Gold Forecast: Multi-Decade Breakouts are Rare and Powerful

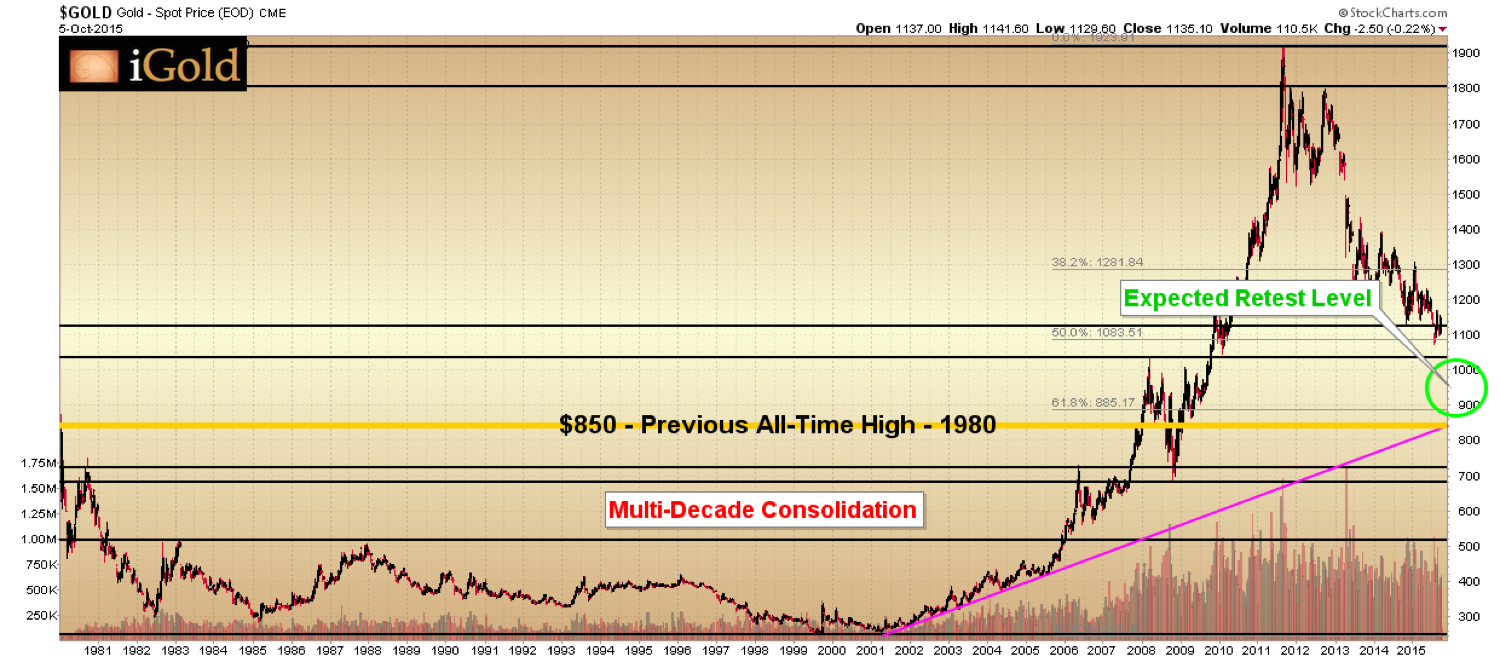

Gold is in the process of retesting its breakout from a multi-decade consolidation stretching back to 1980. The significance of such a retest cannot be understated: multi-decade consolidations usually lead to multi-decade advances, with targets many times the previous consolidation high. In percentage terms, gold has only just begun to move above its 1980 former all-time high, and for this reason, we believe it is critical for investors to view this market with sufficient historical perspective.

Gold is in the process of retesting its breakout from a multi-decade consolidation stretching back to 1980. The significance of such a retest cannot be understated: multi-decade consolidations usually lead to multi-decade advances, with targets many times the previous consolidation high. In percentage terms, gold has only just begun to move above its 1980 former all-time high, and for this reason, we believe it is critical for investors to view this market with sufficient historical perspective.

