Gold Forecast: Gold Set to Soar as the Fed Ends Rate Hikes

On Wednesday, the Fed confirmed they were done hiking rates - metals and miners jumped on the news.

On Wednesday, the Fed confirmed they were done hiking rates - metals and miners jumped on the news.

The pivot from tightening to loosening is precisely what gold needed to trigger the next big run.

The gold train is leaving the station and the days of buying 1 ounce Gold Eagles below $2000 may be forever behind us.

Quick Overview

Gold is close to securing a MAJOR breakout above $2100. Once confirmed, we expect a robust bull run, taking prices towards $10,000 by 2030. This week's Fed pivot was incredibly bullish for precious metals, and we see gold reaching record highs in the coming weeks.

The Gold Train Now Departing

After a 12-year consolidation, the gold train left the station in 2005, embarking on a breathtaking 6-year bull run to previously unthinkable highs.

Today, gold is in a nearly identical setup, and a breakout above $2100 will confirm the gold train is once again leaving the station.

The first stop will likely be around $3250, followed by $4750, and finally $9450 in late 2029 to early 2030.

If the upcoming bull run in gold is anything like its predecessor (2005 to 2011), I strongly recommend keeping your seat on the train. Trying to time the highs and the lows is tempting but almost impossible. Ultimately, you'll lose your seat and chase the train after it leaves the station…not a good feeling.

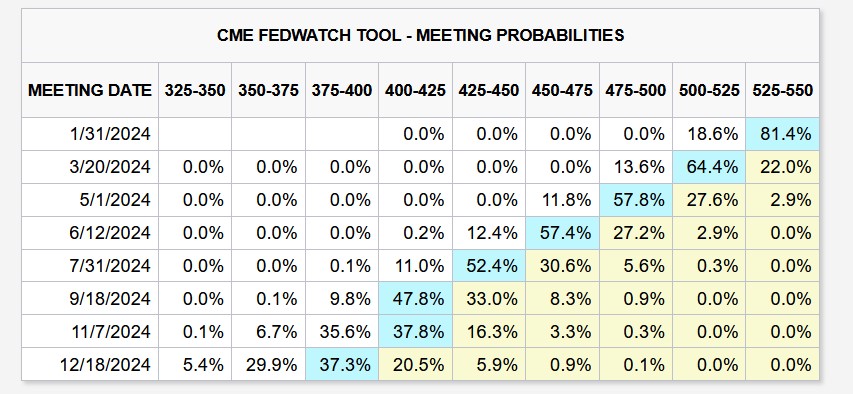

Rate Cut Forecast

What a difference a month makes. Not too long ago, markets expected just two rate cuts in 2024 beginning in June. Now, they expect six cuts starting at the next meeting. This seems a bit optimistic, in my view.

10-Year Treasury Yield

The 10-year Treasury has fallen over 100 basis points since peaking at 5.02% in late October. This has been a tremendous boost to financial markets.

