Gold Forecast: Looking For Next Key Low

Last week's trading saw Gold forming its low in Monday's session, here doing so with the tag of the 1764.20 figure. From there, a decent bounce was seen into Wednesday's session, with the metal pushing all the way up to a peak of 1795.60 - before backing off the same into the weekly close.

Last week's trading saw Gold forming its low in Monday's session, here doing so with the tag of the 1764.20 figure. From there, a decent bounce was seen into Wednesday's session, with the metal pushing all the way up to a peak of 1795.60 - before backing off the same into the weekly close.

Gold's Short-Term Picture

For the very short-term, the upward phase of the 10-day cycle has been deemed to be in force in recent days, though with the same now at 5 trading days along. In terms of patterns, the current rally phase with this component is expected to end up as a countertrend affair, holding well below the prior 10-day top. Here is that 10-day wave:

In terms of price, the upward phases of the 10-day cycle will normally see the 10-day moving average acting as a magnet - and could also act as a short-term resistance level to the same, plus or minus. Stepping back, any reversal back below the 1761.20 figure (August, 2021 contract), if seen, would confirm this wave to have topped.

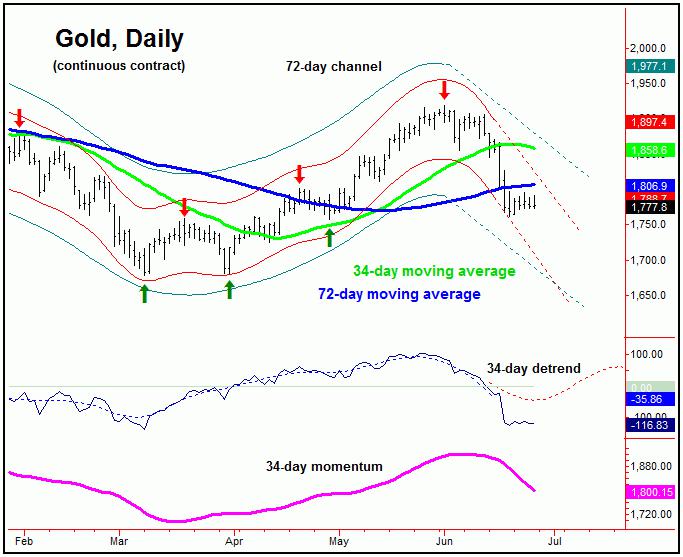

Stepping back slightly, the next downward phase of the 10-day cycle is the odds-on favorite to bottom the larger 34-day component, shown again on the chart below:

Back in late-May, I asked the question: "Will June bring a painful correction for gold?". That question was posed, due, in part, to the configuration of the 34-day time cycle, which was at or into its topping range.

From my May 10th article: " the 34-day wave is in the process of topping - and may well have peaked with the recent tag of the 1915.60 figure. Having said that, this is too soon to say with any degree of certainty, and has yet to be confirmed. However, should the metal make it up to a higher high in the near-term, that move - due to technical considerations - would be the odds-on favorite to top this 34-day wave, for what is likely to be a decent correction in the month of June."

With the above said and noted, gold topped just 2 trading days later at the 1919.20 figure - and has been in correction mode ever since. As mentioned, the next decent swing low should come from this 34-day time cycle, which is moving into bottoming territory. Going further, the next downward phase of the 10-day cycle should be the one that eventually troughs this larger 34-day wave, for what is favored to be a sharp rally in the days/weeks to follow.

