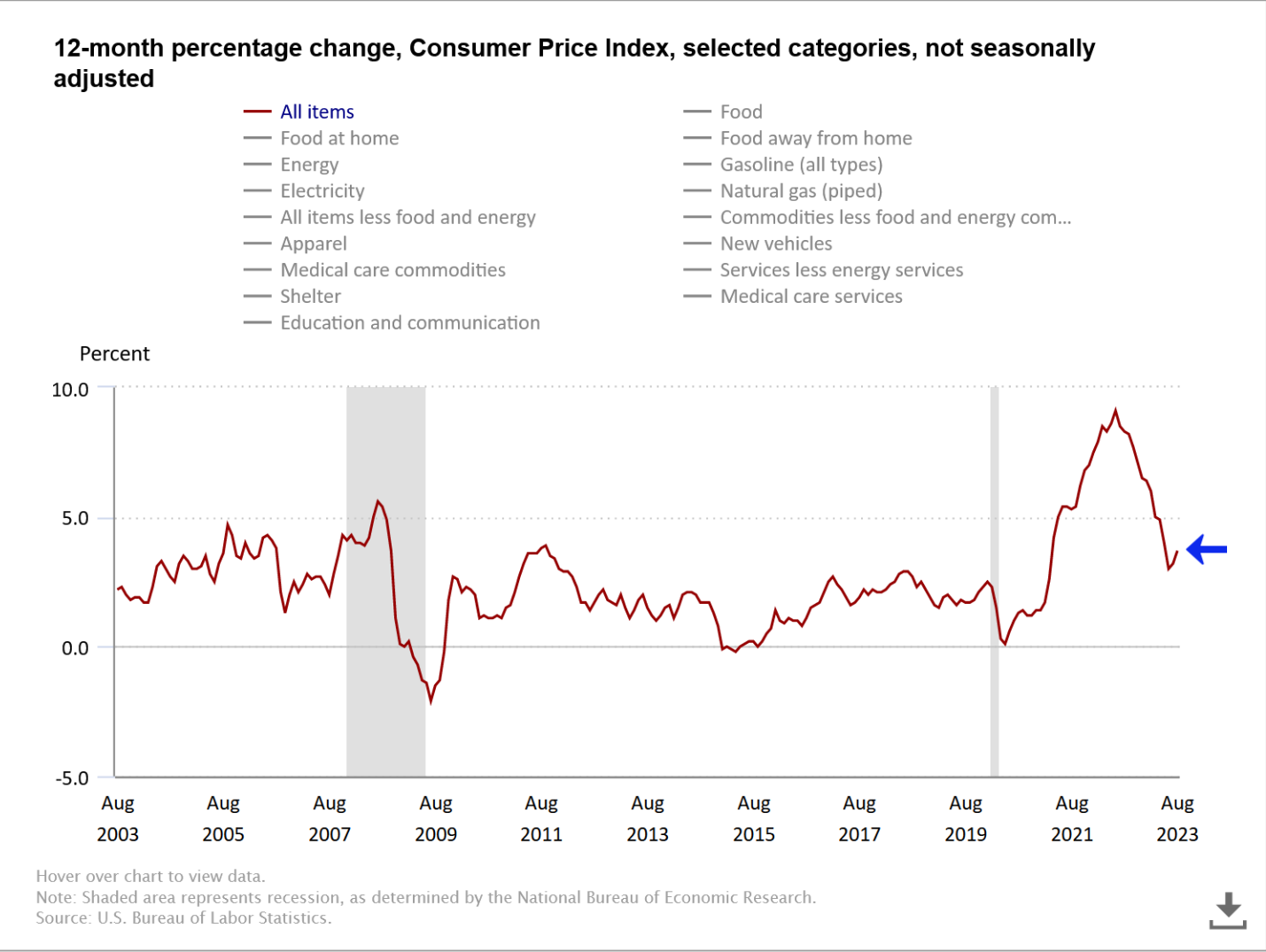

I think the Fed may be done tightening because they finally got the Fed funds rate above inflation. When they first started hiking on March 17, 2022, fed funds were at 0.25% to 5.0%, and CPI was 8.5% (-8.00%). Now, fed funds are 5.25% to 5.50%, and CPI is 3.7% (+1.50%). With fed funds 150 basis points above CPI, Powell is sufficiently restrictive and can stop hiking.

