Gold Gave Up Gains As Treasury Yields Advanced

Strengths

The best performing precious metal for the week was platinum, up 4.52%. This is more related to speculation and, perhaps, to the minting of the $1 trillion coin. According to Raymond James, Wheaton Precious Metals’ investor day highlighted the company’s portfolio of assets. It has a diversified asset base (24 operating sites) with over 70% of the company’s production coming from assets that fall in the lowest cost quartile. The portfolio has over 30 years of mine life based only on reserves. The company has no debt and has a dividend linked to operating cash flows, whereby 30% of the average of the previous four quarters’ operating cash flows are distributed to shareholders.

Uranium spot prices are blasting upward with no sign of slowing. The spot price hit $50 per pound, a 64.5% increase from $30.4 per pound on August 13, according to S&P Global Platts. Most uranium analysts point to a flurry of spot market purchases by Sprott Asset Management LP, which launched a uranium trust in July to scoop up material and give investors exposure to the price of physical uranium. "We have a uranium market completely driven by a single financial player," said Matt Zabloski, managing director of Delbrook Capital Advisors, who intends to short uranium. "Kudos to them, they've figured out a way to get people excited about the market."

Gold shipments from Europe’s key refining hub rose to 116.4 tonnes last month from 94.1 tonnes in July, according to data on the website of the Swiss Federal Customs Administration. Sales to India climbed 93% to 70.3 tonnes and shipments to China fell 9% to 18.2 tonnes.

Weaknesses

The worst performing precious metal for the week was palladium, down 2.18% on further prospects of delays in new car production with the ongoing chip shortage. Exchange-traded funds continued to sell, bringing this year's net sales to 7.18 million ounces, according to data compiled by Bloomberg. The sales were equivalent to $19.2 million. Total gold held by ETFs fell 6.7% this year to 99.9 million ounces.

Spot palladium hit a 52-week low at $1,931.48 per ounce, a 4.2% decrease from the previous close. The previous low was on September 14. Spot prices declined 21% year-to-date. This is driven by the slowdown in auto demand, which reduces the demand for catalytic converters that use palladium.

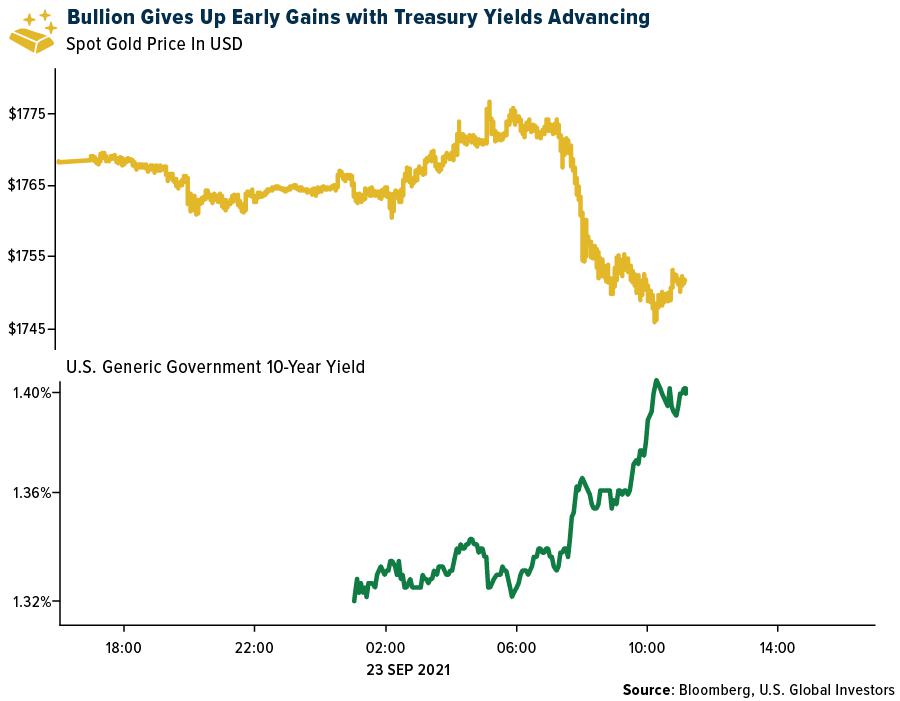

Gold gave up early gains as Treasury yields advanced after the Federal Reserve signaled it could soon begin scaling back asset purchases. The yield on 10-year Treasuries advanced six basis points, reducing bullion’s appeal because it doesn’t offer interest. Gold also fell as rising U.S. stocks dented demand for the metal as a haven, with analysts saying the Fed outlook indicates a strong economy. Bullion has fallen more than 7% this year as the global economic recovery has raised the prospect of central banks reining in their stimulus. Traders are balancing that view against economic concerns over the resurgent pandemic and possible fallout from China Evergrande Group’s debt crisis, giving some support to gold.

Opportunities

Red Pine Exploration said exploration drilling at its Wawa gold project in Ontario showed some high-grade gold mineralization. The company said its best results from drilling into the Jubilee shear zone on the property included 25.73 grams per ton of gold over 4.78 meters of core and 8.76 grams per ton of gold over 0.87 meters.

With regards to platinum, one way to address the U.S. debt ceiling, would be the nuclear option. The steps as outlined by Bloomberg would go as follows: 1) The U.S. Treasury mints a platinum coin of, say, $1 trillion USD notional value. 2) The U.S. Treasury then deposits that coin into its account at the Federal Reserve. 3) With the account at the Fed now credited up to $1 trillion, the Treasury would then buy back U.S. Treasury bonds to prevent the debt ceiling from being breached. 4) This would be the equivalent of quantitative easing, with the Treasury in the role of easer -- essentially swapping reserve balances, which are not counted toward the debt ceiling, for U.S. Treasury bonds, which are. A Freedom of Information Act request showed that the Obama Administration investigated this option but did not go forward with the plan.

Asante Gold announced a strategic investment of $5 million in Roscan Gold this past week. The management team of Asante last sold its prior gold discovery in Ghana, Cardinal Resources, to Shandong Gold and is currently bringing the Bibiani Mine back into production. Roscan has a very strategic board chaired by Sir Samuel Esson Jonah and its CEO is Nana Sangmuah, a native Ghanian. Roscan has a strategic land position in a prolific gold camp in southwestern Mali and has delivered some impressive grades and intercepts.

Threats

South African courts recently set aside mining regulations that govern black ownership targets for companies. In 2018, it was ruled that the ownership target of 26% should remain in perpetuity. If the government decides to appeal the decision, then that would reintroduce uncertainty for investors while the status is a big plus.

Sibanye Stillwater expects South African output of rhodium to decline 9% to 690,000 ounces by 2030, the company says in a presentation on its website. Sibanye says platinum output from South Africa, the world’s No. 1 producer, may drop to 5.7 million ounces in 2030 from 6 million ounces in 2019.

Mining companies in South Africa are considering spending as much as 40 billion rand ($2.7 billion) to construct 2,000 megawatts of power generation capacity, said Roger Baxter, chief executive officer of Minerals Council South Africa. Mining companies have been pushing to develop their own power plants because of persistent power cuts imposed by state power utility Eskom Holdings SOC Ltd. They are also keen to move away from total reliance on the mainly coal-fired power supplied by Eskom as their investors pay more attention to climate change issues.

**********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of