Technical Considerations

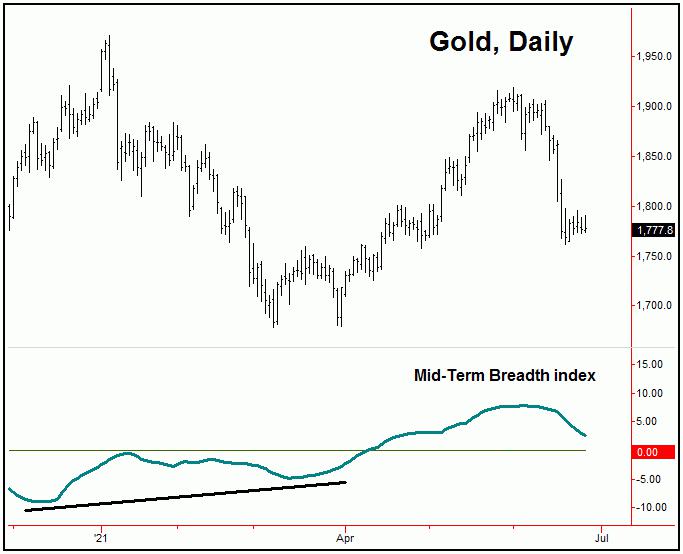

The chart above shows our Mid-Term Breadth index for the gold market, which turned to the downside back in early-June:

With the action seen in recent days, our Mid-Term Breadth index continues to push lower here, and with that is viewed as a near-term technical negative. With that, this is seen as being supportive of the current downward phase of the 34-day cycle.

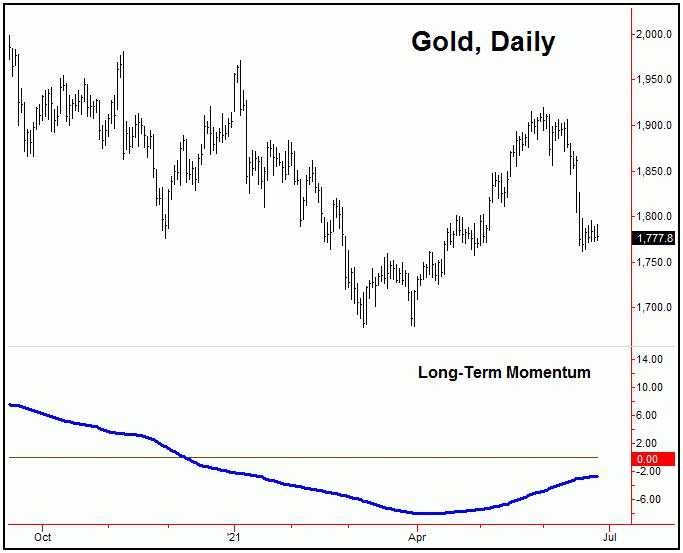

Longer-Term Momentum, however, is still pointing higher:

If the current correction phase with the 34-day cycle is going to end up as a countertrend affair, then we should see our long-term momentum indicator remaining pointed to the upside. Thus, the action of this indicator looks to be key in the coming days, as this 34-day wave next attempts to trough.

In terms of price, it was a reversal below the 1871.00 figure (August, 2021 contract) that actually confirmed the downward phase of the aforementioned 34-day cycle to be back in force. Moving forward, we should get a new upside ‘reversal point’ for this same 34-day wave in the coming days, depending on how the action plays out in-between.

Mid-Term Picture for Gold

Until proven otherwise, the upward phase of the larger 310-day cycle is deemed to be in force for gold, with that cycle shown on the chart below:

For the mid-term picture, until proven otherwise, the overall assumption is that this 310-day cycle is still pointing higher at the present time - thus making the short-term action with the smaller 34-day wave of paramount importance in the coming days. In terms of price, the lower 310-day cycle channel - currently at the low-end 1700's - is a key support level to the downward phase of the 34-day cycle.

The overall bottom line is that the action in the days/weeks ahead looks to be critical for the mid-term picture of the gold market, and promises to offer up some very telling information in regards to the same. With that, we will be on the lookout for any technical indications of a key bottom forming with the metal - though signs which have yet to actually develop. Stay tuned.

Jim Curry

The Gold Wave Trader

http://goldwavetrader.com

http://cyclewave.homestead.com

Jim Curry is the editor and publisher of The Gold Wave Trader and Market Turns advisories - each of which specializes in the use of cyclic and statistical analysis to time the gold and U.S. stock markets. He is also the author of several trading-related e-books, and can be reached at the URL's above.

********