Gold Gains in Gallup’s Latest Poll

Every April Gallup surveys Americans to find out what they believe is the best long-term investment. The choices span traditional financial assets like stocks and bonds to alternatives such as real estate, gold, and cryptocurrencies.

In the latest results, gold climbed to the second spot, overtaking stocks.

It’s a sign that more Americans are waking up to gold’s enduring role as a safer and more secure financial asset—especially during times of economic uncertainty and financial market volatility.

Let’s take a closer look at how each asset stacked up, and why we believe gold may still be underrated in the eyes of most investors.

Crypto

Gallup only added cryptocurrencies to their survey in 2022, and they remain firmly at the bottom of the rankings. Just 4% of Americans named crypto as the best long-term investment.

While digital assets and gold can share some of the same appealing qualities, like privacy and decentralization, gold boasts a 5,000-year track record, while cryptocurrencies are still in their infancy. Thousands of cryptocurrencies have already gone to zero while gold continues to hold value in today’s modern economy.

Unlike gold, cryptocurrencies are known for their high volatility. They seem equally likely to skyrocket, or crash, on the same day.

Apparently, this quality doesn’t appeal to investors when considering the long-term.

Bonds

Despite containing the “risk-free” asset class in Treasurys, bonds received only 5% support, barely outperforming crypto. That’s a surprisingly weak result for an asset class which for the largest segment includes the backing of the “full faith and credit” of the U.S. government.

Compared to the rollercoaster world of crypto, bonds are seen as a safe haven asset in comparison.

However, their near-bottom ranking in this poll reflects a harsh truth: bonds have struggled to keep up with inflation and deliver real returns.

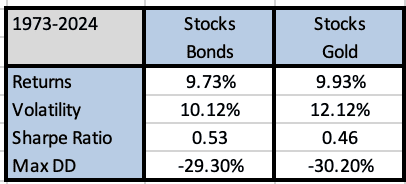

In fact, Meb Faber of Cambria Asset Management has shown that replacing bonds with gold in a 60/40 portfolio changes very little in terms of volatility and drawdowns, while generating a slightly higher return profile.

Savings accounts/CDs

Savings accounts and certificates of deposit (CDs) remained ahead of bonds in popularity this year, likely due to higher interest rates on deposits.

With the Fed’s policy rate around 5%, some accounts offer upwards of 4% APY.

But the national average yields remain stuck at just 0.6%, according to Bankrate.

Similar to bonds, interest from savings accounts and CDs are highly vulnerable to monetary policy shifts and devaluation by inflation.

Stocks and mutual funds

Stocks came in third this year, with 23% of Americans selecting them as the best long-term investment.

That’s a strong showing, but recent market activity signals caution. The stock market has been volatile lately, with rising geopolitical tensions and shifting trade policies contributing to investor uncertainty.

Meanwhile, gold has quietly outperformed equities over the last two decades and continues to outperform in 2025.

Gold

For the first time in over a decade gold overtook stocks, becoming the second-most popular asset class in the poll.

The appeal of gold lies in its simplicity and enduring value as a tangible asset.

In an era of unstable interest rates, ballooning government debt, and economic uncertainty, gold continues to shine.

As gold prices continue to break all-time highs, it seems that the public perception of gold among US investors is increasing.

And with more and more people discovering they can earn a yield in gold, paid in gold, as much as 4% as of today, gold’s role is evolving from a static store of value to productive portfolio cornerstone.

Real estate

Real estate remains respondent’s top choice, as it has every year since 2014.

And for good reason: it has been a proven path to wealth for millions of Americans. Sure, favorable financing in the form of 30-year mortgages, and decades of low interest rates haven’t hurt!

But real estate isn’t without its downsides.

The flip side of increasing home values is increasing unaffordability for new and aspiring home buyers. Investors in the space will tell you it is as crowded as ever, an indicator that perhaps most of the money to make has already been made?

Even after you pay off the mortgage, you still face ongoing property taxes and significant maintenance costs from wear and tear.

In many ways, real estate ownership can feel like renting from the government indefinitely.

By contrast, gold offers full, unencumbered ownership.

It has no ongoing taxes, and no counterparty risk.

Additionally, gold is liquid, divisible, and borderless, which can be ideal for modern wealth builders looking for flexibility when it comes to their assets.

It’s a hard asset that doesn’t rely on tenants, tax breaks, or bank financing to be valuable.

Final thoughts

Americans are rethinking what it means to hold wealth for the long-term.

With inflation remaining stubbornly persistent, government debt exponentially rising, and asset bubbles forming in unexpected places, many are increasingly turning to gold.

And a growing number of gold owners are pairing gold lease income with real estate rental income to create a modern portfolio of productive hard assets to weather the future.

Download our free whitepaper to learn how you can turn gold into an income-generating asset today.

*********

Dr. Keith Weiner is the CEO of Monetary Metals and the president of the

Dr. Keith Weiner is the CEO of Monetary Metals and the president of the