Multi-decade consolidations are a rare formation in the capital markets. By multi-decade consolidations, we are referring to markets in which an asset makes a specific price high, followed by at least two decades of price action below that high (the consolidation), followed by an eventual breakout above the high. In the case of the gold market, we are referring to the high made in 1980 at $850/ounce, followed by the 28-year consolidation below that high, until the breakout which finally exceeded $850 in 2008.

After oscillating above and below the $850 mark from 2008 through early 2009, gold prices finally took off for good in the fall of 2009, confirming the breakout. As we know, gold continued to accelerate into September of 2011, climbing to above $1,900. Since that time, the precious metal has been in a four year bear market, standing just above $1,140 as this article goes to press.

The critical piece of data in this chronicle is that the current four-year bear market has occurred entirely above the 1980 high. What this means is that this bear market represents a retest of the breakout from the former multi-decade consolidation.

A Historic Example in the Dow

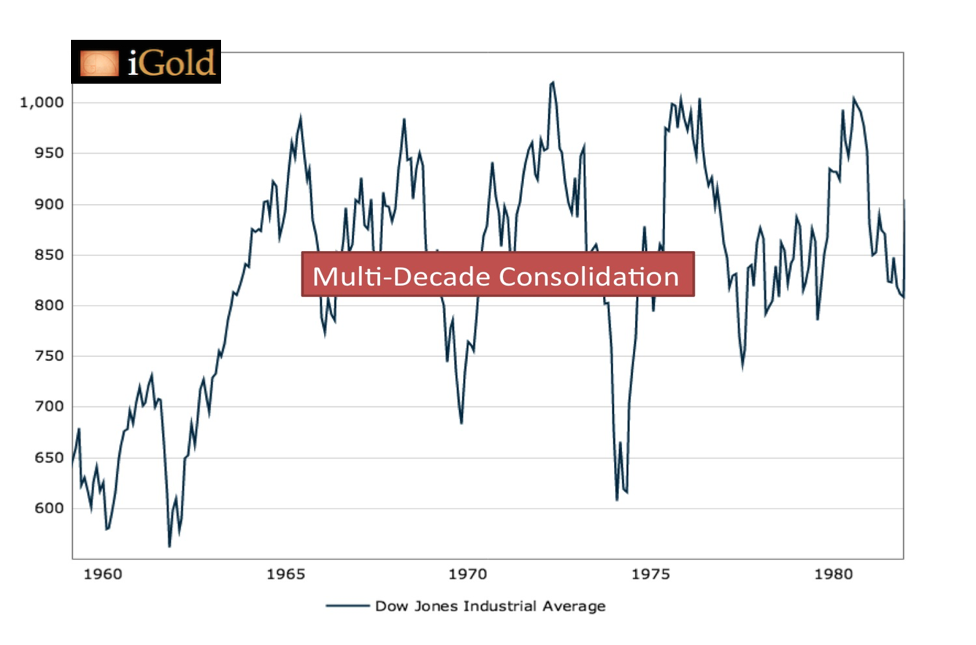

The potential for a market that consolidates for several decades, breaks out, and then successfully retests that breakout point is monumental. As an example, let us turn our attention to another market that underwent a similar multi-decade consolidation, and then broke out successfully, to gauge the possibility for the impending gold advance.

From 1959 to 1982, the Dow Jones Industrial Average consolidated between roughly 550 and just over 1,000. It was a choppy, back and forth consolidation, but with a very clearly defined resistance zone in the 950 to 1,000 range. For these 23 years, no one with a buy and hold strategy in the broad stock market made much money, and many gave up hope.

