Gold On Its Best Run Since 2011

· The best performing metal this week silver, down 1.13 percent. Gold traders were split this week between bullish and bearish outcomes, according to the weekly Bloomberg survey. The yellow metal is on its best run since 2011 as it wraps up a third consecutive quarter of gains and exchange-traded funds backed by bullion are also near the highest in five years. Following two takeovers announced last week, Goldfields has entered into an agreement to purchase a 50 percent stake in Asanko Gold Ghana’s interest in Asanko Gold Mine for an upfront payment of $165 million. This is the second acquisition whereby Goldfields has elected to purchase at the project level and not takeover the company.

· With U.S. protectionist trade policies ever-increasing, world banks are looking away from the dollar, and seeking to build their currency reserves with the euro. As a U.S. trade war with China is threatened, the European Union is searching for trade deals all over the world, in particular in Asia and Latin America, writes Bloomberg. Jens Nordvig, a former Wall Street top-ranked currency strategist, said “A lot of countries around the world are turning to Europe for increased partnership in trade.” This could weaken the dollar, which is historically positive for the price of gold.

· In January and February, gold demand was lower than expected in India, the world’s second largest consumer of gold, due to a looming goods-and-services tax. However, consumption seems to be returning to the precious metals market after the 3 percent tax has now been implemented.

Weaknesses

· The worst performing metal this week was palladium, down 2.44 percent as some investor turn sour on the metal after its stellar performance last year and poor showing so far this year. Gold saw its biggest two-day loss in more than eight months after the U.S. dollar rebounded earlier this week when Chinese President Xi Jinping announced that North Korea’s leader King Jong Un would be willing to meet with President Donald Trump regarding giving up nuclear weapons, reports Bloomberg News.

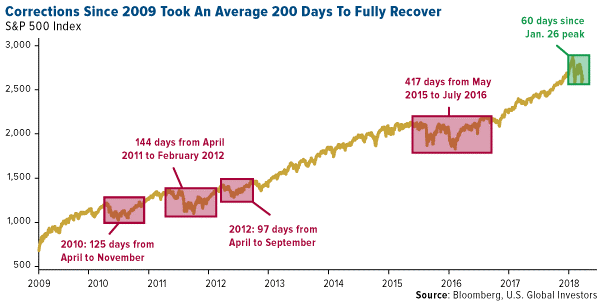

· Historical data shows that market corrections since 2009 have taken an average of 200 days to fully recover and have lopped 14 percent from the S&P 500. If the market is entering a correction phase now, it might take until August to fully correct.

· Kinross Gold will pay $950,000 after settling allegations of failure to implement adequate accounting controls at two of its African locations. According to Bloomberg First World, the SEC alleges that the company awarded a “lucrative” contract to a company preferred by Mauritanian government officials and contracted with a “politically-connected” consultant to facilitate contracts with the Mauritanian government without diligence.

Opportunities

· Goldman Sachs is bullish on gold for the first time in five years due to expected increases in inflation and a heightened risk of a stock market correction, reports Seeking Alpha. The company’s computer bull/bear market indicator is above 70 percent, which is associated with high risks for investors. Nicolas Mathier, managing partner at Global Precious Metals, says that gold will trade higher since “Gold is mainly bought as a hedge against systemic risk or counter-party risk.” UBS is also bullish on gold, increasing its price forecast to $1,300 to $1,400 over the next three months, up from a range of $1,275 to $1,375.

· Bloomberg reported this week that the U.S. is brokering a side deal with South Korea to avoid competitive devaluations as part of its exemption from tariffs. The bigger signal is that the U.S. is using the tariff card to extract certain policy objectives, such as the U.S. doesn’t want South Korea to devalue its currency relative to the dollar. This seems to support the notion that the U.S. does not want to see a strong dollar and its extracting agreements to make that a certainty.

· Pandion Mine Finance LP, an investment fund backed by prominent commodities investors, raised $175 million to finance small precious and base metals miners. Many banks have left the sector of funding smaller mining projects, leaving an opening for less traditional sources of capital for raising money. RBC Capital Markets reports that of the around $925 million raised by junior precious metals companies so far in 2018, only 14 percent has come from traditional equity sources with the rest from alternative lenders, streamers/royalties, excreta. The shift in funding has largely been driven by investors blindly buying gold mining stock ETFs for the exposure to gold’s beta, and not conducting any due diligence on the merits of the underlying securities. The net result is there are lots of cheap non-index companies that may see the first benefits of industry consolidation as the seniors scramble to replace their depleting resource base and falling production profile.

Threats

· The Conference Board survey of U.S. consumer sentiment in March shows that retail investors are at their least enthusiastic for stocks since President Donald Trump was elected in November 2016. Bloomberg reports that only 6 percent of those surveyed believe that equities will be higher than they currently are in one year’s time. According to Jonathan Swan of Axios, President Trump is anti-Amazon, as he believes the online retail giant is helping to kill brick-and-mortar retailers.

· One analyst believes that gold may decline to $1,200 by the end of the year due to Fed interest rate hikes. Rajiv Biswas, Asia-Pacific chief economist at HIS Market, said this week at a conference that “Rising interest rates in the U.S. reduce the incentive to hold gold as an investment.” Many disagree with this analysis as gold historically performs well in times of rising interest rates.

· Ivanhoe Mines released a statement saying that several international companies with active mines in the Democratic of Congo are addressing the government and expressing concern that the new mining code changes would negatively impact revenues. The DRC is the world’s largest supplier of cobalt, which is the key element in rechargeable batteries powering most electric vehicles. Recently the DRC government implemented many changes to its mining code for foreign companies, including raising taxes and royalty fees significantly.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of