https://fred.stlouisfed.org/graph/?g=cmn7

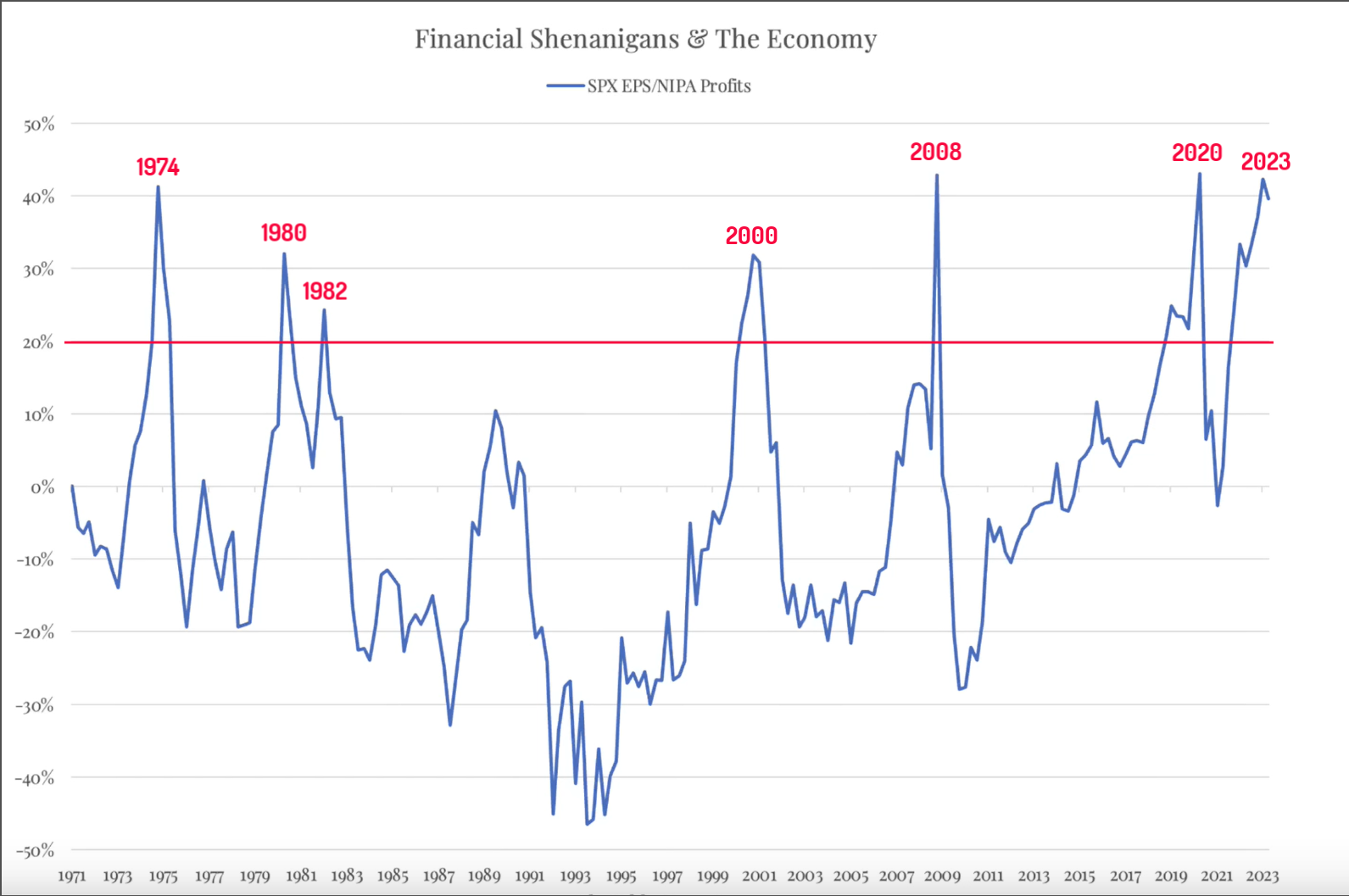

Financial Shenanigans

Companies are very creative when it comes to reporting earnings. With a few tweaks to their balance sheet and depreciation schedule, they can make returns look better than they are. For an accurate picture, I compare earnings per share (EPS) to NIPA (National Income and Product Accounts) profits, which uses “income from current production.”

Whenever S&P 500 EPS/NIPA Profits rise above 20%, that tells you companies are using a lot of tricks to inflate earnings, which only happens before a recession. This measure has exceeded 40% on four occasions: 1974, 2008, 2020 and 2023. The bottom line is corporate earnings are overinflated to extremes, and the next thing that usually happens – is the bottom falls out.

Could the UAW Strike Trigger a Breakout in Gold?

The United Auto Workers (UAW) went on strike at midnight, and this is a big deal for two reasons.

Automotive manufacturing is the largest sector of production in America. According to Peter Zeihan, a prolonged strike (3 weeks or longer) could contract GPD and send the economy into recession.

Auto workers demanding a 40% pay increase (in line with what UPS workers got in August). A 40% bump in wages would increase consumer spending, restoking inflation. In other words, the wage-price spiral the Fed dreads.

Union leader Shawn Fain has been very vocal about what they want. I’m afraid this may paint him into a corner where he must never back down, and negotiations could drag on longer than anyone wants.

A prolonged UAW shutdown would conceivably tip the economy into recession forcing the fed to stop hiking rates, and that’s exactly what gold’s been waiting for.

Student Loan Repayment

Federal student loans were paused in March 2020 during COVID-19. After multiple extensions, payments will resume next month. The Biden administration is trying some last-minute tricks, but they’re running out of options. Roughly 40 million Americans will have to start paying their bills again, which will be challenging for many. One more reason the Fed should stop hiking.