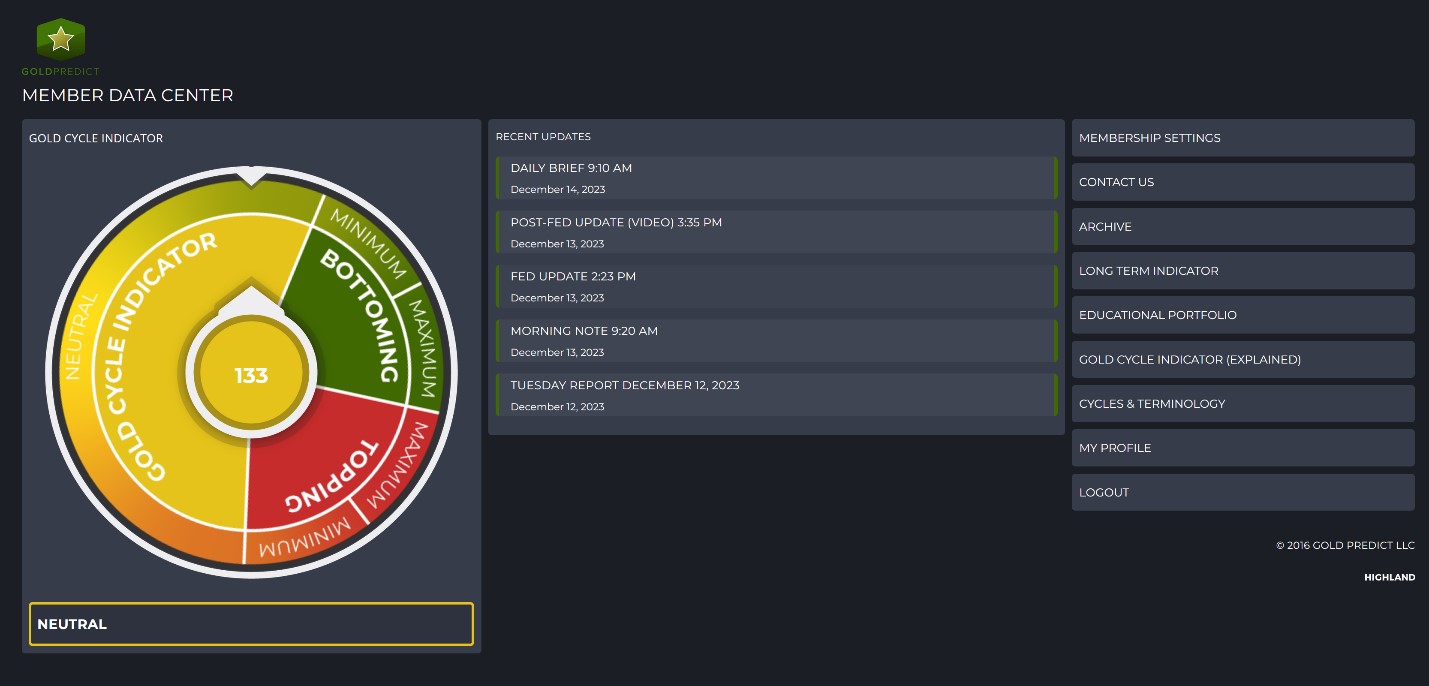

Our Gold Cycle Indicator finished at 133.

GOLD- The Fed confirming a peak in rates is just what gold needed. Progressive closes above $2060 would be near-term bullish, promoting another breakout attempt at $2100 before year-end. Next year is shaping up to be one for the record books.

SILVER- Silver is doing its part to reverse last week's collapse, but more work is needed. To signal a breakout, prices must close above $26.50. In the meantime, as long as prices remain above the 200-day MA, the near-term trend points higher.

PLATINUM- Platinum is attempting to break above $950. Progressive closes above the 200-day MA would support a new uptrend.

GDX- Miners reversed two weeks of decline in two trading days. We could see a pause to digest the progress. A daily finish above $32.00 would be bullish, and support a run towards $35.00 to $36.00.

GDXJ- Juniors need to close above $39.50 to propel prices toward the April $43.89 high. A downside reversal and close below $37.50 would be short-term bearish.

SILJ- Silver juniors could target $12.00 in January upon a confirmed breakout above $10.00.

WTIC- Oil formed a swing low after testing the $67.00 area. A daily close above $73.00 would support a near-term bounce. I'd need to see sustained closes above the 200-day MA for a meaningful rally to the upside.

S&P 500- Stocks are celebrating the Fed pivot and could hit new all-time highs in the coming weeks. It would take a weekly close below 4600 to signal a potential breakdown. Until then, the trend is higher.

Conclusion

Gold is very close to a historic breakout, and sub-$2000 prices may become a distant memory. Gold miners are deeply undervalued and could be the best-performing asset in 2024.

AG Thorson is a registered CMT and an expert in technical analysis. For regular updates, please visit www.GoldPredict.com.

********