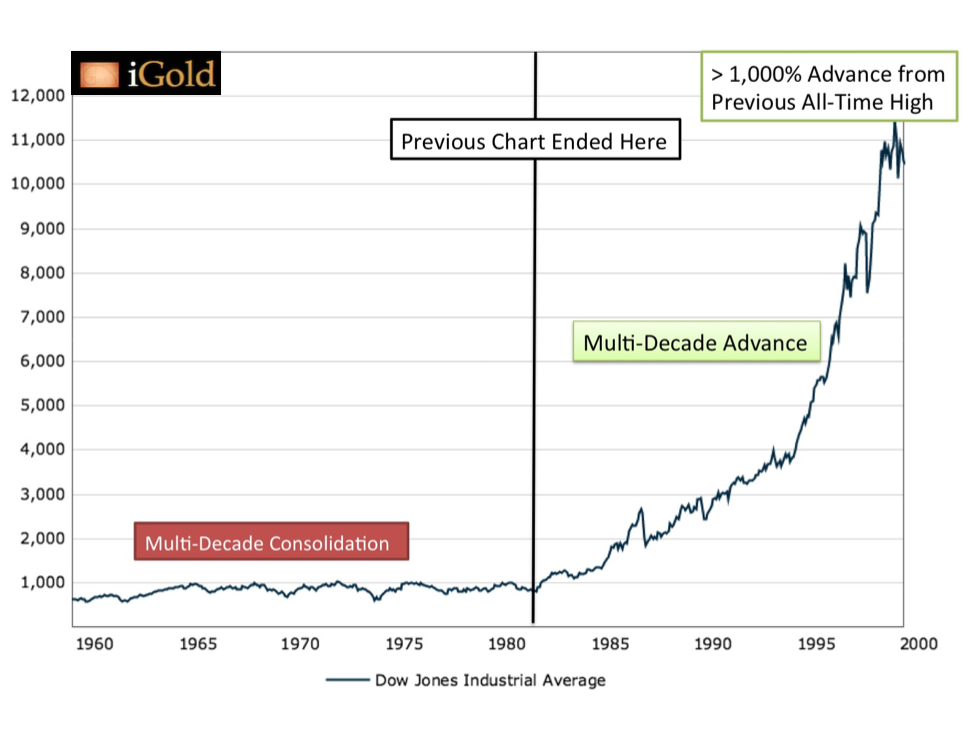

However, in 1982 the Dow finally broke out above 1,000, hitting nearly 1,300 in the fall of '83. Its retest of the former resistance zone was quick, lasting from late-83 to mid-84, and in fact, did not come fully back to that level, only briefly touching 1,100 for a low. Once that successful retest occurred, the resumption of the new bull market was quick to accelerate. The rest, as they say, was history, as one of the greatest bull markets continued on for almost as long as the consolidation -- 16 years -- and achieved over a 1,000% gain from the previous all-time high (hitting 11,500 in 2000).

Gold on the Verge of a Multi-Decade Bull Market?

Gold is positioned similarly to where the Dow was in early 1984, when it retested the 1,000 level after a multi-decade consolidation. Once this retest occurs, we will be looking for an advance that may last a similar length of time as the consolidation. In other words, a multi-decade bull market may be just around the corner for precious metals investors.

Thus, long-term investors would do well to take a step back and pay attention to the underlying pulse of this market by looking again at the first chart in this article: a multi-decade consolidation followed by a successful breakout, currently in the process of retesting that breakout. Multi-decade consolidations tend to lead to multi-decade advances that reach many times the original high. If the example of the multi-decade consolidation and advance in the Dow from 1959 - 2000 is any example, there may be 15-20 years of gains ahead in the gold market and an ultimate gold price level that is many multiples of the former $850 high.

Ultimate Gold Price Target on a Multi-Decade Advance

Putting exact numbers on such a price target at this moment can only diminish the message of the underlying strength gold is giving, but for comparison sake, if the precious metal were to achieve an 11-fold move above it's previous all-time high as the Dow did, it would give us a target of over $9,000 per ounce. Of course, this would happen within the timespan of the next two decades. Our point in this piece is to encourage readers to not obsess over the ultimate target or the final low, but to try to see this market within the context of the unique multi-decade breakout that is currently unfolding.

This pattern is rare and powerful. It often requires a retest of the former all-time high. We may be just about ready to see that retest over the next few months. And decades of price gains after that retest can make the initial consolidation look like merely a warm-up on a long-term scale. Gold is poised at that juncture now.

Courtesy of iGoldAdvisor.com