Gold Forecast: Key Turn Coming Up for Gold Market

Recapping Last week

Recapping Last week

Last week's trading saw Gold forming its high in Monday's session, here doing so with the tag of the 1746.40 figure (December, 2022 contract). From there, a sharp decline was seen into late-week, with the metal dropping all the way down to a Friday low of 1661.90 - before bouncing slightly into the daily/weekly close.

Gold Market, Short-Term

As per the notes from recent articles, the downward phase of the 10, 20 and 34-day cycles was deemed to be in force - never having confirmed an upturn. In terms of time, the 10-day cycle is now 11 trading days along - with the larger 34-day wave now at some 41 days along - with each of these waves well into bottoming range.

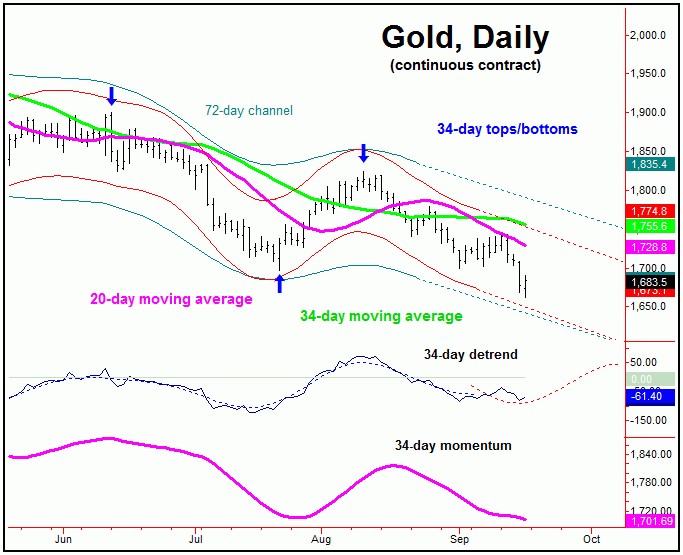

The chart below shows the larger of these two waves, the 34-day cycle:

Once the low for this 34-day wave is complete, we are expecting a decent rally playing out into later this month, a move which is assumed to end up as countertrend, due to the configuration of the larger 72-day component.

In terms of price, any intraday reversal back above the 1718.80 figure (December, 2022 contract) - if seen at any point going forward - would confirm a trough in place with our 10-day cycle, as well as with the larger 34-day wave. Otherwise, below this 1718.80 figure will keep the metal in its current (bearish) position short-term, still with the potential for lower lows for the swing.

Going further with the above, from whatever bottom that forms with the 34-day wave, the probabilities should favor a rally back to the 34-day moving average or better in the days that follow. In terms of patterns, due to the position of the larger 72-day component, that move would be favored to end up as countertrend.

Shown again below is our larger 72-day cycle:

Stepping back, as mentioned in my last article, the downward phase of this 72-day cycle was favored to be in force - with that wave projecting down into the mid-October timeframe, plus or minus. The next low for this 72-day wave is favored to end up as the trough for the larger 310-day component, which is shown again on our next chart:

In terms of price, in our Gold Wave Trader report, I mentioned the decent potential for a drop back to the 1650's or lower before the 72 and 310-day cycles attempted to bottom - an action which was nearly met with Friday's early-day decline.

Having said that, the ideal path still favors a sharp countertrend bounce (10, 20 and 34-day cycles) in the coming weeks, before dropping off to a final low into October - where our larger 72 and 310-day combination trough is due.

Gold Market, Mid-Term View

From whatever bottom that does form the 72 and 310-day waves, as mentioned in prior articles the probabilities will favor a sharp rally of some 20-25% or more playing out in the months to follow - with the upper 310 cycle band acting as the ideal upside magnet to price.

Adding to the comments above, we now have our first upside 'reversal point' for the larger 72 and 310-day waves, which - when taken out - would be our best confirmation that our mid-term bottom is in place. Exact details on this reversal level are always posted in our Gold Wave Trader market report; stay tuned.

Jim Curry

The Gold Wave Trader

http://goldwavetrader.com/

http://cyclewave.homestead.com/

********