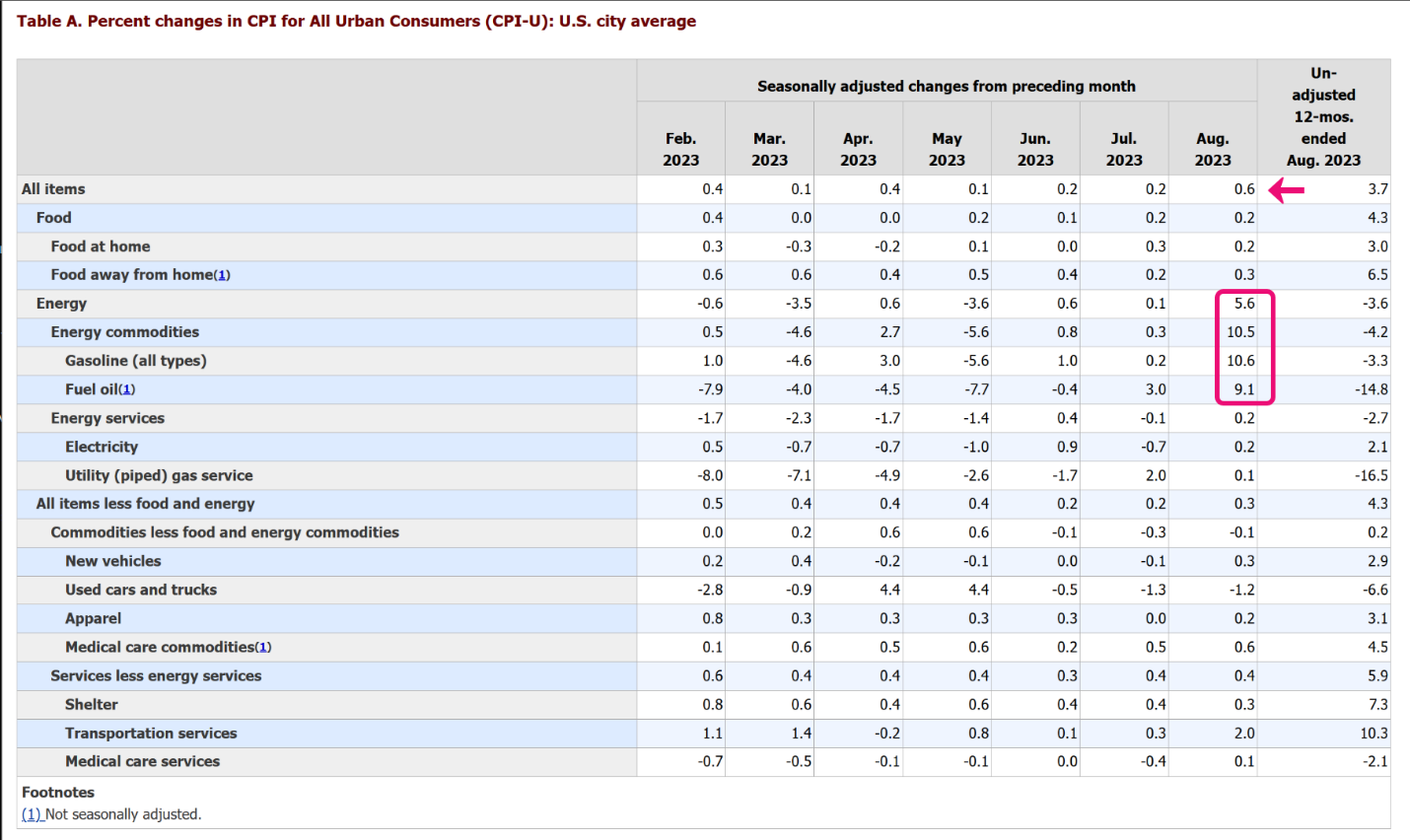

Inflation Update

August CPI came in hot at 0.6% month-over-month due to an uptick in energy prices. This is not what the fed wanted, but I don’t think it’s enough for them to risk hiking rates again.

https://www.bls.gov/news.release/cpi.nr0.htm

The annual inflation rate jumped to 3.7% from 3.2%, but it’s still well below the current Fed funds rate of 5.25% to 5.50%.

https://www.bls.gov/charts/consumer-price-index/consumer-price-index-by-category-line-chart.htm

OIL Update

Crude oil (WTI) is overbought and due for correction, support around $82.00. Overall, I see the potential for continued strength. A repeat of 2007 could take prices to $165 by next year. The next level of resistance arrives at $94.00.

Higher energy prices in 2024 will put the Fed in a difficult spot where they will need to keep rates high as the economy weakens. Ultimately, they will wait too long, and we will get another crisis. Funny how this always happens around a presidential election. To learn more, I recommend checking out what happens to Gold Prices During Stock Market Crashes.

AG Thorson is a registered CMT and an expert in technical analysis. He believes we are in the final stages of a global debt super-cycle. For more charts and regular updates, please visit here. For YouTube content, click here.

*********